UK jobs surprise with lower unemployment and higher wages, stoking inflation concerns ahead of key report

UK jobs surprise with lower unemployment and higher wages, stoking inflation concerns ahead of key report Quick Take

Recent UK jobs data released this morning indicated unexpected heat—unwanted by the Bank of England (BOE).

According to Trading Economics, the unemployment rate defied consensus, arriving at 4.2% instead of the anticipated 4.3%. Furthermore, the average earnings, including bonuses, for the past three months were also higher than expected at 7.9%, surpassing the consensus of 7.4%, according to Trading Economics.

This more robust jobs market could fuel inflationary pressures, adding greater significance to the inflation print due tomorrow, Nov. 14. Analysts predict a drop in headline inflation to 4.8% year over year from 6.7%.

Accordingly, the interaction between employment, earnings, and inflation will be a critical economic narrative in the coming months.

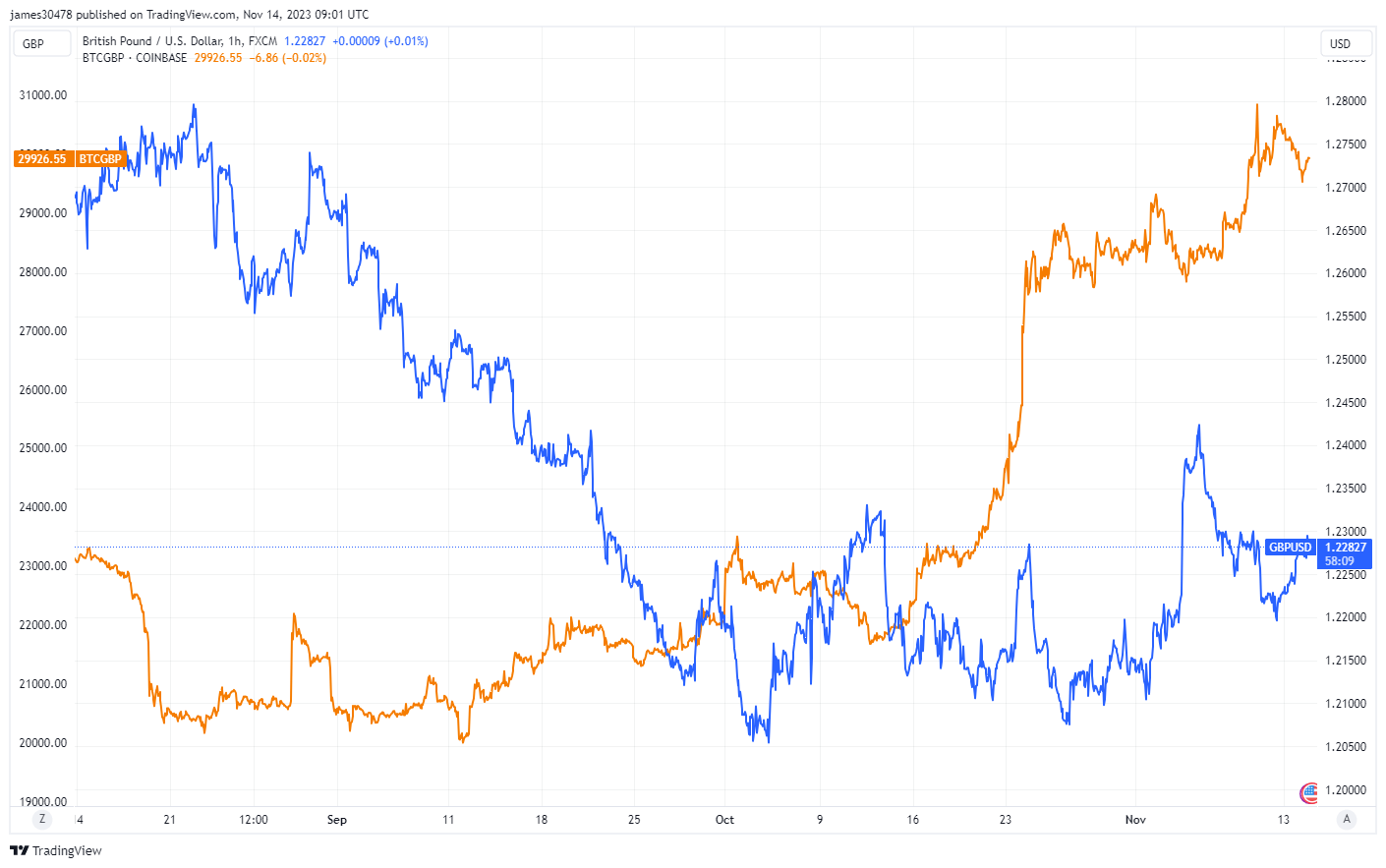

The GBPUSD exchange rate peaked at 1.23, while the value of the British pound against Bitcoin is currently oscillating around the £30,000 mark.