Inclusion in MSCI World Index attracts $6.1 million iShares funding for MicroStrategy

Inclusion in MSCI World Index attracts $6.1 million iShares funding for MicroStrategy Inclusion in MSCI World Index attracts $6.1 million iShares funding for MicroStrategy

MSTR sees strong 5% pre-market increase as it joins MSCI AWI index.

Quick Take

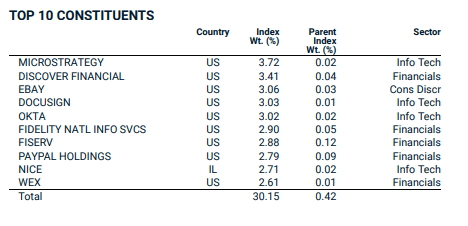

MicroStrategy (MSTR) has been added to the MSCI World Index; changes took effect at the market close on May 31. This inclusion means that June 3 marks the first day MSTR is part of this index. Additionally, MSTR has become a prominent figure in the MSCI ACWI IMI Fintech ESG Filtered Index, where it holds the top position with a significant index weight of 3.72%. Within the broader parent index, MSTR carries a weight of 0.02% and is categorized under the information technology sector.

For MSTR to further enhance its weighting, it must boost its market capitalization, increase its free float, drive sector growth, and maintain positive performance relative to its peers.

Notably, BlackRock, through its iShares MSCI ACWI ETF, has acquired 4,020 shares of MSTR, valued at approximately $6.1 million. This purchase contributes to an index weight of 0.03% within this ETF.

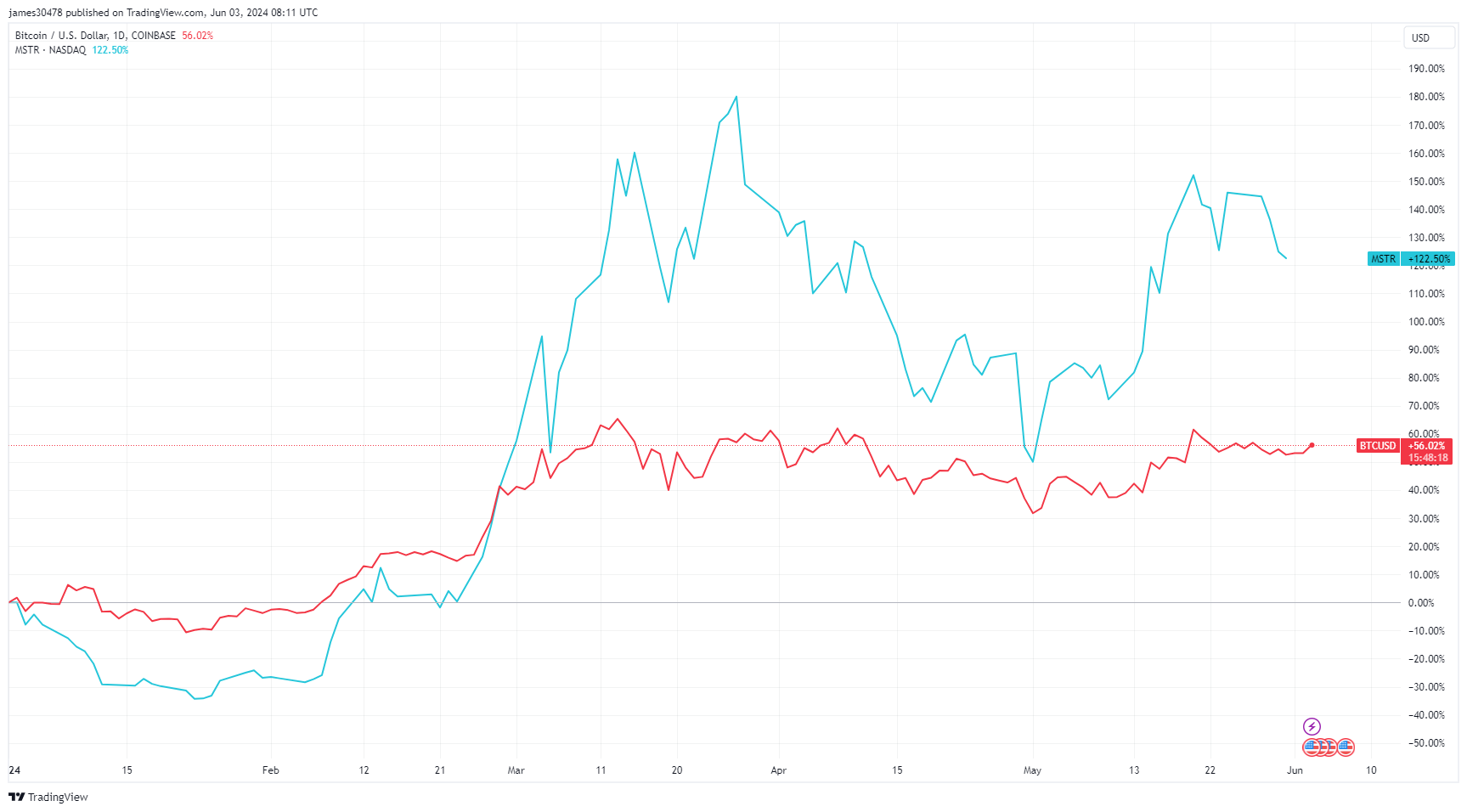

Currently, MSTR is trading at around $1,524, reflecting a remarkable 123% increase year-to-date. Pre-market trading shows a nearly 5% uptick, indicating strong investor confidence and positive market sentiment.