Reflecting on the 2020 DeFi craze: Consider the benefits and risks of DeFi

Reflecting on the 2020 DeFi craze: Consider the benefits and risks of DeFi Reflecting on the 2020 DeFi craze: Consider the benefits and risks of DeFi

Photo by Leon Rohrwild on Unsplash

It’s undeniable: 2020 is the year of DeFi. Everyone in crypto knows it. If you’ve got a friend interested in crypto, you’ve probably heard them raving and ranting about DeFi this year. Even if you’re not engaged in the crypto realm, you’ve probably seen the word DeFi littered around the news or gleaned whispers of it from hushed and excited conversations (500% annual interest rate on a “yield farming” account?!).

DeFi, short for decentralized finance, has been the hottest buzzword in the crypto realm because of its enormous potential and disruptive nature. And it seems like even Big Tech powerhouses such as Facebook, Amazon, Netflix and Google are jumping on the DeFi bandwagon.

So, why the craze? Although cryptocurrencies have made value transfer universally accessible to anyone anywhere, DeFi has expanded the use of blockchain technology to more complex financial use cases: savings, loans, trading, insurance, etc. Now anyone with a smartphone or supported wallet and an internet connection can utilize a variety of financial services that they may not have had access to through traditional means. This is an unprecedented development and terribly exciting, especially if you consider how it opens up opportunities to the unbanked population and numerous others who don’t qualify for traditional financial services.

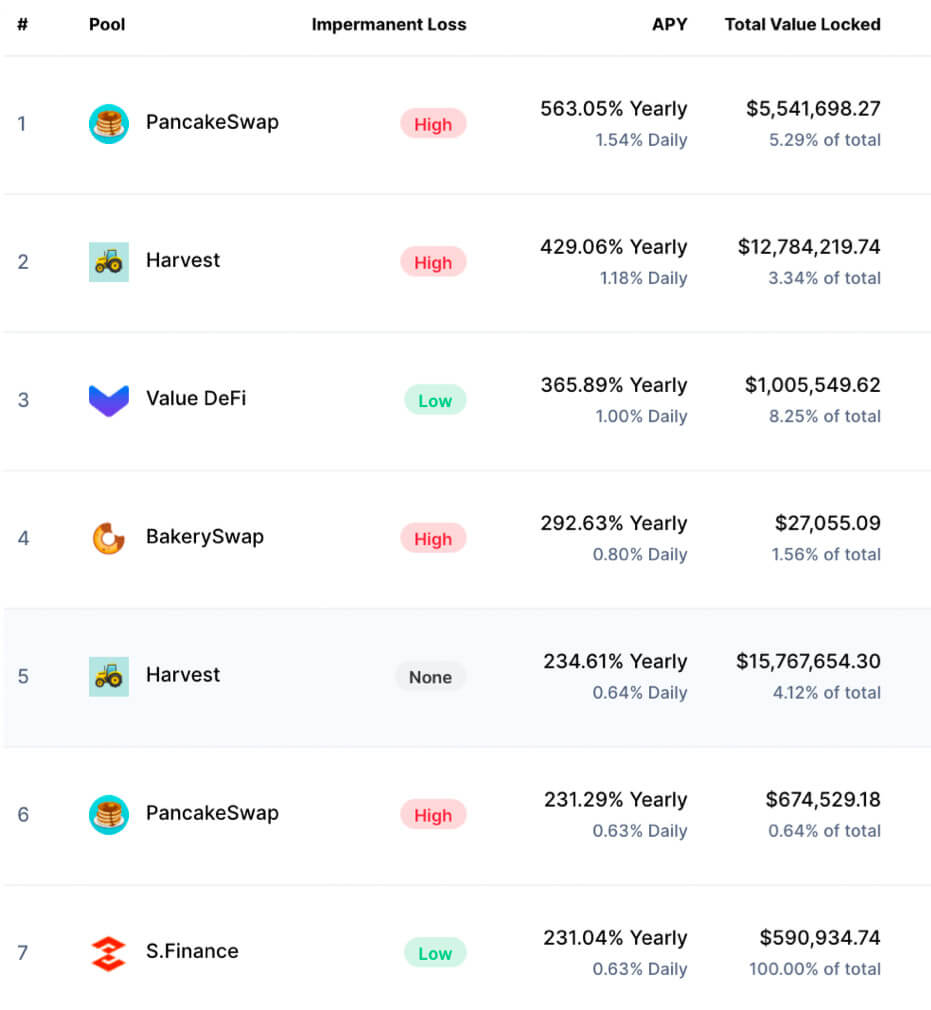

The DeFi craze and its exponential growth has been powered by its potential benefits and, without a doubt, the ever-present “fear of missing out”. In particular, the “FOMO” of DeFi can be attributed to the mind-blowing high yields promised by yield farming projects, which play on the human weakness and desire of getting rich quick with little to no effort or responsibility. Yields from yield farming projects can range from a hallucinatory annual percentage yield (APY) of 500% to a low APY of 0.57%, with plenty of projects in mid-ranges.

