US volatility records third highest reading as Bitcoin dominance surges

US volatility records third highest reading as Bitcoin dominance surges Quick Take

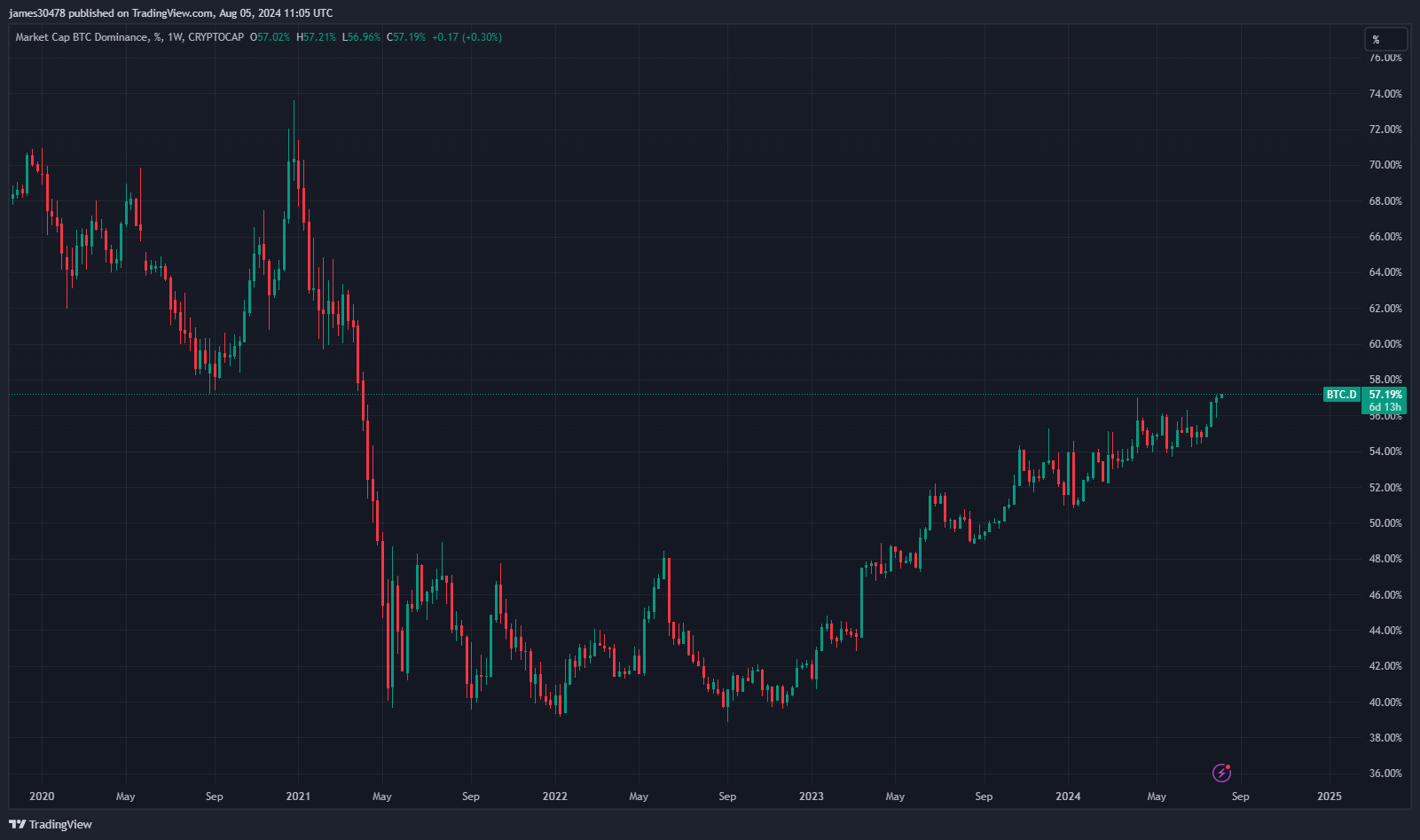

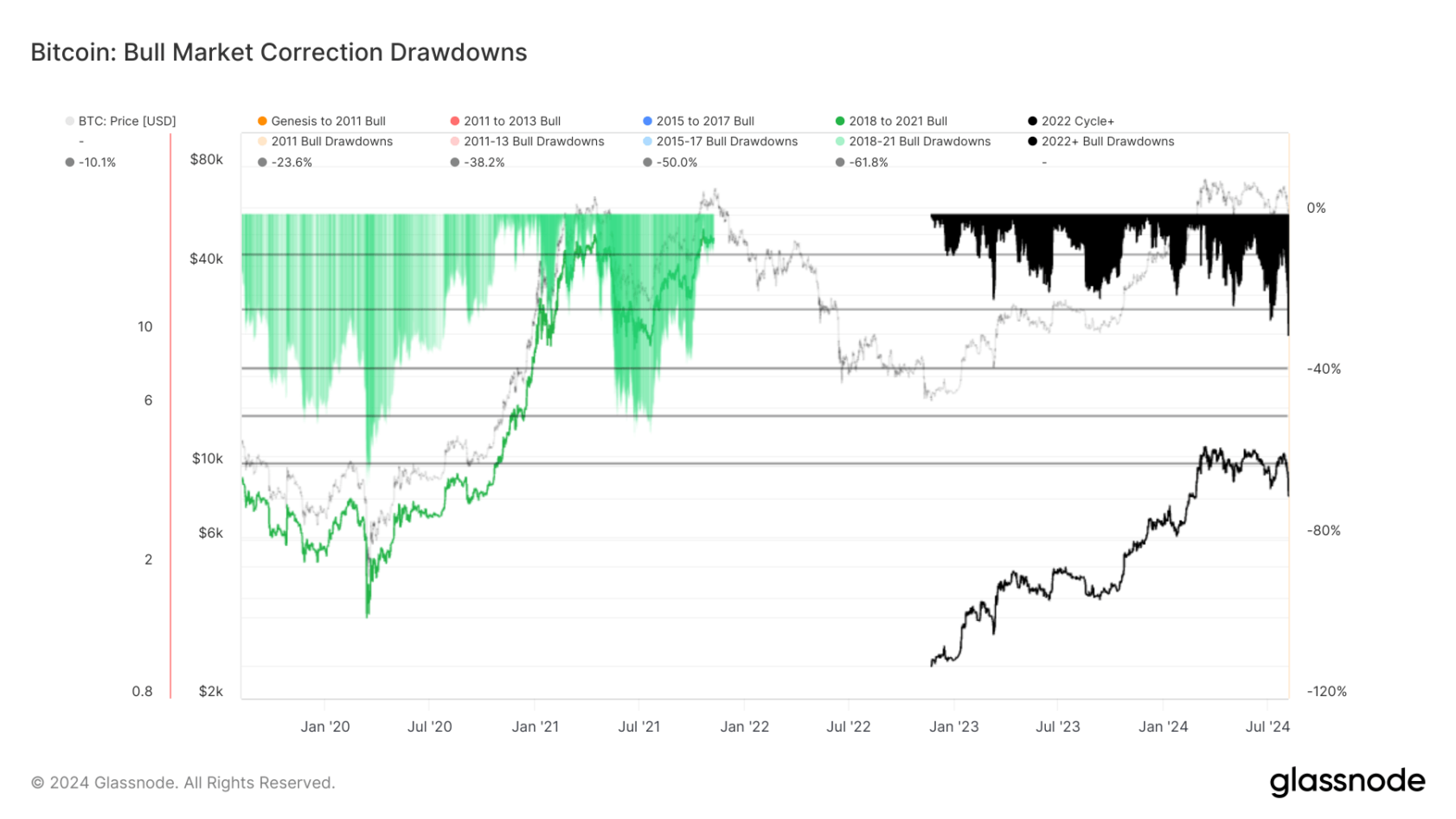

Bitcoin’s dominance in the digital assets market recently surged to a new yearly high of 58%, but it quickly retreated back to 57%. This comes as Bitcoin has dropped to around $50,000, marking a significant 32% decline from its all-time high.

This is the most significant drawdown Bitcoin has experienced since the low of the current market cycle, which was back in November 2022. Meanwhile, Ethereum has also seen a substantial decrease, falling to roughly $2,230. The ETH/BTC ratio continues to decline, hitting as low as 0.0400 before rebounding to 0.044, a level not seen since April 2021.

