JP Morgan points to institutional Bitcoin optimism for resilient market

JP Morgan points to institutional Bitcoin optimism for resilient market Quick Take

Recent research shared by Matthew Sigel, Head of Digital Assets Research at VanEck, J.P. Morgan, highlighted several reasons institutional investors remain optimistic about Bitcoin. The research begins with a positive outlook, stating,

“One can find several reasons for institutional investors to remain optimistic.”

Firstly, J.P. Morgan points to a significant development at Morgan Stanley, where wealth advisors are now permitted to recommend spot Bitcoin ETFs to their clients. This move indicates a growing acceptance and integration of Bitcoin ETFs into traditional investment portfolios.

Secondly, the research suggests the bulk of liquidations related to the Mt. Gox and Genesis bankruptcies are likely behind us. This alleviates some of the selling pressure that had previously weighed on the market, providing a more stable environment for investors.

Thirdly, the report suggests that the anticipated cash payments from the FTX bankruptcy later in the year could inject further demand into the crypto market.

Additionally, J.P. Morgan notes that both major political parties in the US are indicating favorable crypto regulations. This bipartisan support suggests a more stable environment, which is crucial for institutional investors.

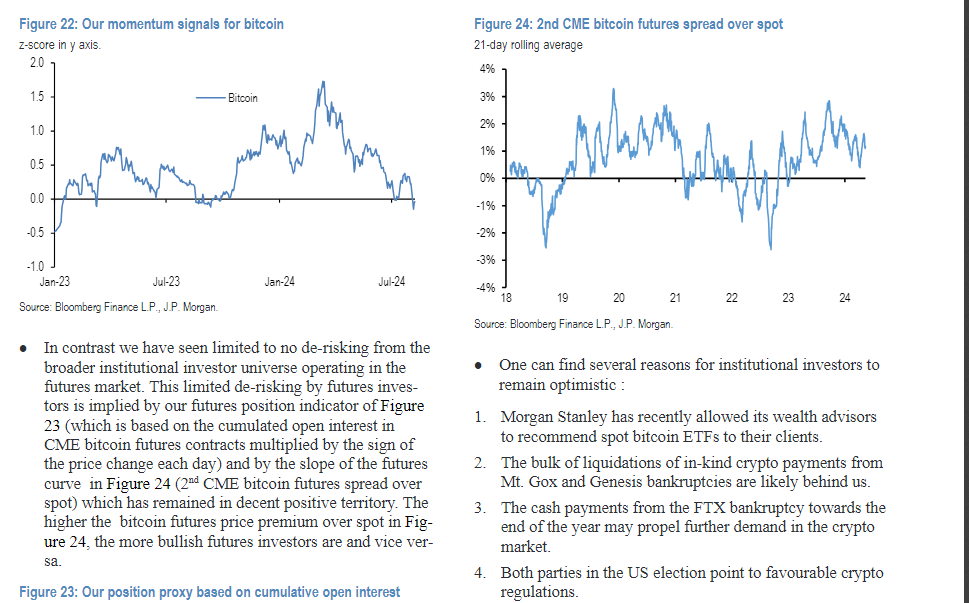

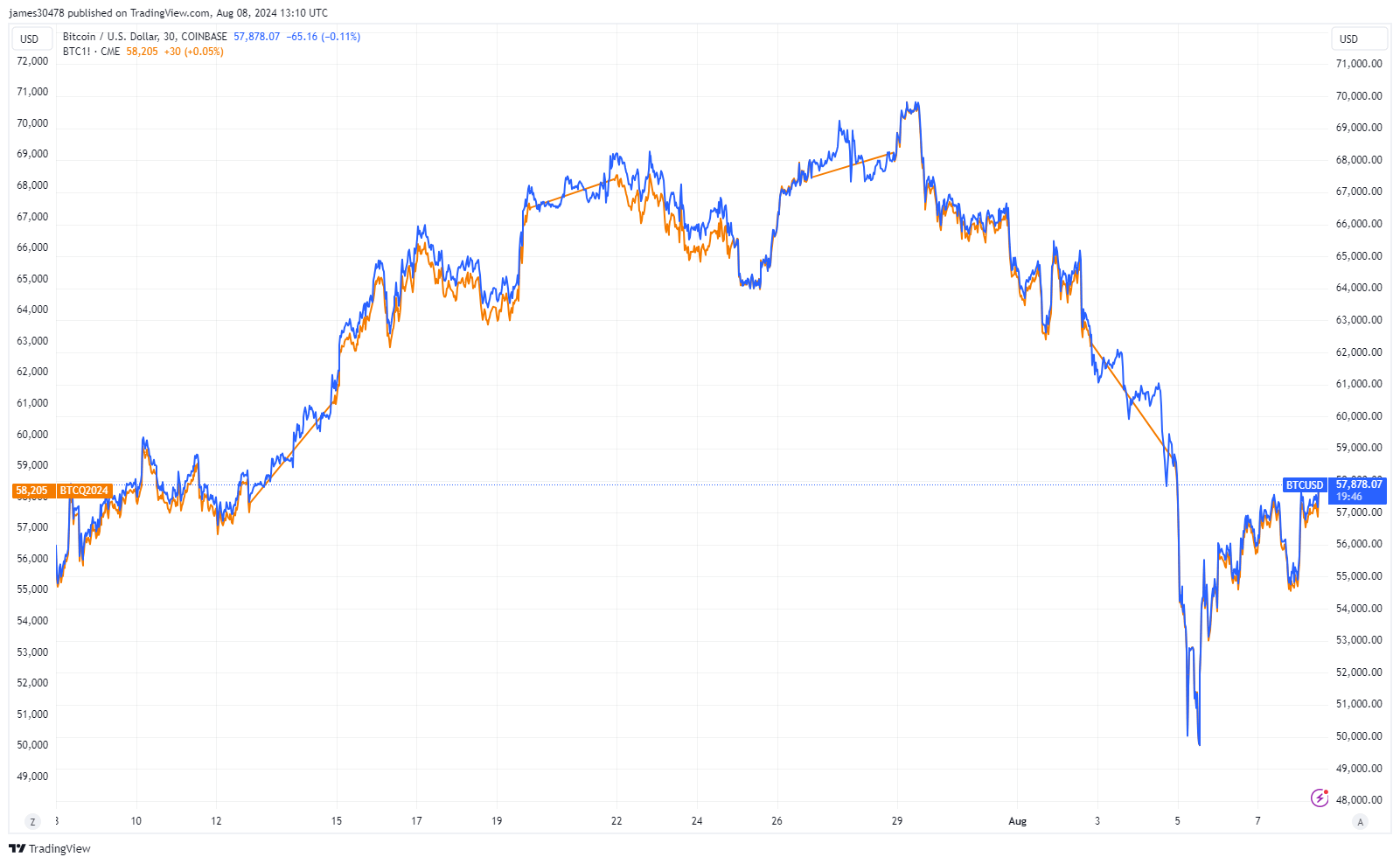

Moreover, J.P. Morgan observes limited de-risking in the Bitcoin futures market. They also note that the futures price is currently above the spot price, referred to as contango, indicating bullish sentiment among futures investors.

“The higher the bitcoin futures price premium over spot, in Figure 24 the more bullish futures investors are”

These factors contribute to an optimistic outlook for the digital assets market.