One Bitcoin now buys over 10,000 Big Macs, up from just 51 in 2015

One Bitcoin now buys over 10,000 Big Macs, up from just 51 in 2015 One Bitcoin now buys over 10,000 Big Macs, up from just 51 in 2015

The Big Mac Index reveals Bitcoin's purchasing power has dramatically outpaced traditional assets like gold since 2015.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

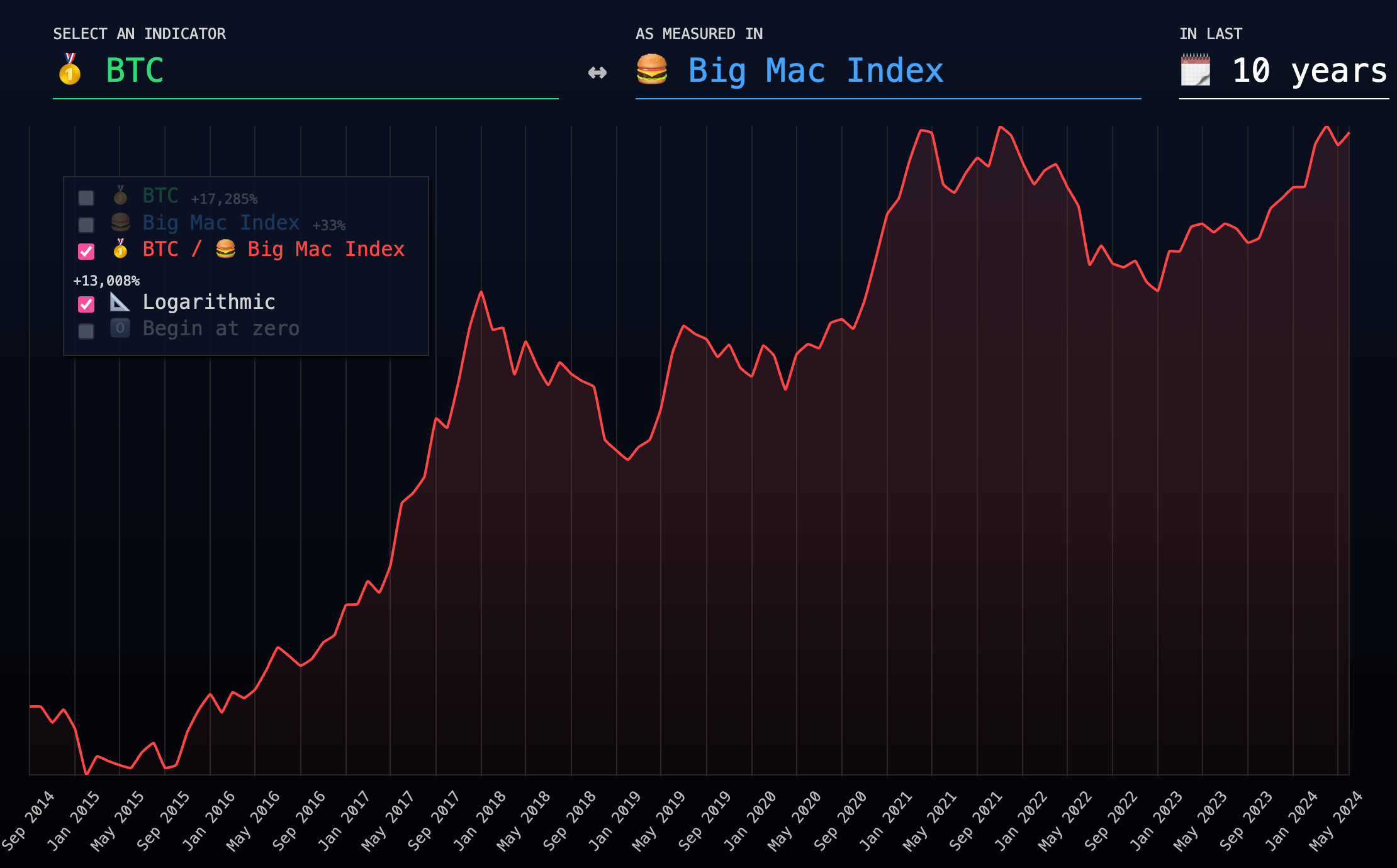

Bitcoin’s purchasing power, as measured by the Big Mac Index, has significantly increased over the past decade. In 2024, one Bitcoin can buy approximately 10,500 Big Macs, a substantial 20,488% rise from just 51 Big Macs in 2015. This growth highlights Bitcoin’s dramatic appreciation in value relative to a consumer staple like the Big Mac.

