New ERC-20 token VMPX triggers Ethereum burn spike, consumes $3M in gas fees in 24 hours

New ERC-20 token VMPX triggers Ethereum burn spike, consumes $3M in gas fees in 24 hours New ERC-20 token VMPX triggers Ethereum burn spike, consumes $3M in gas fees in 24 hours

The VMPX token website does not provide any information about its utility and some are questioning its purpose.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

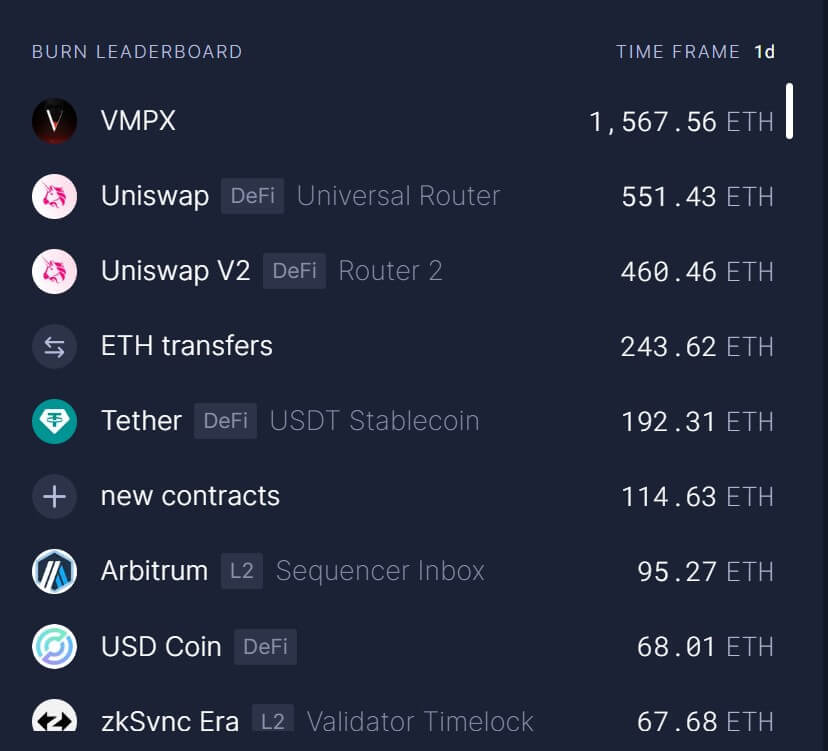

VMPX, a newly launched ERC-20 token, is responsible for over 30% of all Ethereum (ETH) burns in the last 24 hours, according to data from Ultrasound.money.

Software engineer 0xCygaar first called attention to the project, claiming its minting contract had no purpose except to increase the network’s overall gas usage.

“The top ETH gas guzzler is this contract where users make validators run useless/unnecessary code just to increase overall gas usage. People are literally burning their money to increase gas fees for everyone else.”

Qedk, a smart contract engineer at Polygon (MATIC), confirmed this, adding that the ERC-20 token would make users spend more gas if they want to mint more tokens.

According to tweets from the project founder, Jack Levin, VMPX is the first ever BRC-20 token linked to Ethereum’s ERC-20 token. The project’s website states that its supply is 108.62 million but fails to provide additional information about its utility.

VMPX consumed nearly $3M in gas fees

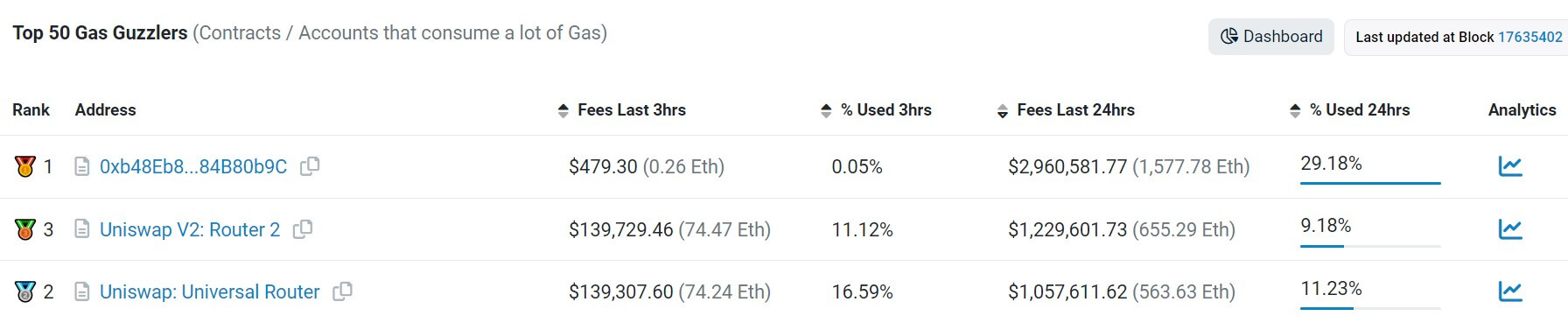

Meanwhile, Etherscan data shows that the VMPX mint contract consumed over 1,500 ETH, around $3 million, in gas fees during the last 24 hours. This represents around 30% of all the gas fees spent during the period, above those generated by the Uniswap (UNI) decentralized exchange.

Harrison, the co-founder of PopPunk, pointed out that those who minted the token paid gas fees as high as 1.36ETH.

EigenPhi, a DeFi data platform, corroborated Harrison’s statement, adding that an average mint transaction of VMPX was 0.167ETH, around $317 per tx.

This high network activity saw Ethereum network fees jump to as high as 76.3 Gwei during the reporting period, according to Ultrasound.money.

A representative from Push Protocol, the Ethereum messaging service, told CryptoSlate:

Gas fees still play a vital role in interacting with Ethereum and is probably one of the reason projects are moving to L2s or prefering off-chain yet verifiable executions.”