Short term holders in profit sent record Bitcoin to exchanges on road to $50k

Short term holders in profit sent record Bitcoin to exchanges on road to $50k Quick Take

On Feb. 12, Bitcoin’s value ascended above $50,000 for the first time since Dec. 2021, marking a nearly 20% increase over the past month.

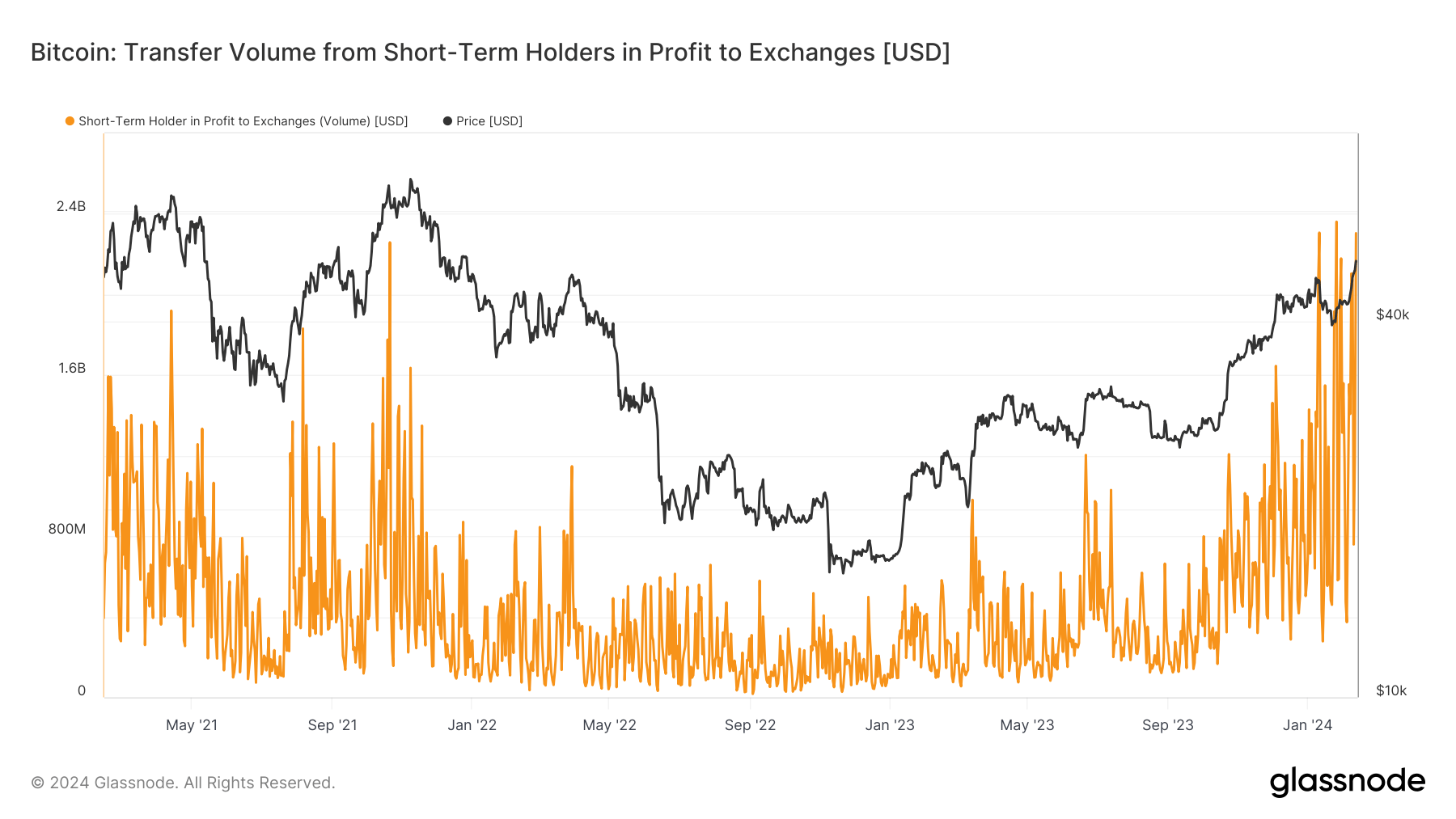

This surge was accompanied by robust inflows from the spot Bitcoin ETF, indicating a heightened investor interest. Notably, this rally has been reflected in significant profit transfers to exchanges, particularly from short-term holders (STHs) who have held Bitcoin for less than 155 days.

