US national debt hits $35.3 trillion as Bitcoin’s relative strength alters perspectives

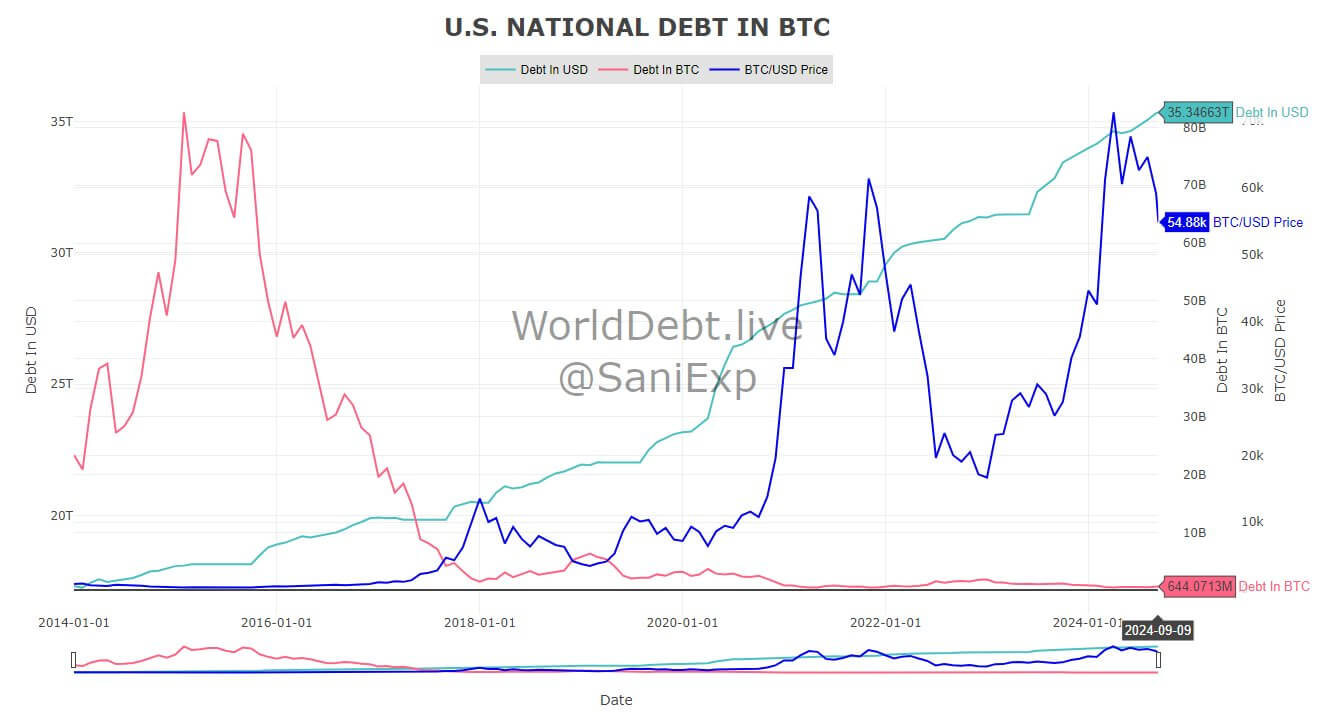

US national debt hits $35.3 trillion as Bitcoin’s relative strength alters perspectives The US national debt has reached a staggering $35.347 trillion as of Sept. 9, 2024, marking a significant increase of $1.357 trillion since the beginning of the year. This surge in debt, when viewed through the lens of Bitcoin, presents an intriguing perspective on the evolving relationship between traditional fiat currency and digital assets.

According to Timechain Index founder Sani, the US national debt is equivalent to 644.071 million Bitcoin (BTC), over thirty times the maximum supply. This figure represents a notable decrease from the 761.325 million BTC equivalent recorded at the start of 2024 despite the substantial rise in the dollar value of the debt.

The apparent paradox of increasing dollar debt but decreasing BTC equivalent can be attributed to Bitcoin’s price appreciation against the US dollar over the same period. The BTC/USD price has experienced significant volatility, reaching peaks above $70,000 before settling at $54,880 as of the most recent data point, now $56,800 as of press time.

Analyzing the data reveals several key trends. The dollar-denominated debt has shown a consistent upward trajectory, increasing from $33.990 trillion on Jan. 1 to $35.347 trillion by Sept. 9. However, the BTC equivalent of this debt has fluctuated dramatically, ranging from a high of 802.081 million BTC in February to a low of 485.635 million BTC in April.

Despite the increase in dollar terms, the reduction in the BTC equivalent over the nine months suggests a strengthening of Bitcoin’s value relative to the US dollar. This trend has implications for investors and policymakers alike, as it reflects changing perceptions of value and store of wealth in an increasingly digital economy. The interplay between traditional financial metrics and digital asset valuations offers a unique lens through which to view fiscal policies and their global impact.