US national debt soars past $34 trillion, spotlight on Bitcoin as potential hedge

US national debt soars past $34 trillion, spotlight on Bitcoin as potential hedge Quick Take

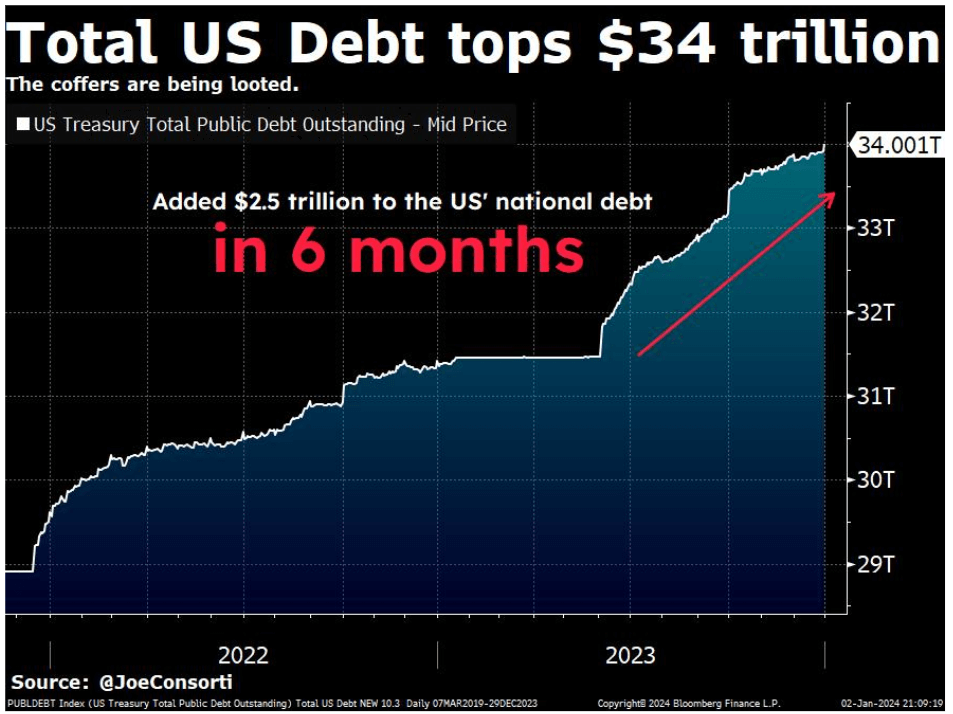

The US national debt has recently hit an unprecedented landmark, crossing the $34 trillion mark. As reported by analyst Joe Consorti, the national debt has seen an alarming increment of $2.5 trillion in just six months, according to Consorti.

In a broader timeframe, an addition of approximately $10.5 trillion in the past three years and $12 trillion in the past five years has been noted. According to analyst Charlie Bilello, the US national debt stands at an astonishing 123% as a percentage of the GDP.

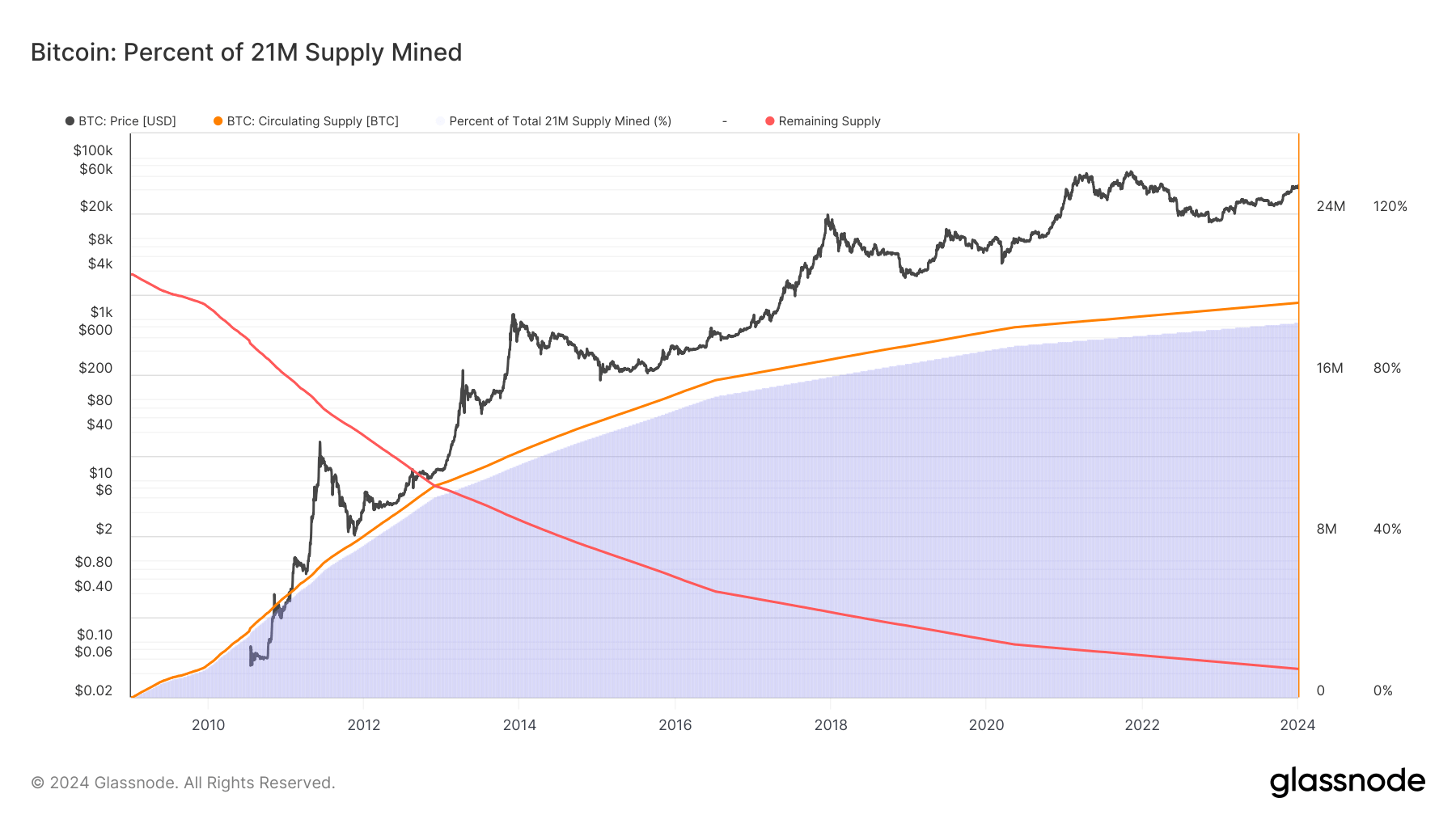

Within this fiscal environment, Bitcoin emerges as a potential hedge. The fundamental aspect of this digital asset is its finite supply, which starkly contrasts the US dollar. This means that the holdings of Bitcoin cannot be diluted, unlike the US dollar, whose value may depreciate in relation to the increasing national debt as they continue to borrow more money. Thus, this feature presents Bitcoin as an alternative financial instrument in the current scenario of escalating national debt.