Bitcoin sees largest short-term holder activity since May 2021 with $6.1 billion transferred

Bitcoin sees largest short-term holder activity since May 2021 with $6.1 billion transferred Quick Take

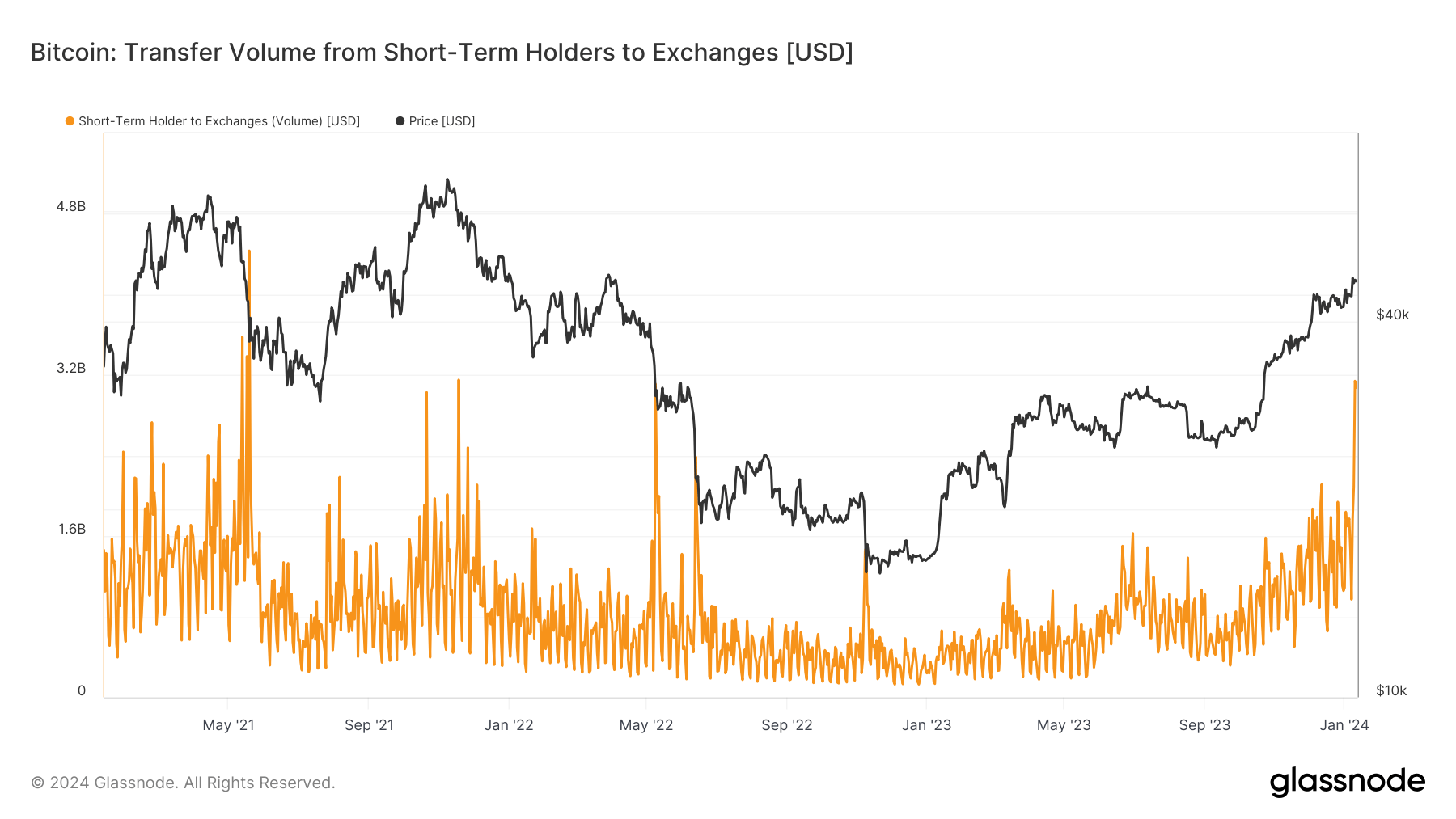

The trading dynamics of Bitcoin ETFs on Jan. 10 and Jan. 11 demonstrate an intriguing behavioral trend of short-term holders (STHs). These investors, who held Bitcoin for less than 155 days, transferred a staggering total of $6.1 billion to exchanges over these two days.