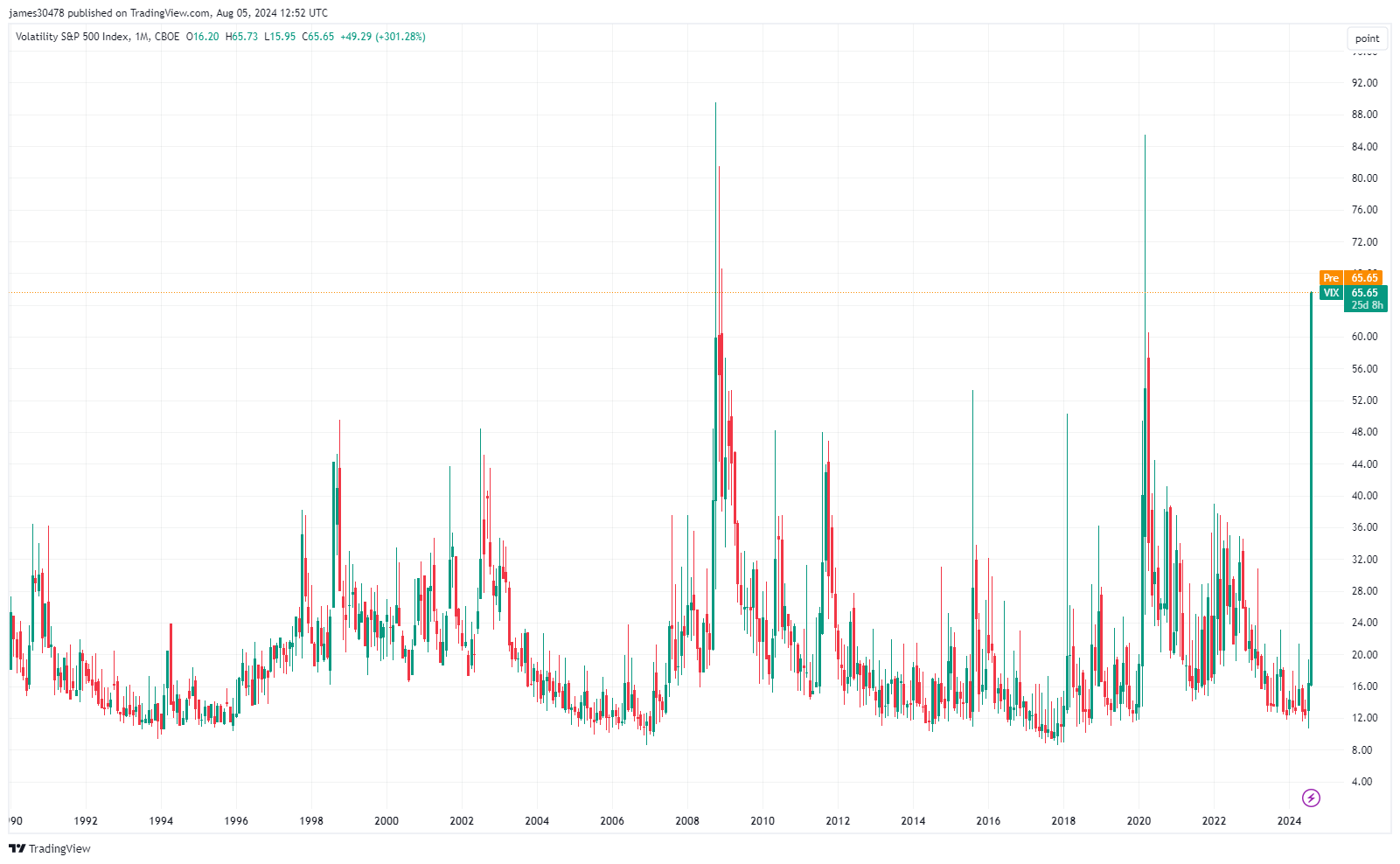

More notably, the Volatility Index (VIX) has spiked to 65, approaching levels not seen since the COVID-19 market crash in March 2020, when it soared to a high of 84. The only other time the VIX was higher was during the 2008 financial crisis when it nearly reached 100. This sharp rise in the VIX indicates heightened market uncertainty and fear, suggesting that current market conditions are reminiscent of past major financial disruptions.

