Shift to contango: Bitcoin futures premiums rise on CME

Shift to contango: Bitcoin futures premiums rise on CME Quick Take

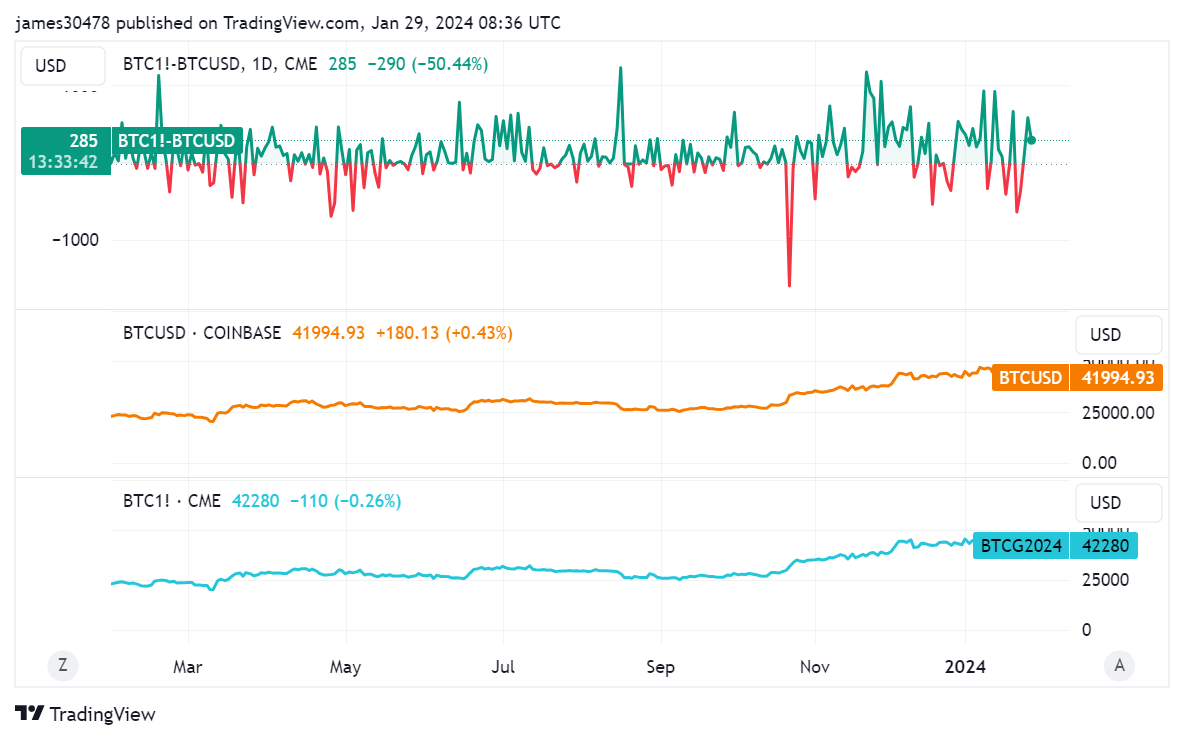

Recent data analysis has shown a marked increase in the premium paid by traders for Bitcoin futures contracts on the Chicago Mercantile Exchange (CME).

Following a downward trend from Jan. 22 to Jan. 25, which saw the Bitcoin futures contract consistently trading below the spot price, a phenomenon known as backwardation, a swift reversal has occurred.

The traders are again paying a premium of over $285 above the spot price. This change indicates a shift back to the contango trade, which could involve buying spot Bitcoin and selling Bitcoin futures, a possible sign that US institutions are regaining interest in this type of trade.

The underlying data has been drawn from the comparison of BTC1! (Bitcoin on the CME) and BTCUSD prices on the leading exchanges such as Coinbase.