The lure of huge rewards is hard to resist, enticing many to flock towards DeFi and yield farming without understanding the risks involved. However, let’s put the risks of DeFi on the backseat for the moment and consider the many benefits and advantages that make DeFi so compelling.

Benefits and Strengths of DeFi

I. Decentralized — Quick smart contract deployment with little to no human intervention, and at reduced cost

The decentralized nature and cutting out of middlemen from all kinds of transactions is one of the primary advantages of DeFi. Since smart contracts rather than centralized systems or human gatekeepers are at the center of DeFi operations, they can be deployed quickly and run with little to no human intervention, at reduced cost. The lack of middlemen also means that users don’t need to entrust their money to third-parties and that they are therefore empowered with direct control over their funds.

II. Transparent — One can verify any and every transaction that occurs on the blockchain

DeFi codes and transactions are transparent on the blockchain for anyone to view or audit. This transparency builds trust with users since anyone has the opportunity to verify and understand a contract’s functionality or find bugs. Although transaction activity is public for anyone to view, they are pseudonymous by default so a user’s private details are still protected.

III. Global, permissionless, and inclusive — Anyone, anywhere, anytime

DApps are designed to be global, “permissionless” and inclusive. This means that anyone, anywhere, anytime can access the same DeFi services and networks as long as they have an internet connection. Unlike traditional financial services that usually require you to fill out lengthy forms with personal details and have certain limitations, anyone can create and use dApps from their crypto wallets.

Anyone, anywhere, anytime can access the same DeFi services and networks as long as they have an internet connection.

IV. Interoperable — Open source enables lego-style composability

The codes behind DeFi apps are open source and public for anyone to view, so anyone can “compose” new apps with the code as building blocks. The composability of DeFi lends itself to infinite possibilities as DeFi apps can be put together like “money legos” to build new financial products. For example, a user can buy the stablecoin DAI and then lend it on Compound to earn interest.

The modular composability of DeFi lends itself to infinite possibilities as DeFi apps can be put together like “money legos” to build new financial products.

V. Opportunity to earn — Higher interest at lower cost

Interest rates from central banks worldwide sit at pitiful numbers and seem to just get worse as the years go by. The current American interest rate FED (base rate) is 0.250%, British interest rate BoE (base rate) is 0.100%, and European interest rate ECB (base rate) is 0.000%. In contrast, DeFi offers users the opportunity of earning through interest from lending platforms (as mentioned above) or yield farming. Since middlemen and central banks are cut out of any operations, users tend to earn higher interests.

DeFi Challenges and Risks

Make no mistake, DeFi is risky. Despite the benefits that the DeFi ecosystem has exhibited and the potential it has yet to fully unleash, it’s not without risks and challenges. As a young financial system compared to the traditional one we’re used to, the entire crypto world is still developing and in the process of ironing out its wrinkles. This takes time and means that it’s important to understand the risks present in today’s DeFi. An immediate flashback to the 2017 ICO boom comes to mind.

I. A repeat of the 2017 ICO boom?

Source: A Comprehensive Guide to the Next Generation of ICOs & Crypto Funding

The Initial Coin Offering (ICO) boom of 2017 took the crypto market by surprise as it generated over $6 billion USD, four times more than what was generated between 2013–2016 combined. ICOs revolutionized crowdfunding and helped crypto start-ups attract a record amount of funds with a minimum amount of accountability, and yes, a never-ending list of risks. This resulted in a large portion of projects reportedly operated by scammers (over 80% according to Statis Group’s study) while many other projects crashed and burned when they failed to deliver positive returns for investors.

Deadcoins has recorded that 780 coins were scams and over 1,000 coins have died out. And yes, another parallel with the current DeFi craze is, well, the crazy names. From JesusCoin, ButtCoin, and CryptoMeth in 2017 to PancakeSwap, SushiSwap, and BakerySwap in 2020. If one thing is clear in hindsight, it’s that the 2017 ICO hype was short-lived and the entire crypto realm crashed right into a bear market in the beginning of 2018. No wonder concerns are growing as to whether the DeFi craze will be a repeat of the past, with projects dying out and many people likely losing a lot of money.

