MicroStrategy made largest Bitcoin purchase since 2021 in Q2 2023 amid slight revenue decrease

MicroStrategy made largest Bitcoin purchase since 2021 in Q2 2023 amid slight revenue decrease MicroStrategy made largest Bitcoin purchase since 2021 in Q2 2023 amid slight revenue decrease

The company purchased 12,333 BTC for $347 million in Q2 2023.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

In its Aug. 1 financial results, business intelligence firm MicroStrategy said it acquired substantial Bitcoin during Q2 2023.

Andrew Kang, Chief Financial Officer at MicroStrategy, said:

“The addition in the second quarter of 12,333 bitcoins [is] the largest increase in a single quarter since Q2 2021. We efficiently raised capital… and used cash from operations to continue to increase bitcoins on our balance sheet.”

In a separate presentation, the firm said that the 12,333 BTC it bought was purchased for $347 million at an average of $28,136 per Bitcoin.

However, those numbers only represent the company’s latest additions, not the total amount of Bitcoin it acquired. MicroStrategy said that, as of July 31, 2023, it had acquired 152,800 BTC for $4.53 billion or $29,672 per Bitcoin.

Despite those high estimates, the company said that the carrying value (the original cost of the asset, less any depreciation, amortization or impairment costs) of its Bitcoin was just $2.3 billion. That number reflects cumulative impairment losses of $2.196 billion since MicroStrategy’s first purchase and an average carrying amount per Bitcoin of $15,251.

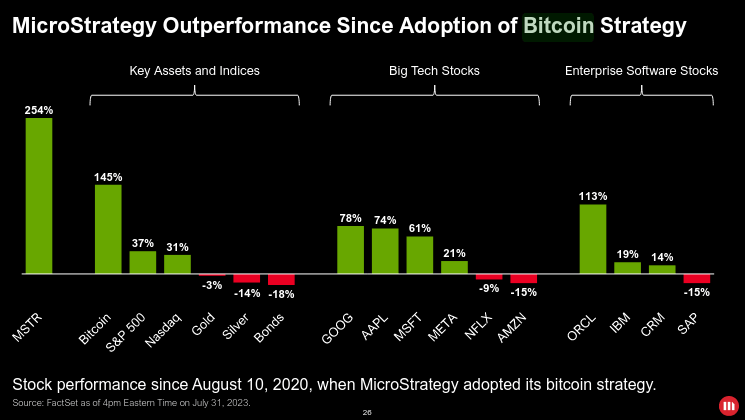

MicroStrategy noted elsewhere that Bitcoin and its own MSTR stock have outperformed numerous other indexes and assets. MSTR has gained 254% since it adopted its Bitcoin strategy in August 2020, while Bitcoin itself has gained 145% since that date.

MicroStrategy otherwise reported total revenues of $120.4 million in Q2 2023, which represents a 1% decrease in revenue year-over-year.

Bitcoin in the bigger picture

Kang also positioned MicroStrategy’s purchases within broader industry developments, such as increasing interest from institutional investors and regulatory clarity around Bitcoin.

Kang also said that MicroStrategy is seeing progress regarding Bitcoin accounting practices. In May, the company submitted a letter to the Financial Accounting Standards Board (FASB) expressing support for a fair value accounting for crypto assets. It said this would allow it to provide a “more relevant view” of its Bitcoin holdings.

In its company profile, Microstrategy called Bitcoin a “dependable store of value” and described Bitcoin acquisition as one of its two main strategies alongside its enterprise software business.

UPDATE: Aug. 2, 2023, 9AM – MicroStrategy announced the sale of up to $750 million of its Class A stock on Aug. 1 potentially to fund additional Bitcoin purchases.