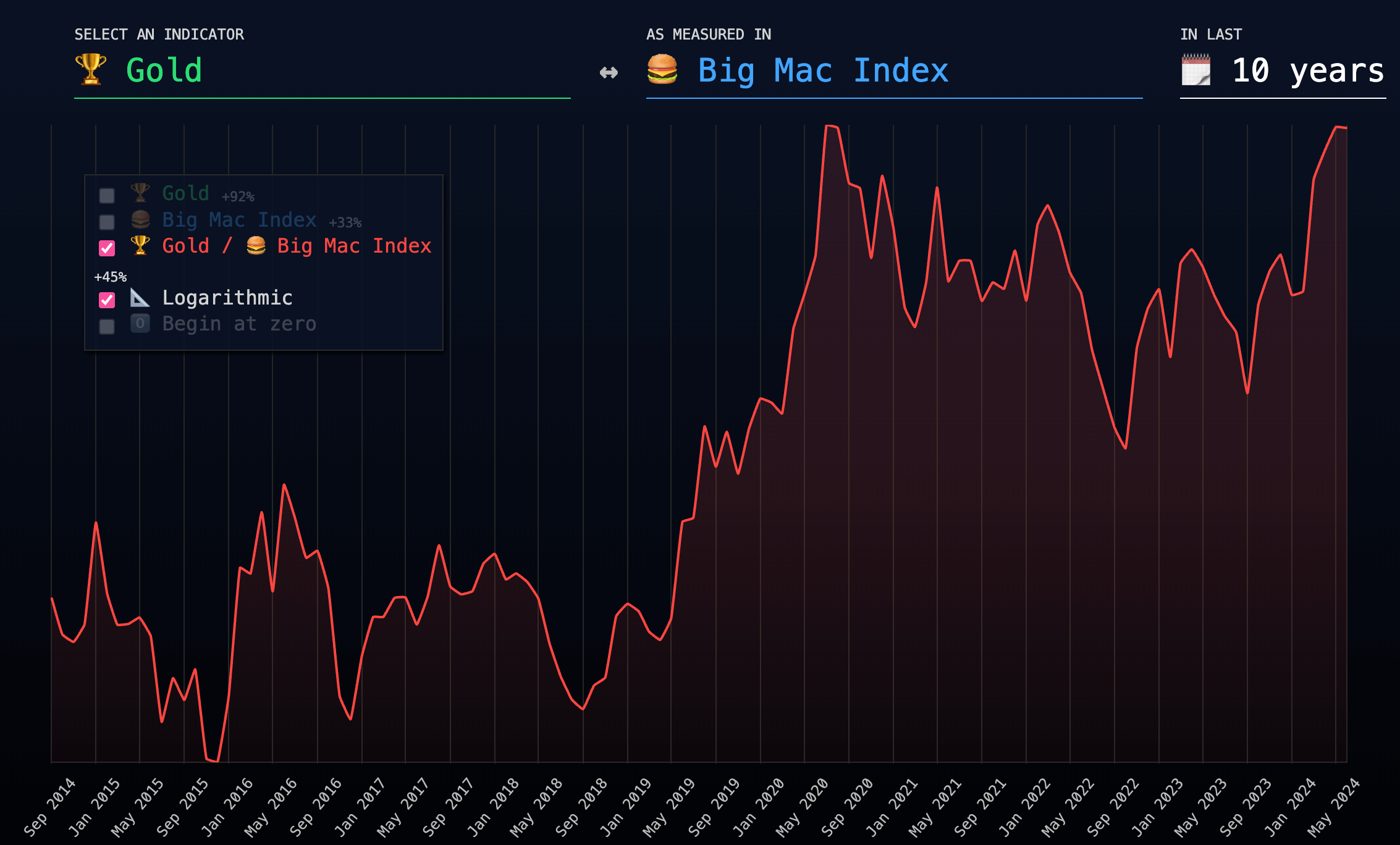

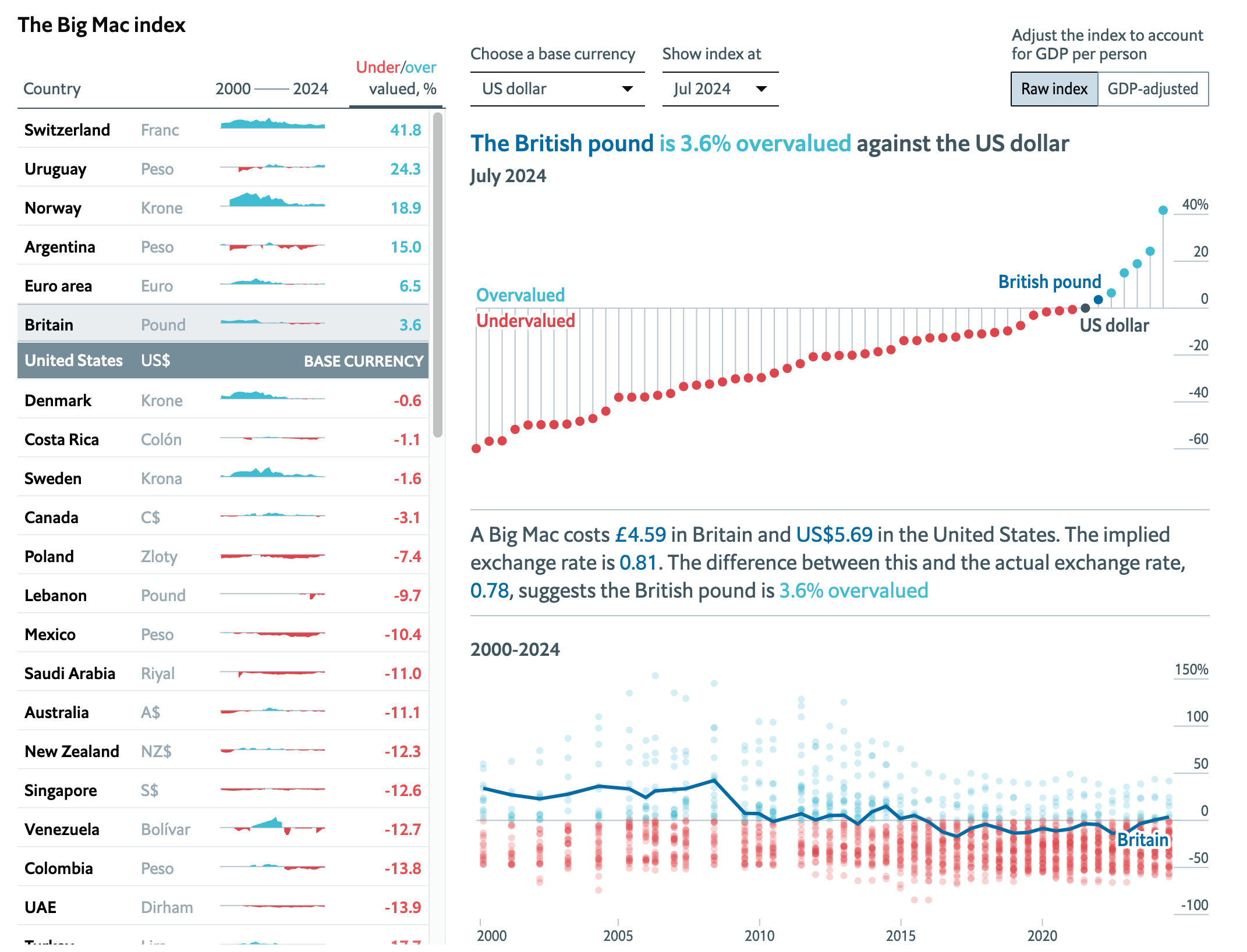

The Big Mac Index, initially developed by The Economist, serves as an informal gauge of purchasing power parity, comparing the price of a Big Mac across different countries to assess currency valuation. The index indicates that while Bitcoin’s value has surged, traditional assets like gold have also seen growth, albeit at a slower pace. Over the same period, gold’s purchasing power in terms of Big Macs increased by roughly 35%, showcasing a more modest rise compared to Bitcoin.

The official Economist Big Mac Index also reveals currency valuation trends, such as the British pound being overvalued by 3.6% against the US dollar as of July 2024. This index provides insights into global economic conditions and currency fluctuations, reflecting broader market trends.

Of all currencies tracked, only the British pound, Swiss franc, Uruguay peso, Argentine peso, Norwegian krona, and euro are currently overvalued against the dollar.

