Historic exchange withdrawal prices in profit for BTC as upward cost basis trend begins

Historic exchange withdrawal prices in profit for BTC as upward cost basis trend begins Quick Take

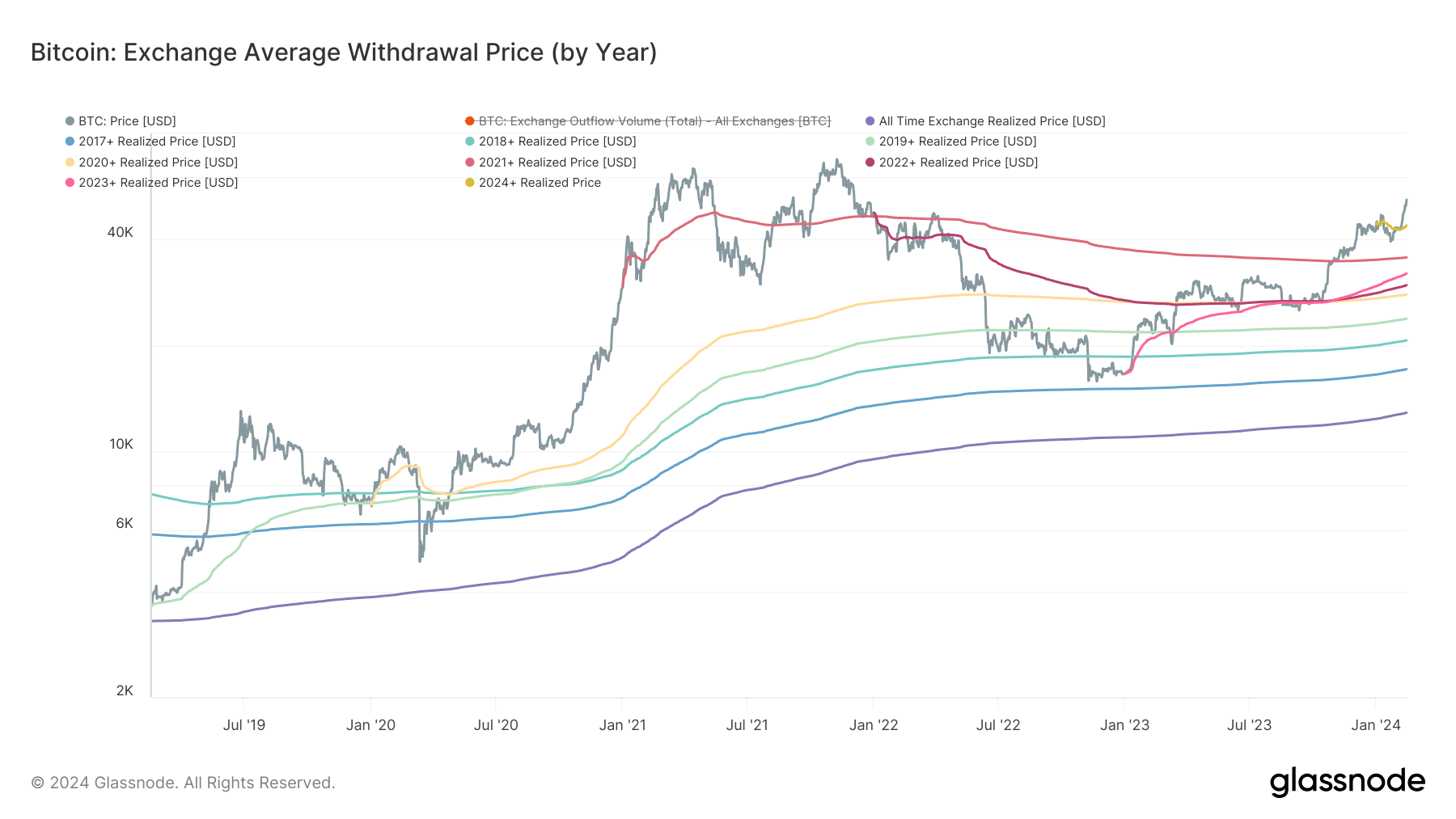

Tracking the average withdrawal prices from digital asset exchanges provides a viable method to estimate a market-wide cost basis.

A deep-dive into the cohorts’ performance reveals an interesting narrative. The most notable cohort is 2021, which had an initial realized price of approximately $47,000 back in 2021. Since then, continuous purchases have brought their cost basis down to $35,553, marking their entry into a profitable phase in November 2023 when Bitcoin exceeded the $40,000 mark.

| Year | Price ($) |

|---|---|

| 2017+ | 17,115 |

| 2018+ | 20,658 |

| 2019+ | 23,800 |

| 2020+ | 27,897 |

| 2021+ | 35,553 |

| 2022+ | 29,646 |

| 2023+ | 32,007 |

| 2024+ | 43,780 |

Contrastingly, the 2024 cohort, with a realized price of $43,780, experienced a brief period of loss in January following the ETF’s launch, as Bitcoin retraced 20%. However, they quickly bounced back to a favorable profit position, aligning with the overall optimistic trend of all cohorts.

For the first time since November 2021, all cohorts are experiencing profitability due to Bitcoin’s rise above the $50,000 mark. The all-time exchange cost basis remains steady, averaging around $12,800.

Intriguingly, a recent trend is emerging across all cohorts. Their cost basis has been on an upswing in the past few weeks, indicating that they are purchasing Bitcoin at a price higher than their existing cost basis.