Mammoth $200M Bitcoin single-day inflow to exchanges mirrors key 2023 moments

Mammoth $200M Bitcoin single-day inflow to exchanges mirrors key 2023 moments Quick Take

Yesterday, Oct. 11, exchanges noted an inflow of around 8,000 Bitcoins, equating to approximately $200 million, signaling a significant shift in crypto market dynamics. Most of these transactions ranged from $1M to $10M, suggesting that ‘whales’ or large-scale investors were likely active, particularly as Bitcoin’s price fell below $27,000.

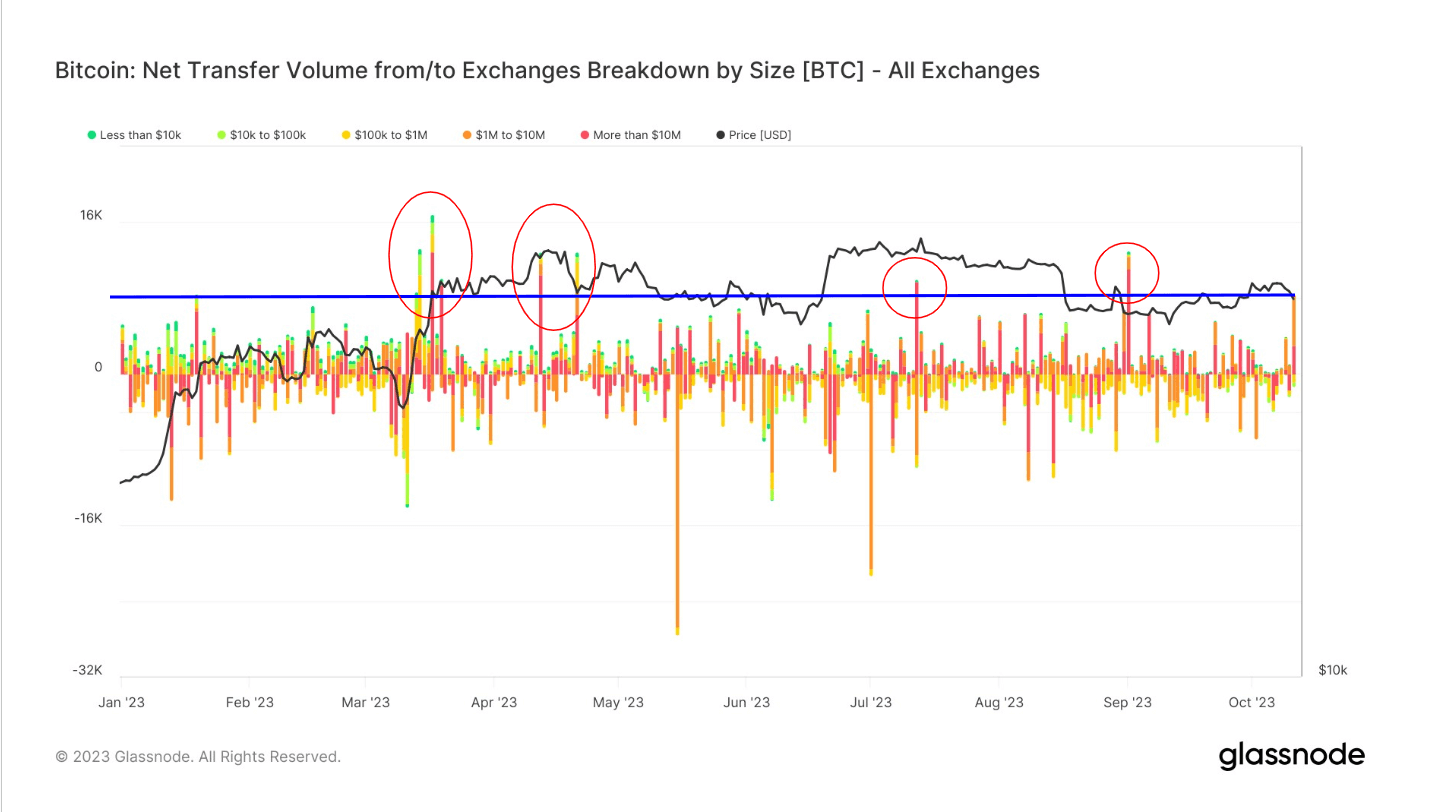

These sizeable inflows are part of a trend observed several times throughout 2023. These occurred in March during the SVB collapse, followed by similar inflows in April, July, and September.

Notably, the inflows at the start of April and July happened after Bitcoin hit $30,000, suggesting profit-taking, while the mid-April and September inflows occurred after Bitcoin’s price failed to hold above $25,000. Such instances indicate that significant market events and price fluctuations often coincide with large-scale inflows.

This demonstrates that while inflows have historically correlated with price events and other macroeconomic factors during 2023, there is no definitive link that ties them exclusively to either bullish or bearish market events.

Intriguingly, the majority of the inflows on Oct. 11 were recorded on Binance, marking it as the platform’s seventh-largest inflow this year.