Troubling signs for Bitcoin as U.S. investors pull back

Troubling signs for Bitcoin as U.S. investors pull back Quick Take

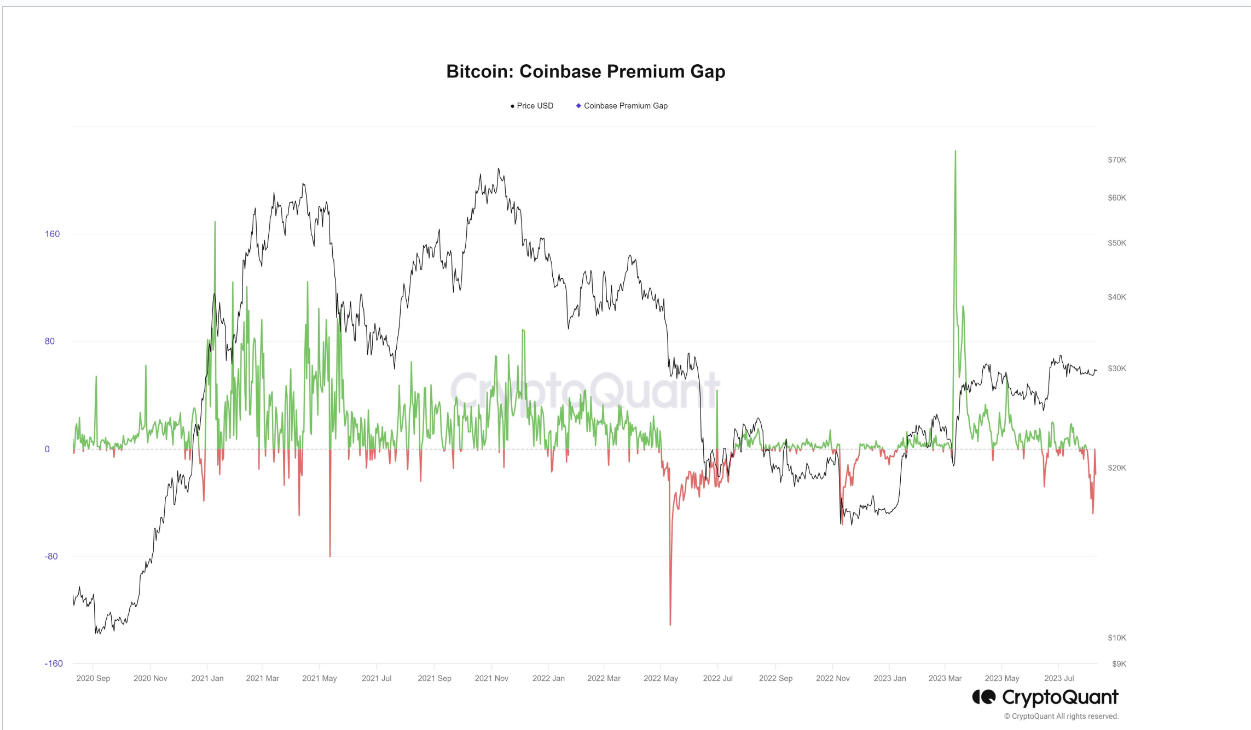

The summer’s end is ushering in continued sideways price action for Bitcoin, as critical indicators point to a lackluster spot demand. The Coinbase premium index, a barometer of US investors’ buying pressure gauged by CryptoQuant, has taken a nosedive. This metric delineates the percent disparity between the Coinbase Pro price (USD pair) and the Binance price (USDT pair).

A surge in premium values typically signals robust buying pressure. However, the recent plunge aligns with Bitcoin’s fall below the $29,000 mark, mirroring the previous low in the aftermath of the FTX collapse. This suggests that the sell-off pressure primarily stems from Coinbase, usually championed by US investors.

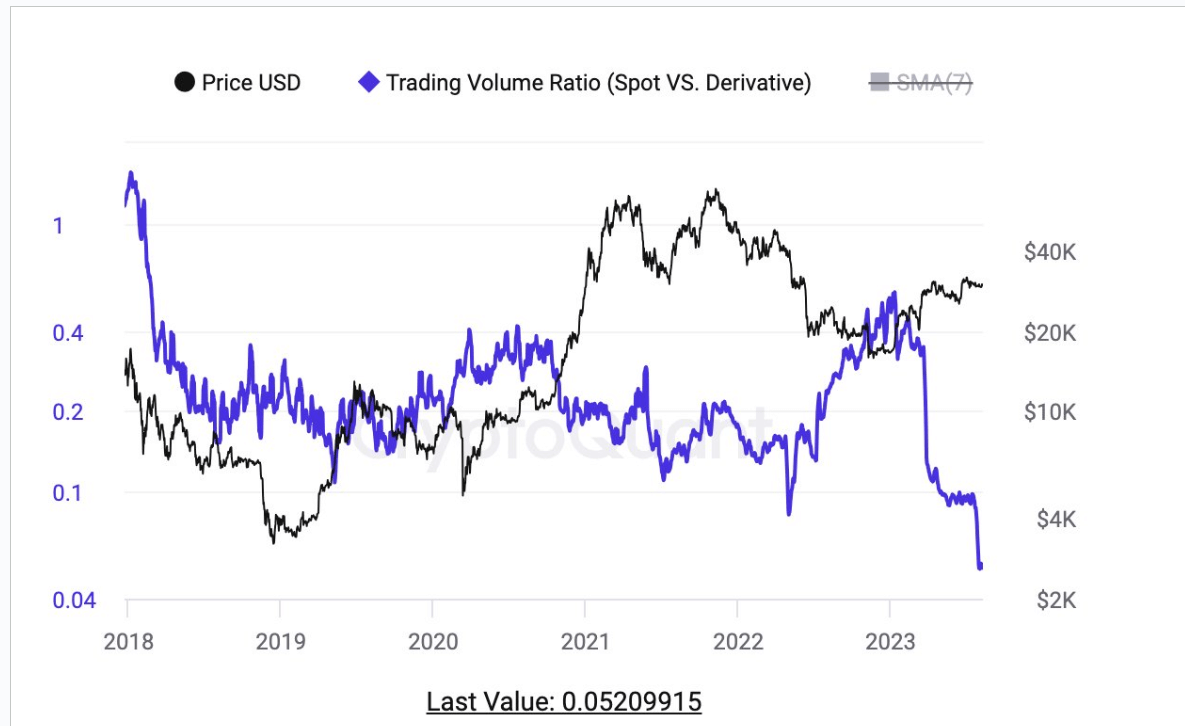

Further corroborating the absence of spot demand is the anomalously low spot-to-futures ratio, touching a five-year low. Dylan LeClair, a Bitcoin Magazine analyst, underscores that derivative traders have overtaken the market, a hypothesis buttressed by the year-to-date high in open interest.

According to LeClair, the spot bears have largely exhausted their coin reserves. In contrast, spot bulls are either entirely invested or biding their time in traditional finance (TradFi) pending the approval of an ETF.