Short-term Bitcoin holders’ sell-off leads to third-largest loss in 2024, totaling $537 million

Short-term Bitcoin holders’ sell-off leads to third-largest loss in 2024, totaling $537 million Quick Take

On June 24, Bitcoin experienced a significant price drop, breaking below the $60,000 mark and hitting a low of approximately $58,500. This decline led to a substantial realized loss of over $500 million, with data from Glassnode pinpointing the loss at $537 million.

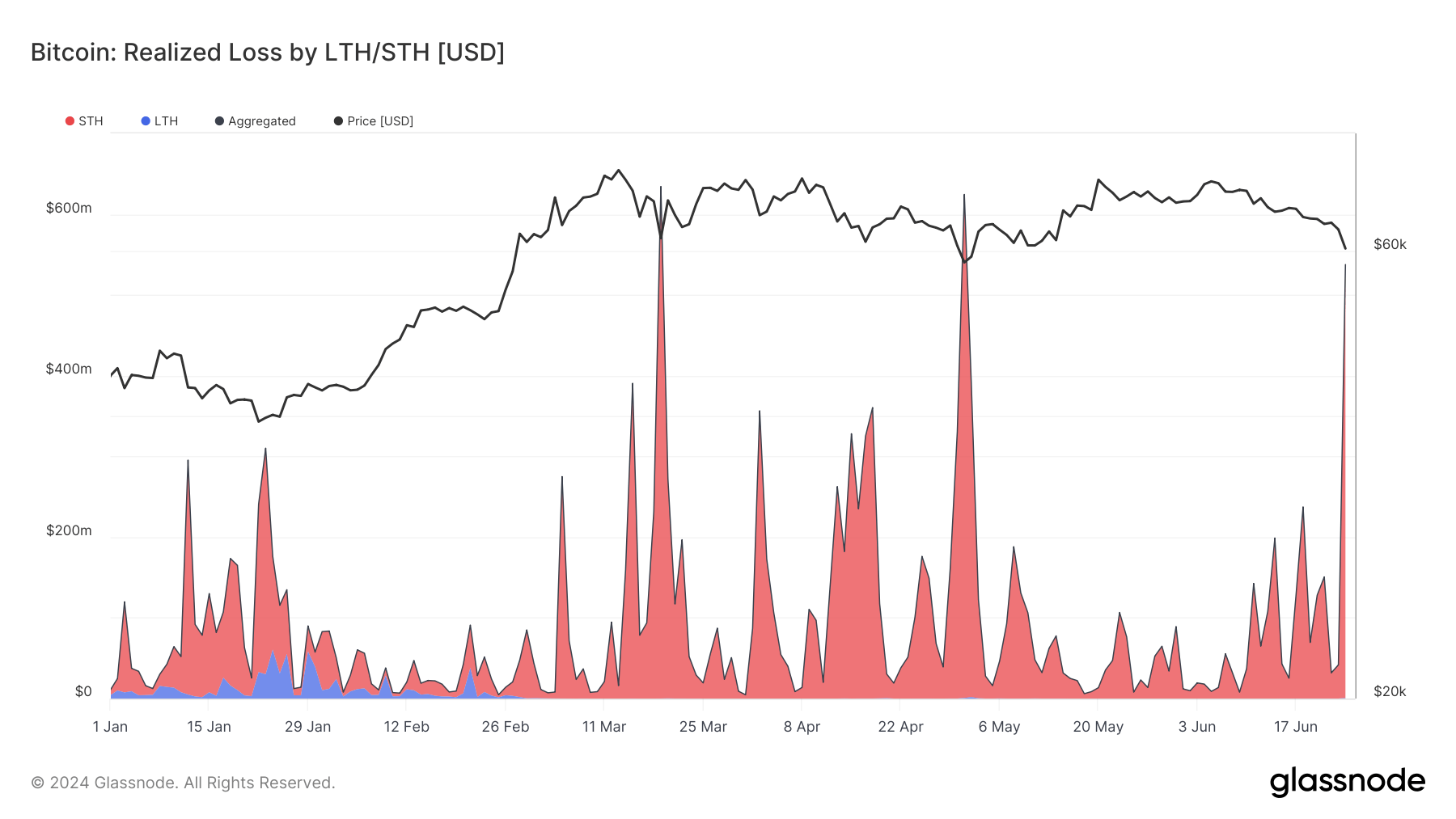

Data from Glassnode shows that the sell-off was predominantly driven by short-term holders (STHs) who have held Bitcoin for less than 155 days. They accounted for almost the entire $537 million in realized losses. In stark contrast, long-term holders (LTHs), those holding for over 155 days, realized a mere $543,000 in losses.

