Upcoming Bitcoin halving could push floor price above $41,000

Upcoming Bitcoin halving could push floor price above $41,000 Quick Take

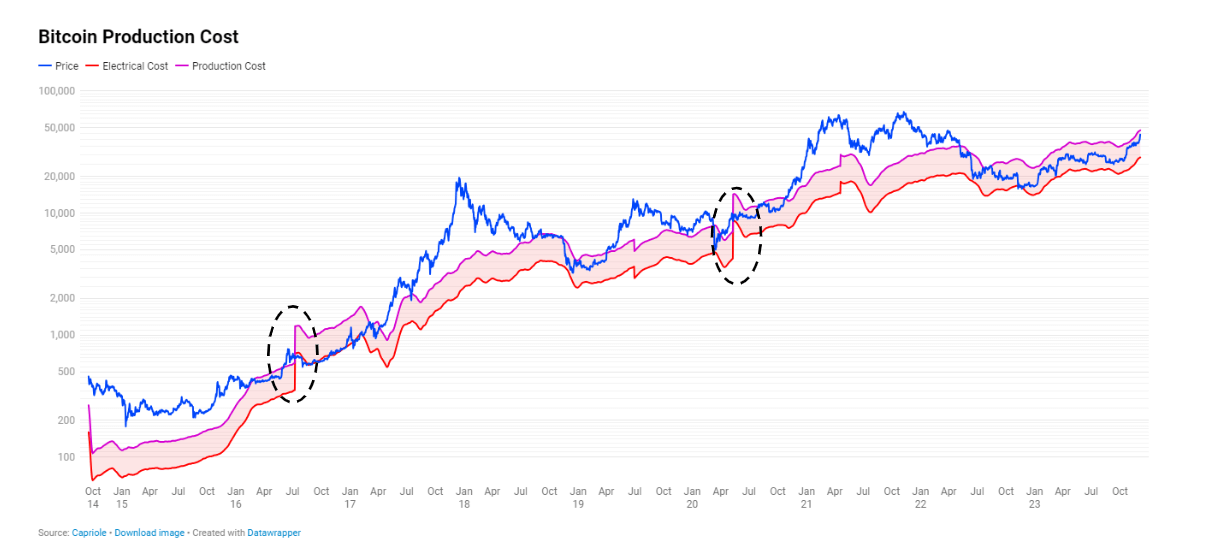

The forthcoming Bitcoin halving in April 2024 is projected to significantly impact the Bitcoin mining landscape, potentially doubling the cost of Bitcoin production and electrical costs. Recent data from Capriole Investments underscores the severity of this change, with current Bitcoin electrical and production costs estimated at around $28,500 and $47,655, respectively, against Bitcoin’s current median price of $43,000.

Historical analysis of the previous halvings in July 2016 and May 2020 reveals a consistent trend – both electrical and production costs doubled from their pre-halving bottom levels, setting a theoretical floor price for Bitcoin at about $41,000 in the upcoming cycle.

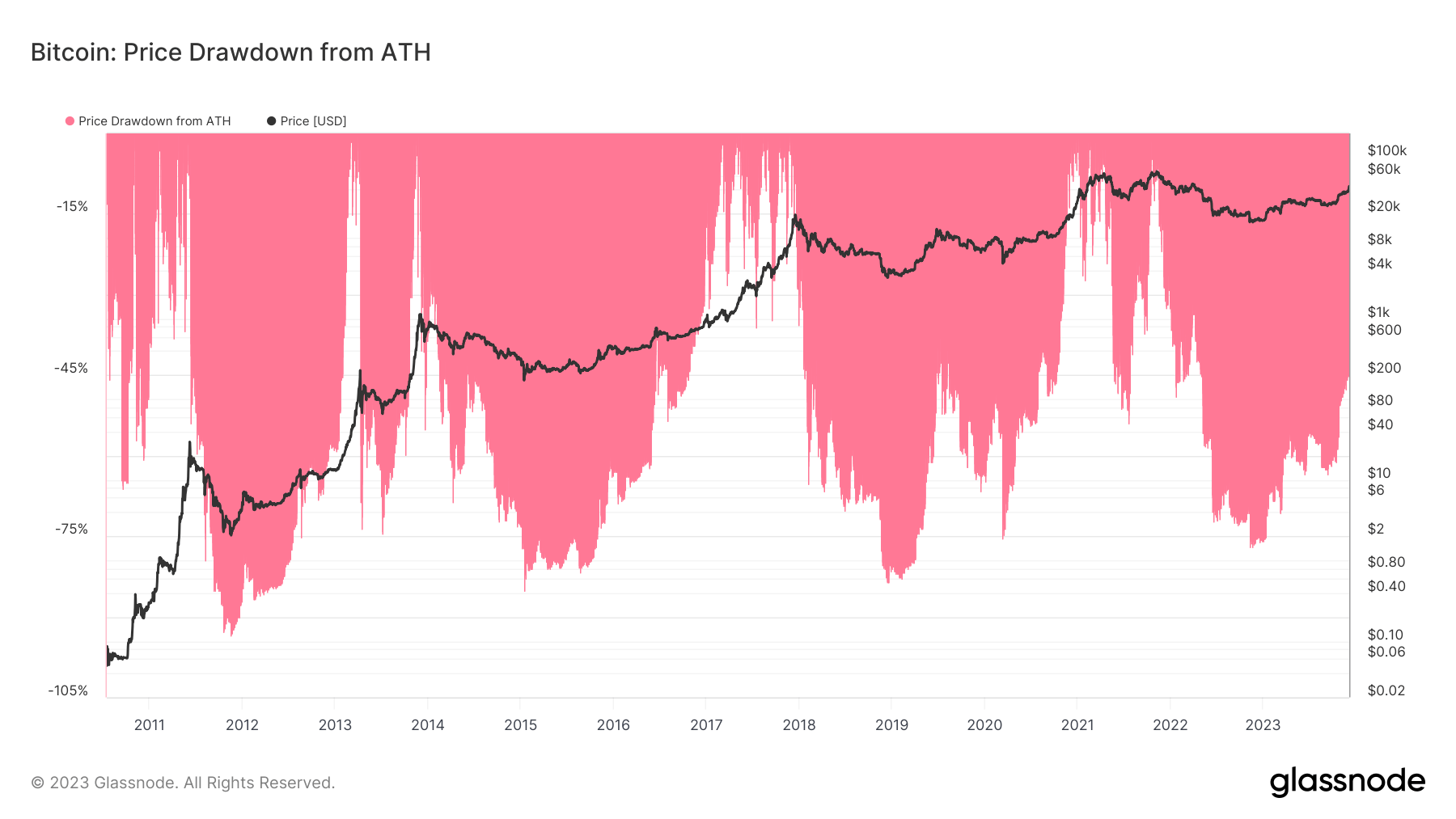

Additionally, the pattern of diminishing severity and volatility in the drawdown from all-time highs across Bitcoin’s price cycles suggests a potential theoretical ceiling of $133k per Bitcoin, assuming a 70% drawdown from the top.

This information presents the potential for advantageous strategic planning for both miners and investors as they navigate the complexities of the rapidly approaching halving year.