II. Smart contract bugs — Devastating vulnerabilities

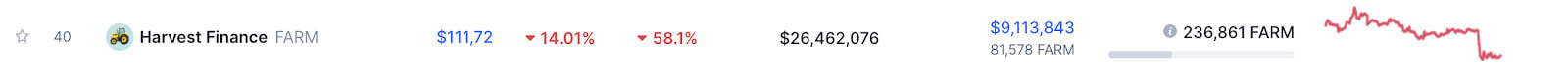

As with anything that exists online and in the digital world, smart contracts are vulnerable to both unintended programming mistakes and malicious hacks. Hackers that find bugs in open source code for a dApp can easily exploit them, resulting in the instant draining of millions of dollars. A great past example is the Parity Hack, where over 600,000 ETH was lost due to a bug in the smart contract. Another prime example that occurred more recently is the Harvest Finance hack on October 26, where 24 million USD was drained from Harvest Finance’s stablecoin and BTC pools in less than seven minutes. The hack resulted in Harvest’s governance token FARM plummeting 60% and 400 million USD in total liquidity drained as liquidity providers fled the platform.

Although smart contract bugs and vulnerabilities are a risk, teams like Nexus Mutual are building decentralized insurance to cover users in the event of smart contract hacks or failures. It is an open platform on Ethereum that “uses the power of Ethereum so people can share risk together without the need for an insurance company”.

Source: Hackers Drain DeFi Protocol Harvest Finance of $24 Million

III. Yield farming — Huge yields at huge risk

Yield farming is arguably the buzzword behind the explosion of DeFi. The concept of yield farming emerged from the DeFi movement as a new way of earning impressive yields on cryptocurrencies. Binance Academy explains yield farming as:

“The wild west of Decentralized Finance (DeFi), where farmers compete to get a chance to farm the best crops.”

Yield farmers use (secret) strategies to move their cryptos between different lending marketplaces to maximize their returns. This pursuit of high yields is incredibly complex, risky, and usually unsuitable for general users.

“It’s all too easy to get caught up in hype and be blinded by outrageous yields. If you aren’t careful or simply unaware of risks such as hidden backdoors in unaudited smart contracts, it becomes increasingly possible that you could get burned.” — DeFi Pulse about Yield Farming.

IV. Differentiating good and bad projects

According to Coindesk, “an ‘anything goes’ culture thrives in DeFi, with ridiculously named projects from Yam to SushiSwap exploding in popularity overnight, only to quickly die out”. It’s difficult for general users to separate good DeFi projects from the bad, resulting in many users getting scammed by fraudulent projects or investing in projects doomed to fail. A quick search on the internet will reveal plenty of horror stories from people who have lost thousands overnight or been subject to farming scams (such as Jhon Doe who lost $140,000 worth of Uniswap’s UNI tokens to a fraudulent yield farming project). There have been numerous failed projects already and the sad reality is that there will likely be more to come. This definitely feels like an ICO craze.

V. Security — The biggest risk of them all

Just like a traditional wallet in your back pocket is vulnerable to the deft fingers of pickpockets, the digital nature of cryptocurrencies opens doors to cyber-attacks unless they are properly secured. The basics of protecting and storing cryptocurrencies with secure solutions need to be understood and practiced by cryptocurrency owners. The vulnerabilities of smart contracts are already a risk, and one that is usually beyond the control of general users, so it’s important for cryptocurrency owners to reduce the vulnerability of their digital assets to hackers however they can. Secure solutions include owning your private keys yourself by using cold wallets, wherein NGRAVE’s NGRAVE ZERO is the “coldest” digital wallet available.

Another challenge is that users struggle to manage multiple addresses on multiple individual platforms to access their assets and data. The recently launched DeFi wallet (the first of its kind), Frontier, solves this by combining all of a user’s wallets into a single integrated interface without sharing their private keys. It enables users to track, view and manage multiple wallets, assets and protocols in a novel and secure way.

Conclusion

DeFi is promising. DeFi is full of risks. DeFi sits at the forefront of innovation in today’s blockchain space and won’t hold back from disrupting every financial service it encounters. Like any innovation, it carries huge promise and the burden of risks as it goes through the process of breaking through its shell and finding its bearings. The lure of huge rewards has hundreds of thousands flocking to DeFi without understanding the challenges, which leads to uninformed choices and loss.

So take the time to do your own research, to consider the benefits and risks before you plunge in with both feet. Because what lies ahead is a dream that’s taking shape in reality, where anyone, anywhere, anytime, can have seamless, secure, and low-cost access to payments and remittances, borrowing and lending, savings accounts, wealth management, and more. DeFi is gaining ground as projects are continuously developed and fail/succeed; it will continue to grow and redefine the standard of finance as we know it.

Farside Investors

Farside Investors