Man The Harpoons! Whale-Hunting App Helps Traders Spot Market Manipulators

Man The Harpoons! Whale-Hunting App Helps Traders Spot Market Manipulators Man The Harpoons! Whale-Hunting App Helps Traders Spot Market Manipulators

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The nascent cryptocurrency market may be stabilizing rapidly, but it’s still a whale’s playground. Individuals that are able to place extremely large orders are able to dominate cryptocurrency markets, especially when it comes to altcoins that possess a smaller market cap. Until recently, the average trader has not been able to identify when a whale is manipulating a market. With the release of a major update to a whale-tracking app, however, traders will now be able to spot crypto whales in the wild.

The Crypto Whale tracking App is designed to track the activity of whales in buy and sell walls on cryptocurrency exchanges. While the app is only compatible with GDAX at this point in time, the creator is aiming to arm traders with the tools they need to spot market manipulation.

Using the whale tracking app, traders are able to correctly identify where the volume behind buy and sell walls comes from. In organic cases, these walls emerge when large groups of cases place orders around a modal point, but they also occur artificially when whales attempt to manipulate the market.

Put simply, the Crypto Whale Tracking App allows traders to determine whether resistance or support levels are caused by organic or artificial means— and thus protect themselves from whale tactics such as stop loss hunting. Paul Jeffries, the creator of the Whale Tracking App, states that the app is intended to solve issues present in cryptocurrency markets:

“A few weeks ago while trading I noticed an asymmetric information problem in the cryptocurrency markets. I wrote some Python code that would build a simple app to help me trade in a more informed manner, and the community loved it. “

Wait— What’s a Buy Wall?

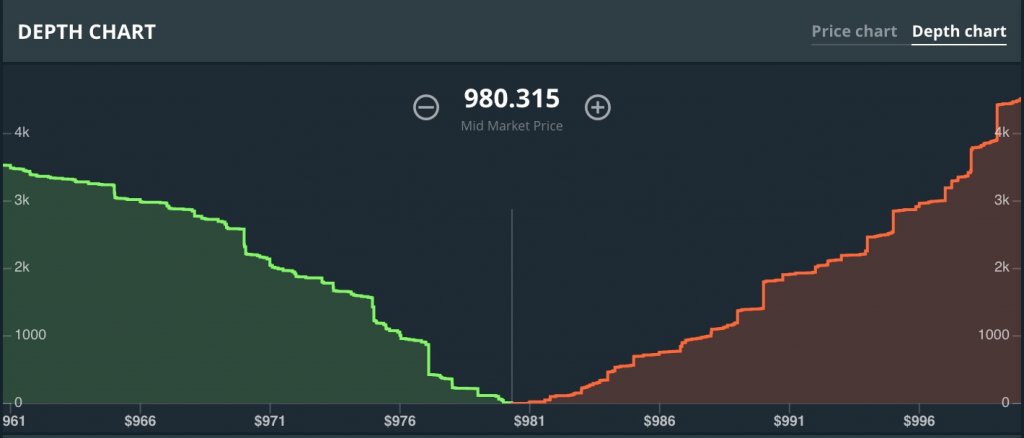

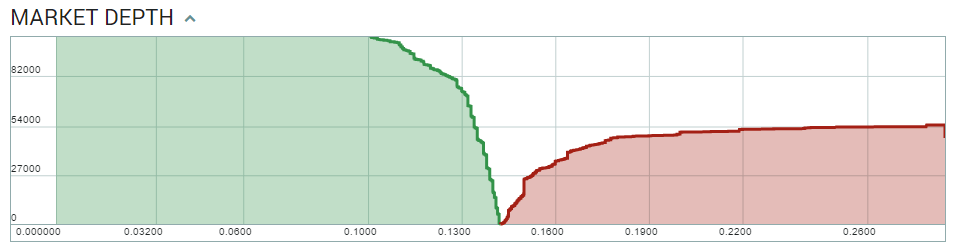

Understanding how buy and sell walls work is important to developing a strong trading strategy and avoiding getting burned during “pump and dump” schemes. Walls work like this: trades on any given exchange are facilitated by both buy and sell orders being placed on the order book. The order book allows traders to view a complete list of orders in any given trading pair, as well as providing a sense of market depth.

A “buy wall” occurs when the amount or size of buy orders for a crypto are far higher than the total number of sell orders in the book. Buy walls are commonly seen as a positive sign for the crypto in question — people want to buy it more than they want to sell it. In this case, traders race to purchase all cheap orders, buying more than they sell.

A “sell wall” is essentially the same event in the opposite direction. A sell wall indicates a cryptocurrency is going through a rough patch. Sell walls occur when a big sell-off is underway — during these periods, the highest buy order will be filled first, followed by the next largest, until the market levels.

Why Are Buy and Sell Walls Important?

Buy and sell walls are important, as they are key indicators that whales — high net worth individuals with a significant amount of capital to throw around — could be manipulating a market. These whales are able to place buy or sell orders in specific positions, at sizes that they are highly unlikely to be filled. These “un-fillable” orders then set the floor or ceiling for future price movements.

Whales can place fake buy walls that lure less-aware investors under the mistaken assumption that the current price points are the new floor, which “pumps” the value of a crypto. In reality, the sentiment is artificial, and can be revoked by the whale whenever they like.

Fake sell walls can also be created by whales in order to artificially suppress the price of attractive cryptos, allowing them to buy up large amounts of coins at a low price. After pulling enough coins, whales will then revoke these fake sell walls, at which point organic positive sentiment will cause the price to spike.

Some particularly unscrupulous whales use fake sell walls to place pressure on the price of a crypto that they’d like to collect in order to trigger stop loss orders. This practice, called stop loss hunting, often occurs before a whale begins artificially pumping a token, and is effectively used to gather up more coins at a discount.

How The Whale Tracking App Works

As the Whale Tracking App is currently in a developmental stage, it’s not presented on a slick website — but can be accessed via a web-hosted version. The app focuses on the individual limit orders that are used by whales to create walls, and places a strong emphasis on the biggest orders.

Hovering over a price bubble provides users with information on how many orders are behind a price point, which makes it possible to identity un-fillable orders quickly and efficiently.

Ultimately, the Crypto Whale Tracking App helps traders make more informed trading decisions by determining whether a buy or sell wall can be pulled by a whale.