CryptoSlate reported that on Feb. 8 and 9, STHs transferred over $4 billion worth of Bitcoin in profit to exchanges. On Feb. 12, as Bitcoin crossed the $50,000 threshold, about $2.3 billion in profit was sent to exchanges by STHs, echoing similar movements witnessed on Jan. 26 and Jan. 11. Despite the rallying Bitcoin value, the trend of profit transfers to exchanges persists among investors.

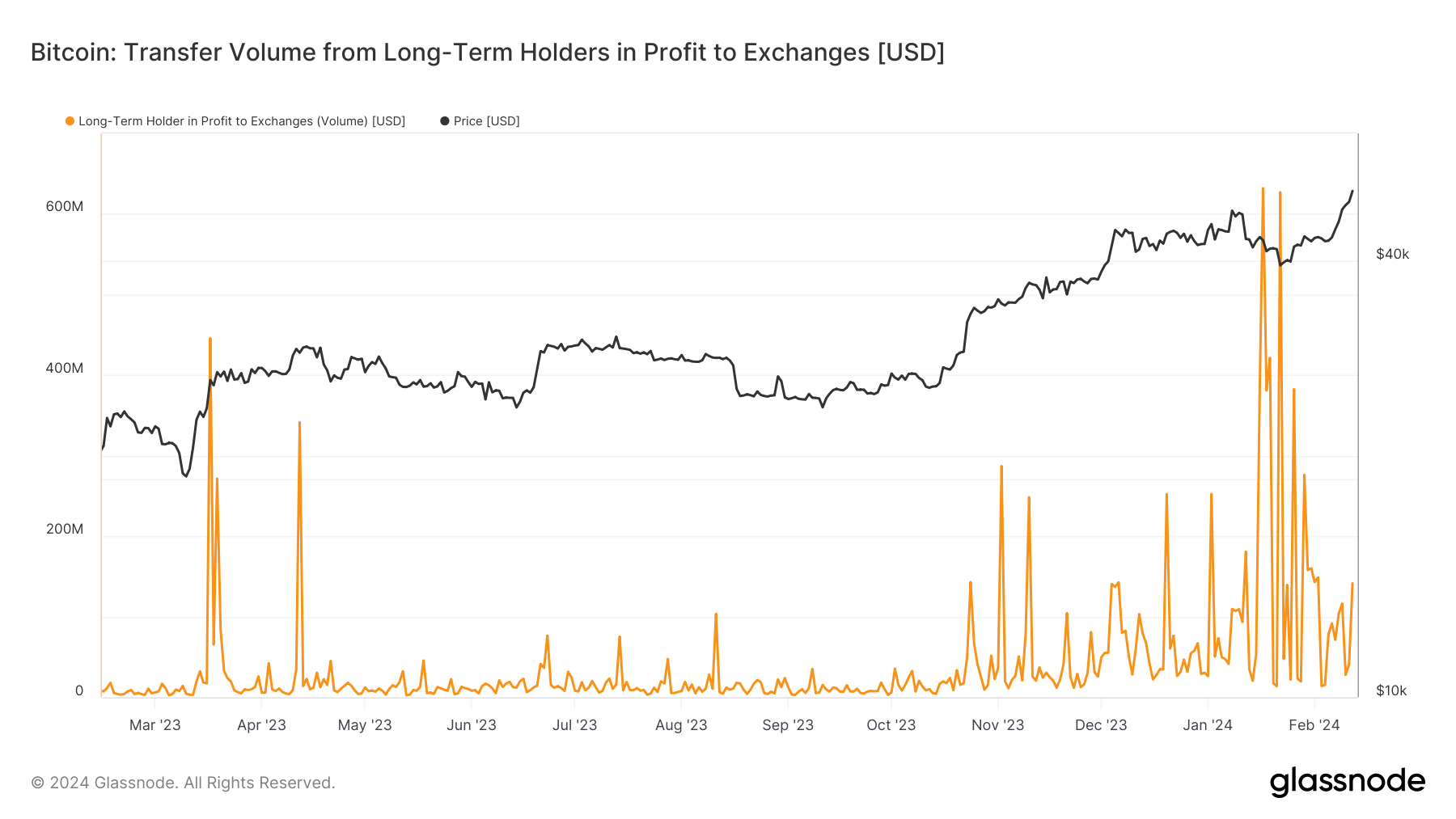

A minor uptick was observed among long-term holders, those who have held Bitcoin for more than 155 days, with a profit transfer of about $142 million, a figure that significantly trails the values associated with STHs.