The data highlights Bitcoin’s volatile yet upward trajectory, positioning it as a unique asset class with substantial purchasing power growth over the past decade.

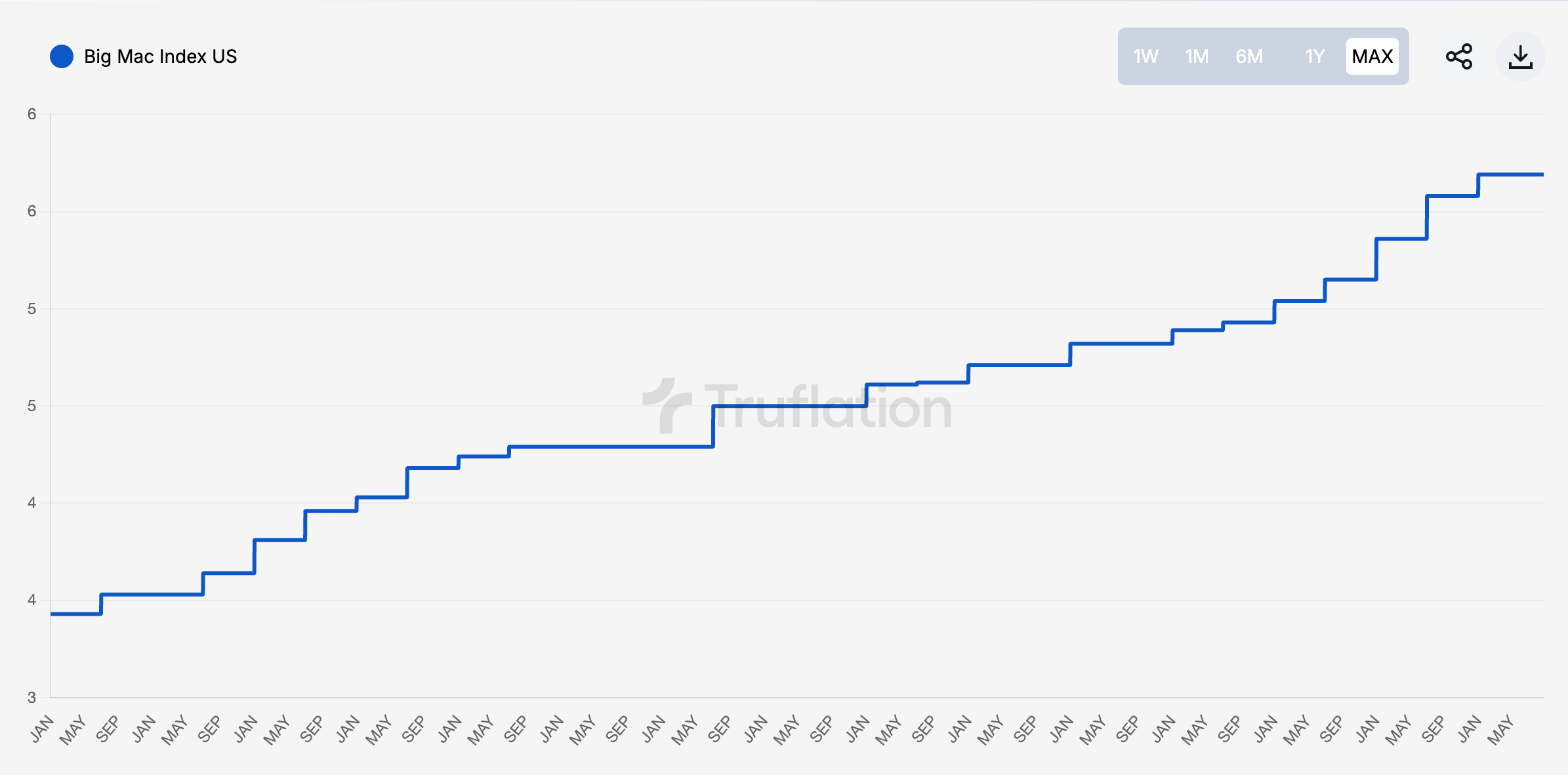

The cost of a Big Mac in the United States was $4.29 in 2015 and is now $5.69, an increase of 32%.

