Investors brace for turbulence as Fed shrinks balance sheet below $8 Trillion

Investors brace for turbulence as Fed shrinks balance sheet below $8 Trillion Quick Take

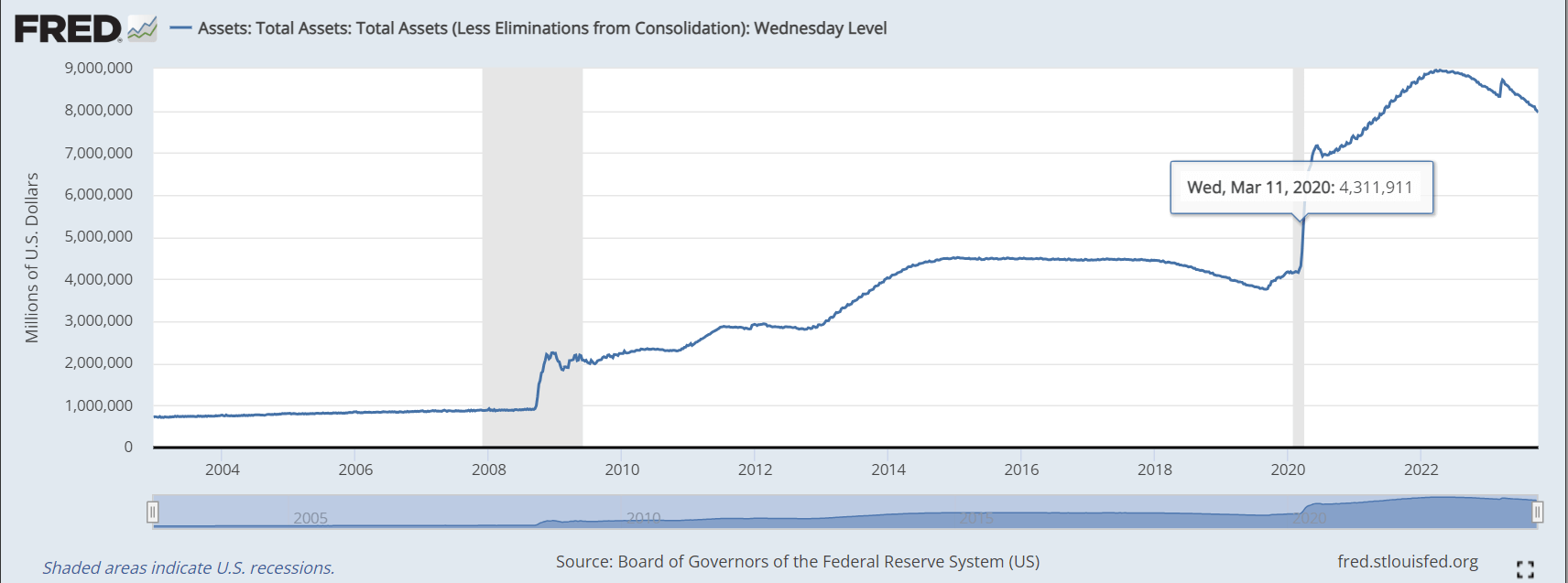

The Federal Reserve’s balance sheet contraction has recently crossed the significant $8 trillion benchmark. The balance sheet peaked at approximately $9 trillion in Q2 2022, signifying around $1 trillion of quantitative tightening over recent months. This contraction aligns chronologically with the Federal Reserve’s decision to escalate interest rates at the most rapid pace witnessed in 40 years.

The outcome of this aggressive move has driven yields across the curve to reach cycle highs, a trend that CryptoSlate has diligently tracked in recent coverage. The Federal Reserve’s balance sheet reduction and accelerated interest rate hikes potentially present a challenging landscape for the cryptocurrency market.

Interest rate increases have historically influenced crypto’s appeal as an alternative investment, often leading to increased market volatility. Investors may need to adjust their strategies accordingly.