Short-term Bitcoin holders under market pressure with millions potentially at stake

Short-term Bitcoin holders under market pressure with millions potentially at stake Quick Take

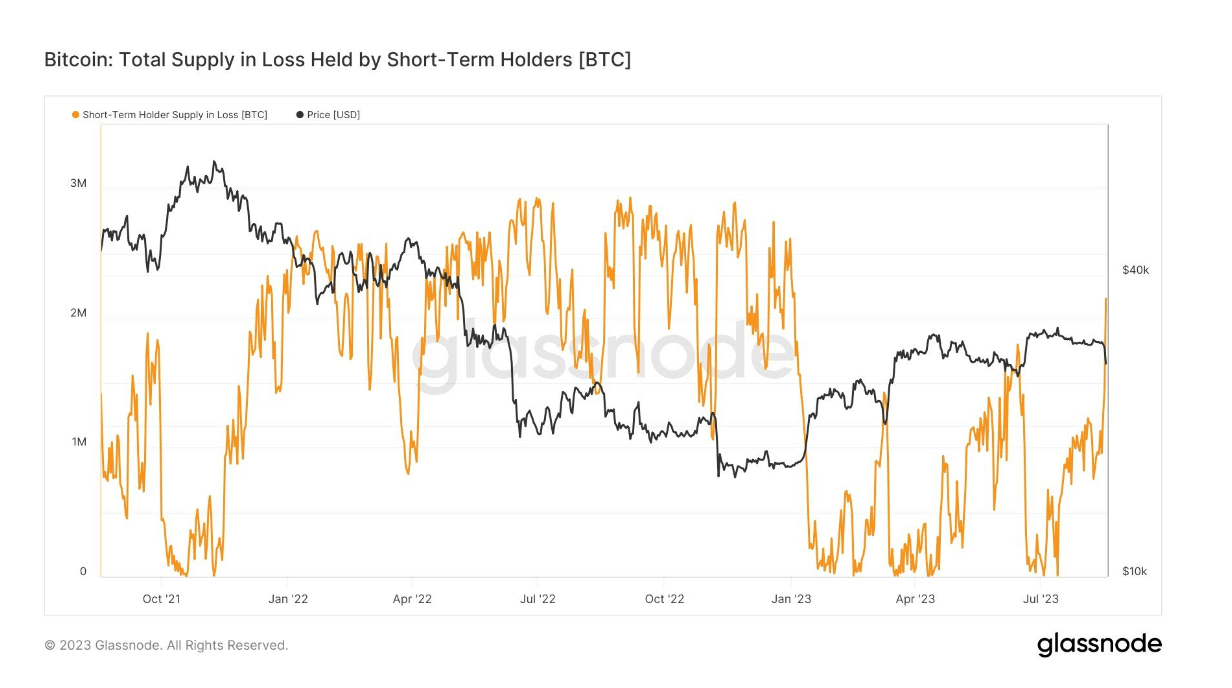

The current landscape of Bitcoin appears to be significantly influenced by the movements of short-term holders, specifically those who have possessed Bitcoin for less than 155 days. As per CryptoSlate’s recent data analysis, these individuals are experiencing notable financial pressure due to their positions. The data suggests that 2.1 million Bitcoin, currently held by these short-term investors, are at a loss. This sizable chunk of the market could trigger a substantial sell-off if panic seizes this investor cohort, potentially contributing to increased market volatility.

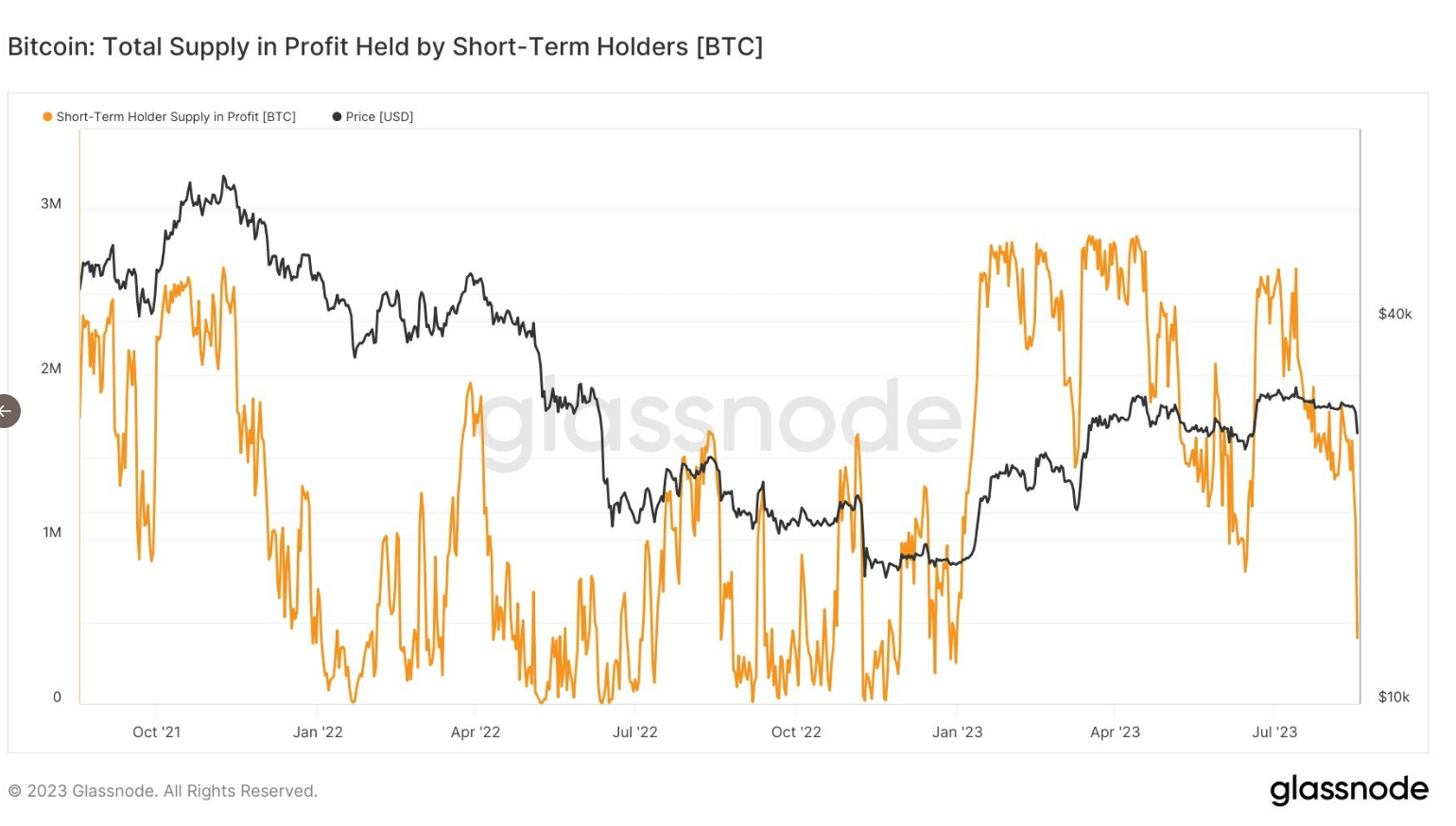

Simultaneously, another subset within this group, holding approximately 400,000 Bitcoin, is currently in profit. Although smaller, this group also presents a potential sell pressure point. If these profit-making investors decide to cash in, it could further contribute to the selling pressure.

While these scenarios don’t definitively predict a market turn, they underscore the importance of monitoring the behaviors of short-term investors and their potential impact on the Bitcoin market.