Total Bitcoin ETF net inflows reach $8.9 billion

Total Bitcoin ETF net inflows reach $8.9 billion Quick Take

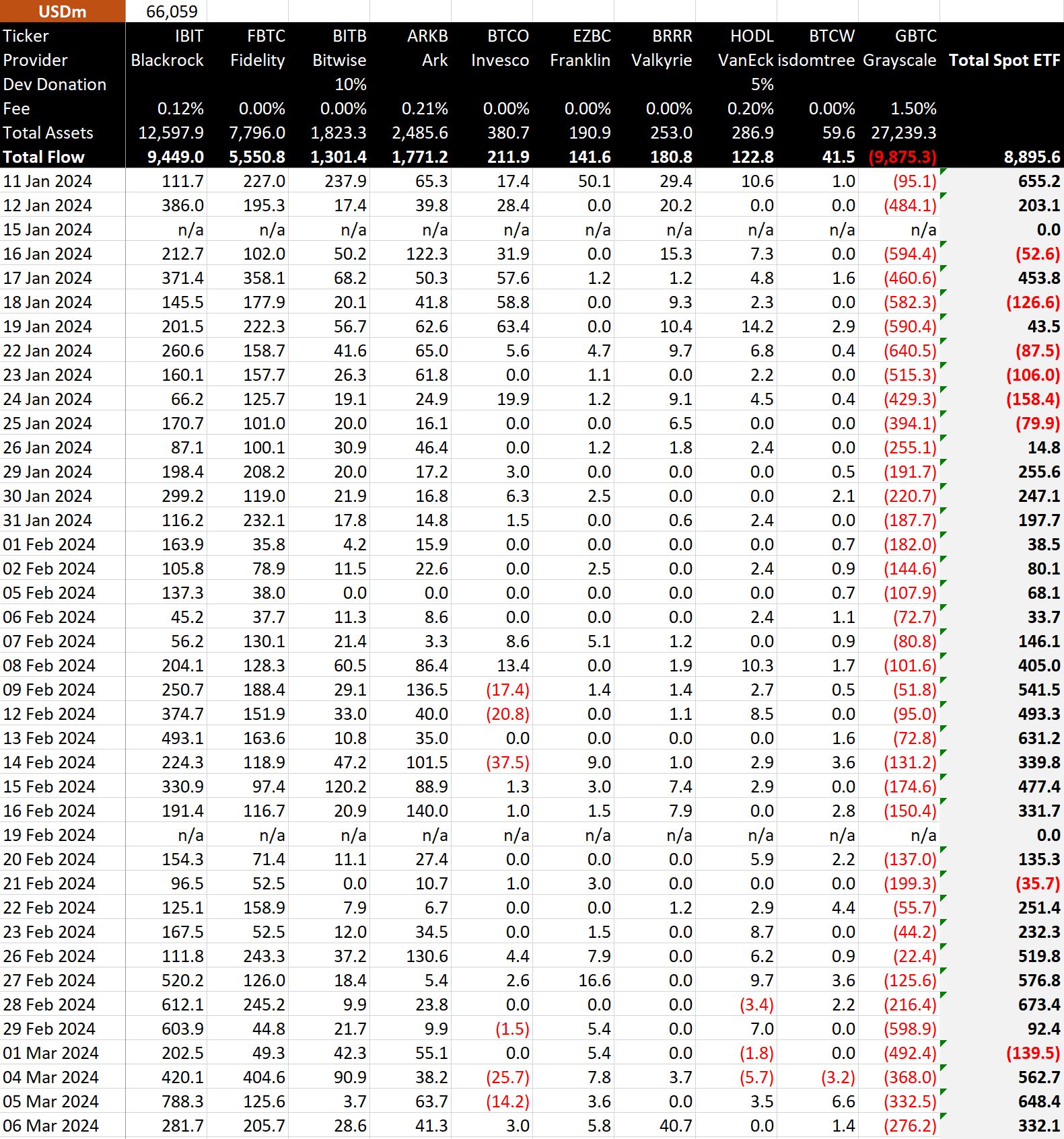

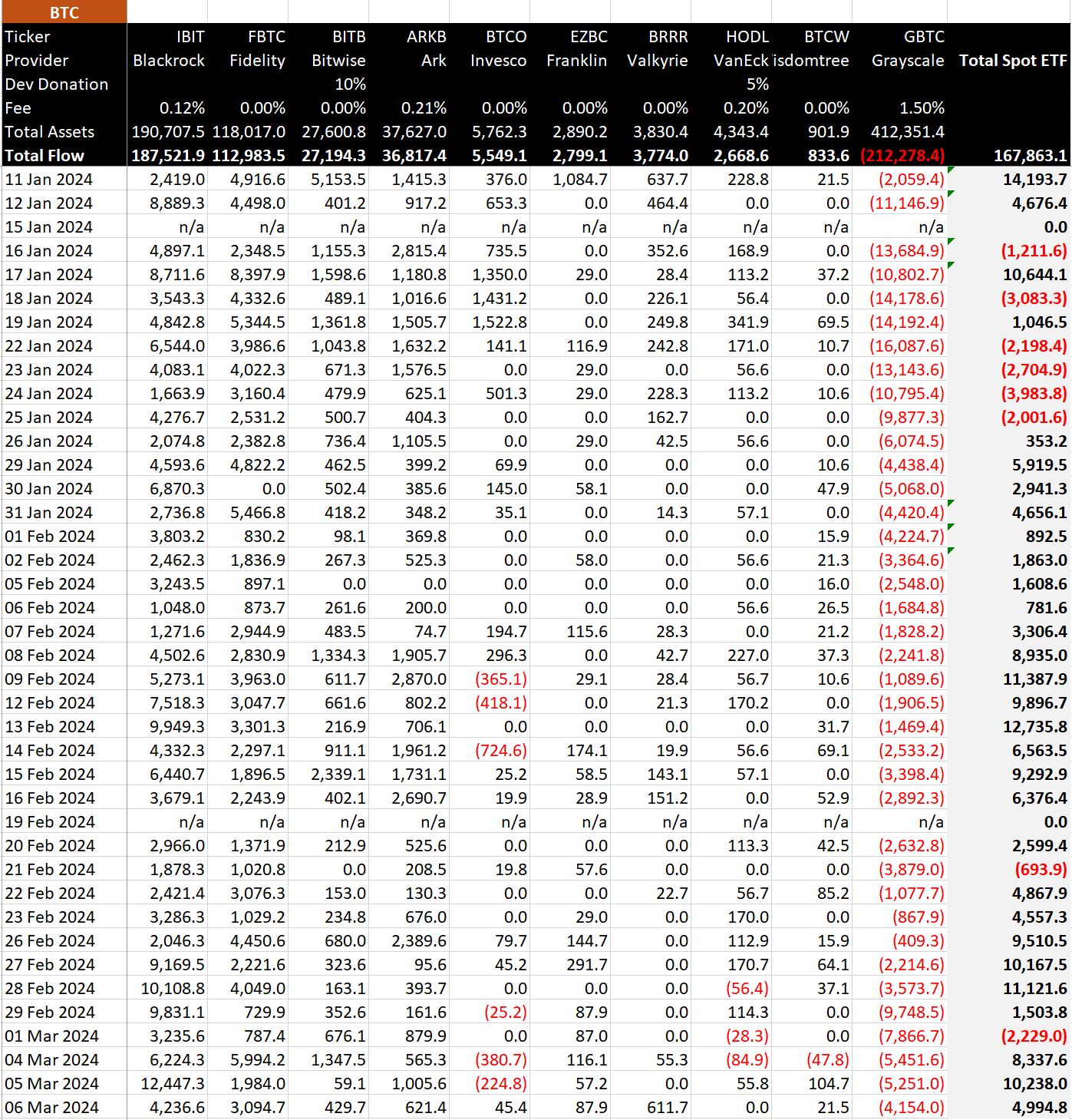

BitMEX data showed $332 million in inflows into Bitcoin ETFs, equivalent to 4,995 Bitcoin, on Mar. 6. Leading the charge was BlackRock’s IBIT, which added $282 million to its coffers, bringing its total net inflows to $9.4 billion. This implies that IBIT currently holds around 188,000 BTC.

Fidelity’s FBTC wasn’t far behind, maintaining a strong momentum with a robust net inflow of $206 million. This growth brings their total net inflows to $5.6 billion, equivalent to roughly 113,000 Bitcoin, according to BitMEX.

BitMEX reports that GBTC’s outflows are progressively diminishing, with an outflow of $276 million. The observed decrease in capital outflows, now totaling $9.9 billion, is a favorable development for the market.

Valkyrie’s BRRR has recorded its highest inflow to date, bringing in a substantial $40.7 million, bringing its total net inflow to $181 million.

BitMEX data puts the total net inflows now at $8.9 billion, representing around 167,863 Bitcoin, showing a significant accumulation of Bitcoin through ETFs.