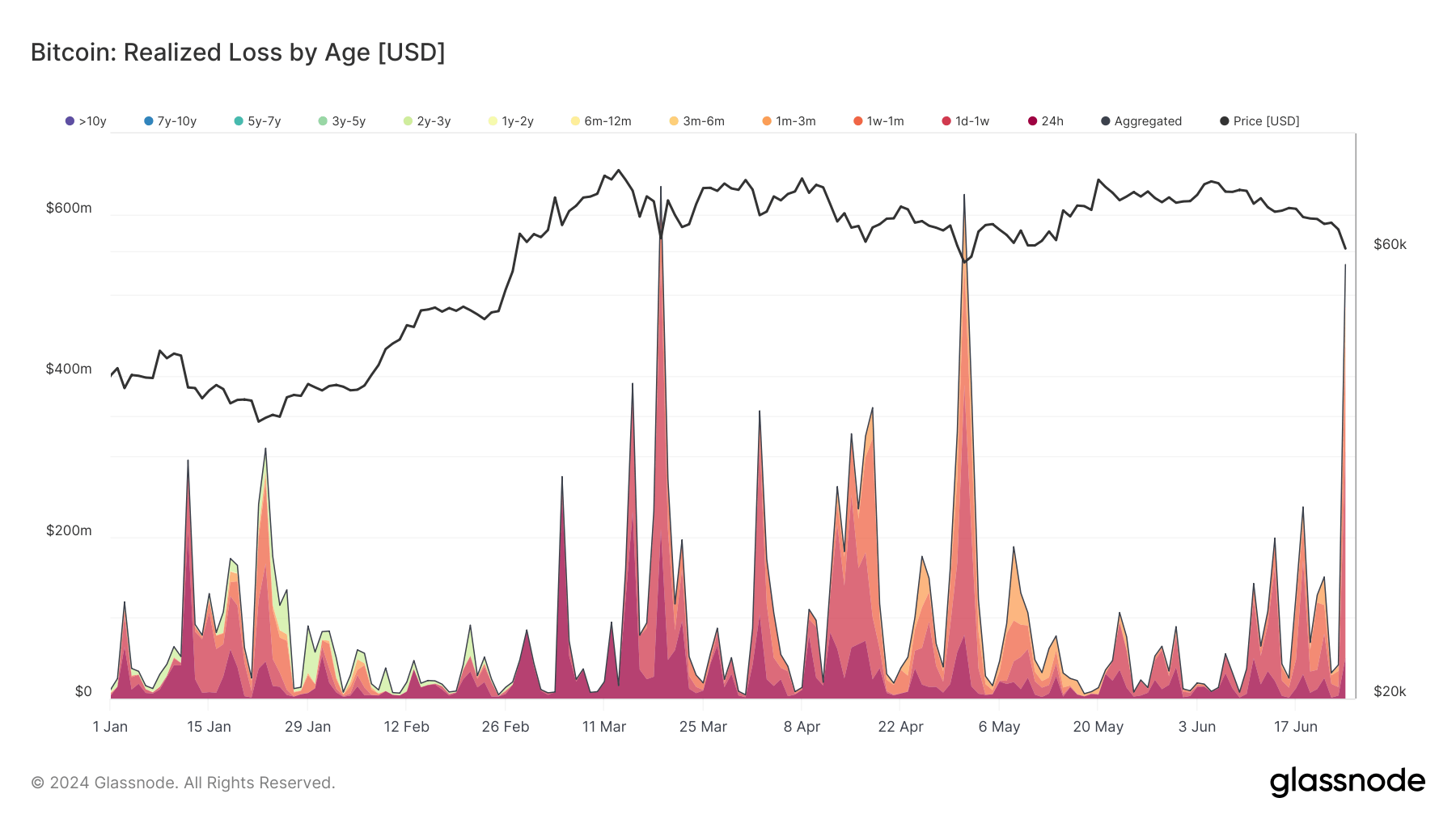

This event marked the third-largest realized loss in 2024. It followed significant sell-offs on March 19, when Bitcoin retraced to $62,000 from an all-time high, and May 1, when the price dipped below $60,000, reaching as low as $56,500. A closer analysis reveals that out of the $537 million in losses, $441 million were from holders who had possessed Bitcoin for one month or less, according to Glassnode.