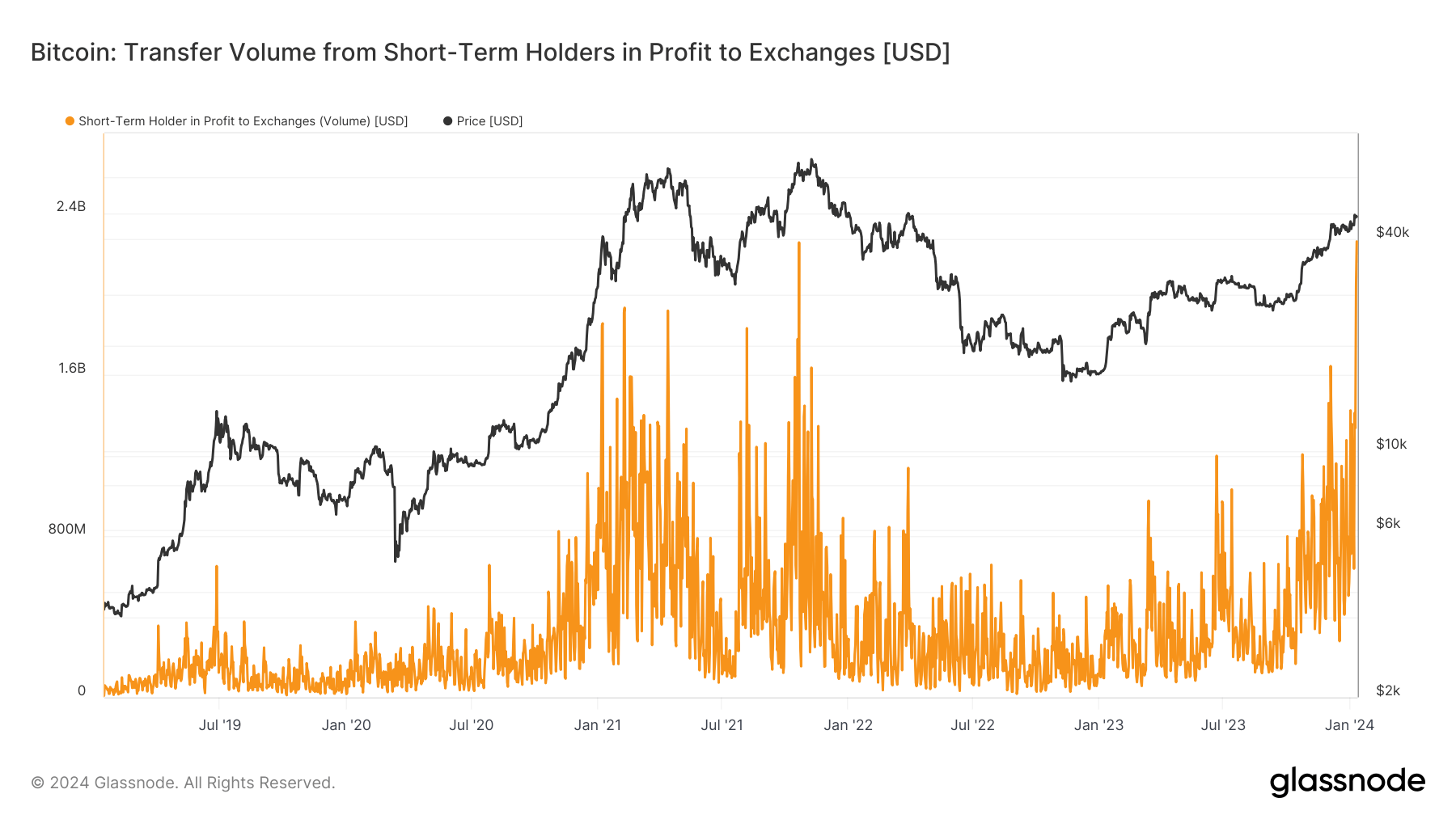

This level of activity is unprecedented, marking the highest recorded since May 2021. Even more striking, a significant portion of these transfers, $2 billion on Jan. 10 and a record-breaking $2.263 billion on Jan. 11, materialized as sending profit to exchanges. This trend underscores a particular investment strategy employed by STHs that leads to a substantial profit extraction from the digital assets market.

While the data provides factual insight, careful observation of future trends becomes crucial to understanding the broader implications on Bitcoin’s price stability and market dynamics.