Price fluctuations in stablecoins spotlight diverging market sentiments

Price fluctuations in stablecoins spotlight diverging market sentiments Price fluctuations in stablecoins spotlight diverging market sentiments

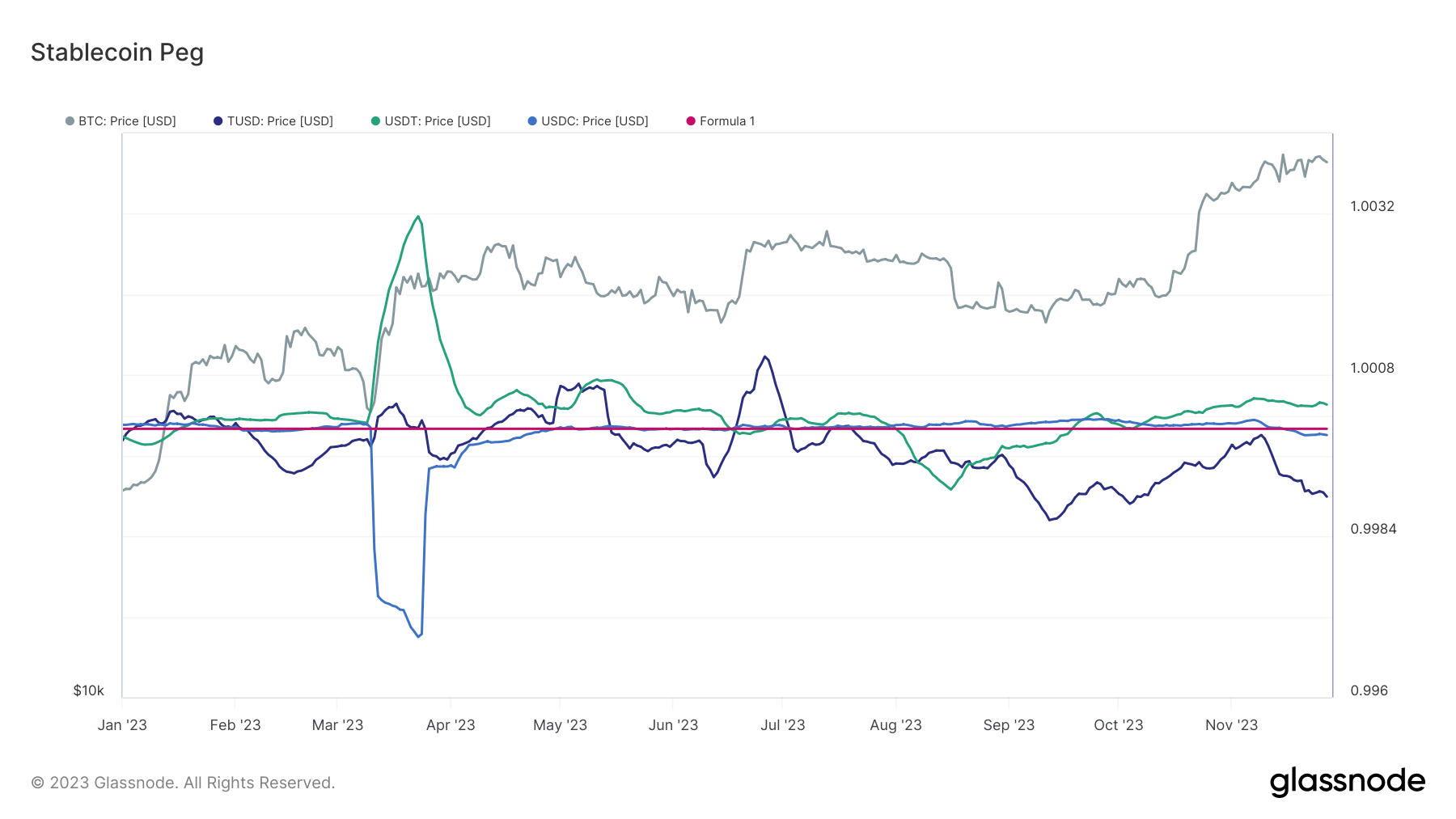

Stablecoin shake-up: USDT trades at premium while USDC and TUSD exhibit price variations despite dollar peg.

Quick Take

While the core purpose of stablecoins like USDT, USDC, and TUSD is to equate to $1, an intriguing pattern of fluctuating price movements emerges upon close scrutiny. By employing a 14-day moving average to smooth out the price variations, we discern noticeable disparities in their respective trajectories.

USDT, after trading at a discount to $1 from July to September, has shifted to trading at a slight premium in recent months. This could indicate a growth in demand for USDT despite its pegged value, possibly due to its widespread adoption and liquidity.

In contrast, USDC, which remained steadfastly anchored to $1 following the banking collapse in March 2023, is now experiencing a slight depreciation. The precise reasons for this relatively minor deviation are yet to be determined, but USDC dominance has dropped below 20% as the circulating supply continues to dwindle.

TUSD, however, exhibits the most pronounced discount, reaching one of its lowest for the year, despite trading within a cent of a dollar.