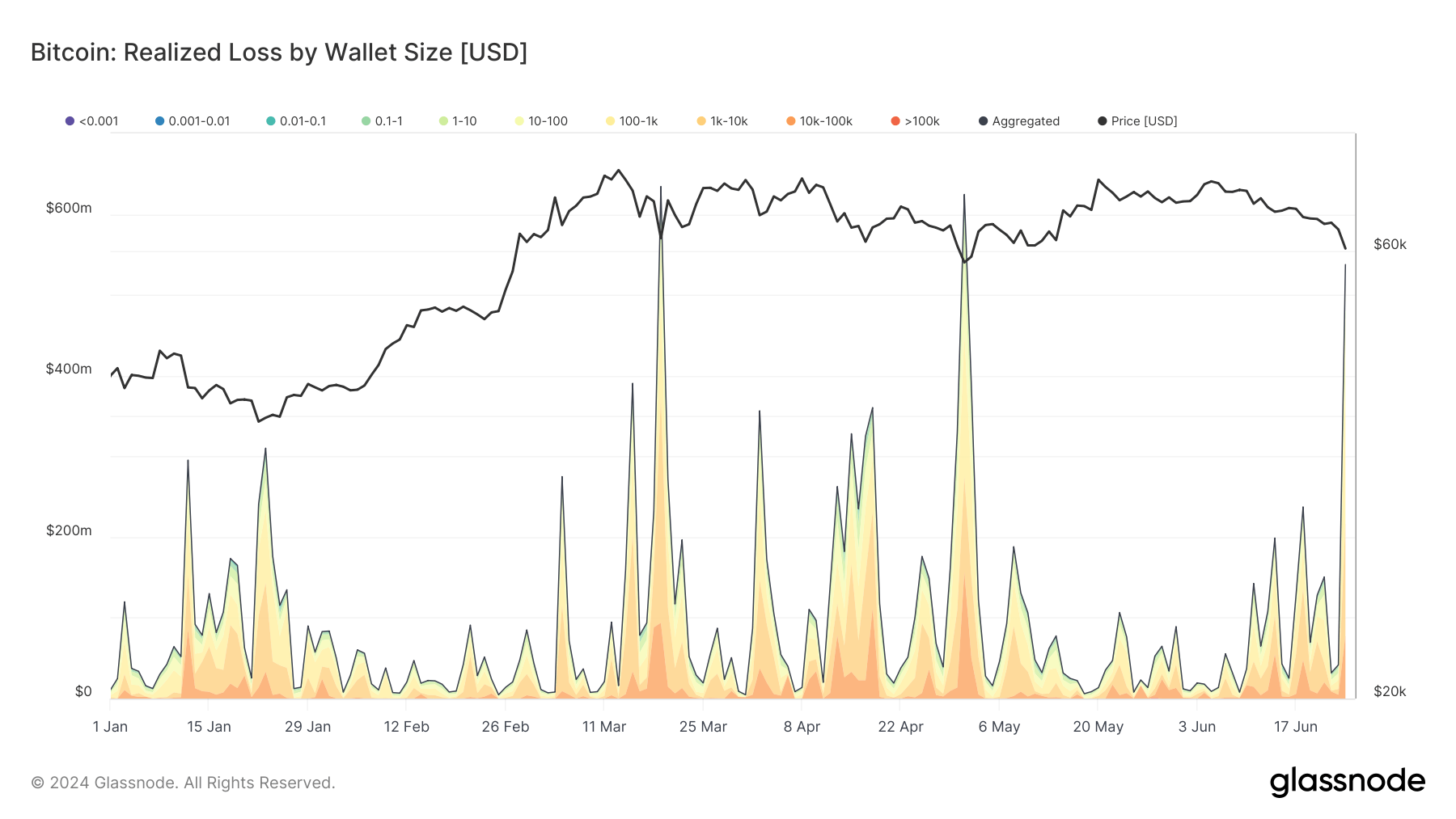

Data from Glassnode shows that around $325 million of the losses were attributed to whales, entities holding between 100 and 10,000 BTC. This emphasizes that even large-scale investors, or whales, are susceptible to selling under market pressure, similar to retail investors.