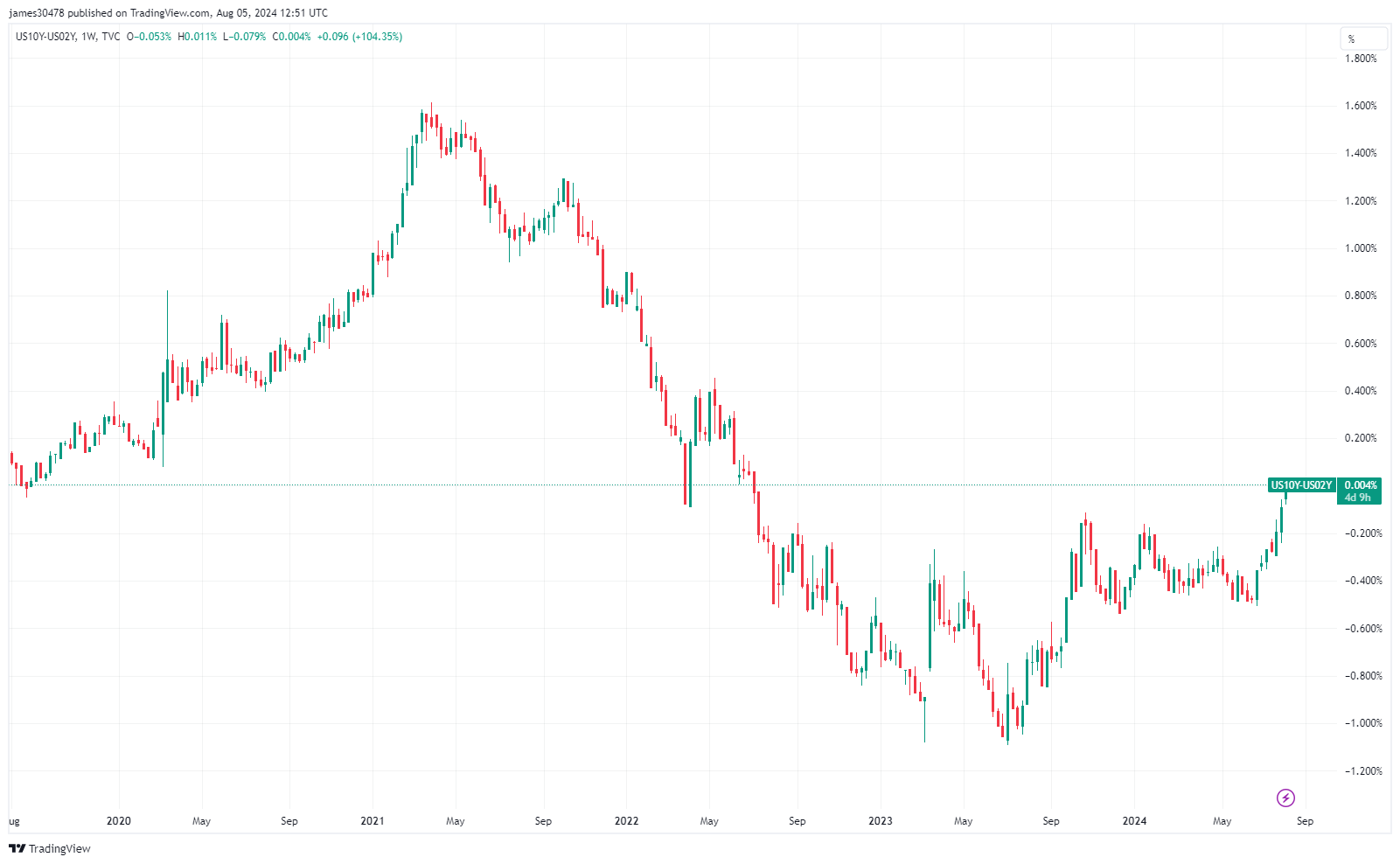

In addition, the yield curve spread between the US 10-year and 2-year Treasury notes has normalized for the first time since July 2022.