The argument that Bitcoin is not a hedge against inflation is only valid when using short timeframes. Over a single day or month, Bitcoin rarely competes with more stable assets such as US Treasuries or even many FIAT currencies. However, over the past ten years, even gold has not been able to compete with Bitcoin in terms of raw purchasing power.

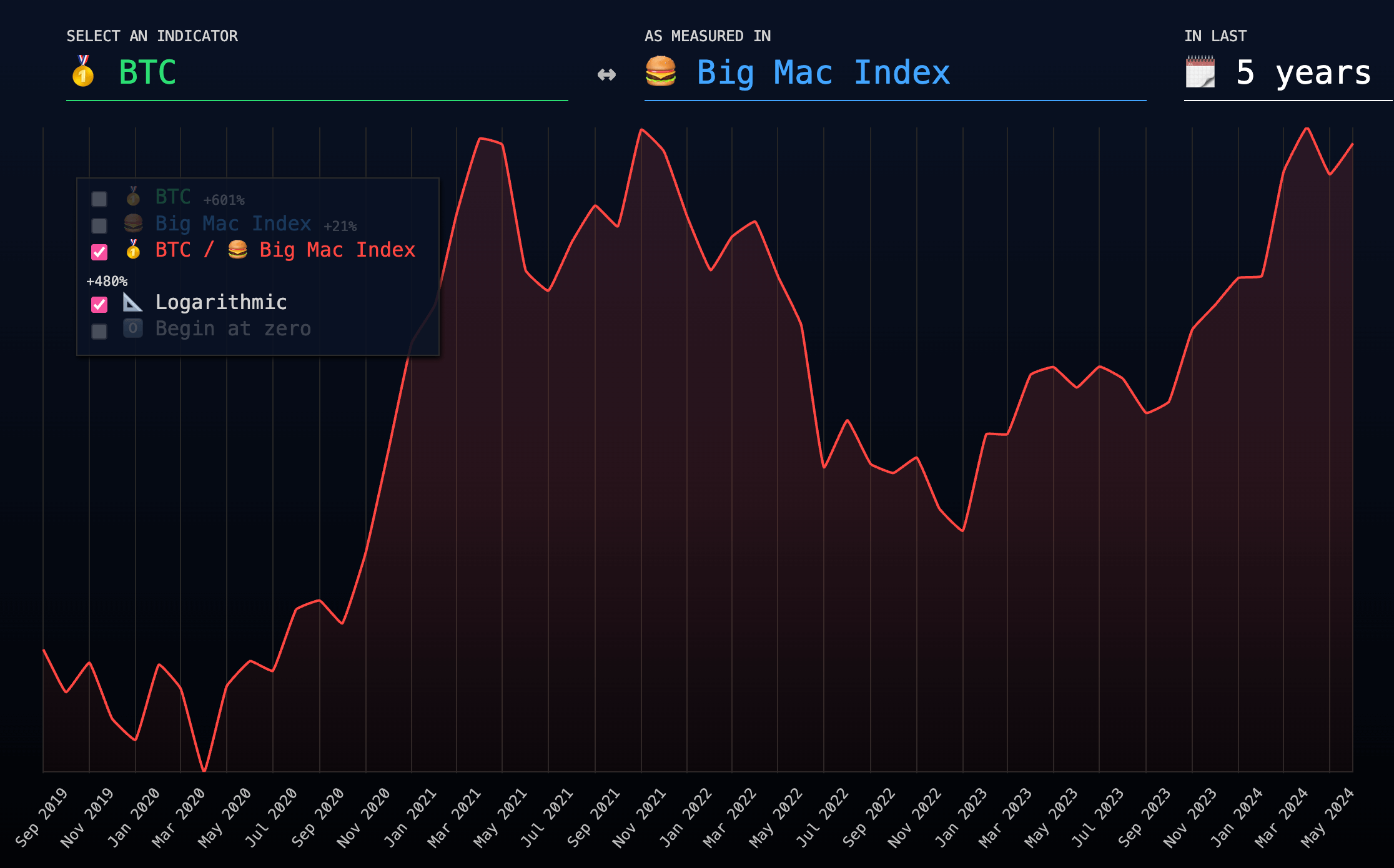

If we reduce the timeframe to just five years, Bitcoin still buys 8,500 more Big Macs per coin. Thus, while it’s a stronger argument to state that Bitcoin is a hedge against irresponsible central bank policies, we can still maintain that Bitcoin beats inflation—certainly in terms of Big Macs.