Institutional Bitcoin ETF ownership led by Wisdom Tree at 92%, IBIT at 47%

Institutional Bitcoin ETF ownership led by Wisdom Tree at 92%, IBIT at 47% Quick Take

Matthew Sigel, head of digital assets research at VanEck, noted the institutional ownership in Bitcoin ETFs, reflecting the growing interest in these financial instruments. A breakdown of institutional ownership percentages in Bitcoin ETFs shows that Wisdom Tree (BTCW) leads with 92%, followed by Coinshares Valkyrie Bitcoin Fund ETF (BRRR) at 90%, Bitwise (BITB) at 50%, BlackRock (IBIT) at 47%, Fidelity (FBTC) at 37%, Invesco Galaxy Bitcoin ETF (BTCO) at 28%, and VanEck Bitcoin Trust (HODL) at 15%. Notably, VanEck’s own seed investment significantly contributes to HODL’s ownership.

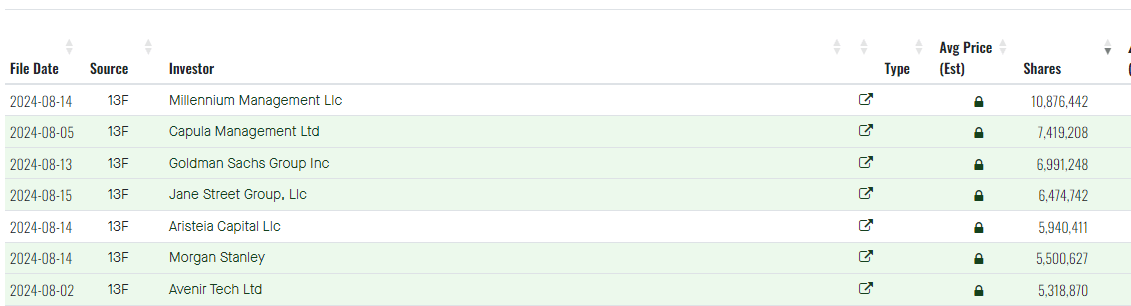

As revealed in recent 13-F filings, institutional ownership includes stakes in publicly traded miners, MicroStrategy, and Bitcoin ETFs. However, it’s important to consider the motives behind these investments. While some institutions, like Wisconsin’s Pension Fund, likely adopt a buy-and-hold strategy, others, such as Goldman Sachs and Morgan Stanley, might be trading on Bitcoin’s volatility, treating these ETFs as new financial instruments.

According to Fintel, five of the seven largest positions in IBIT were filed in the most recent round of 13-F filings.

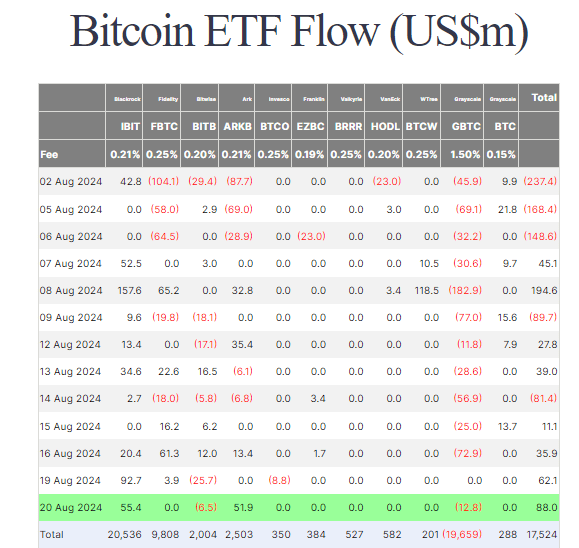

Despite Bitcoin’s price struggles, Bitcoin ETFs continue to attract inflows. On Aug. 20, IBIT received an additional $55.4 million, while ARK’s ARKB saw a $51.9 million inflow, bringing the total daily inflow to $88.0 million. Overall, total inflows into Bitcoin ETFs now stand at $17.5 billion, according to Farside data.