Halving cycles amplify significance of Bitcoin transaction fees

Halving cycles amplify significance of Bitcoin transaction fees Onchain Highlights

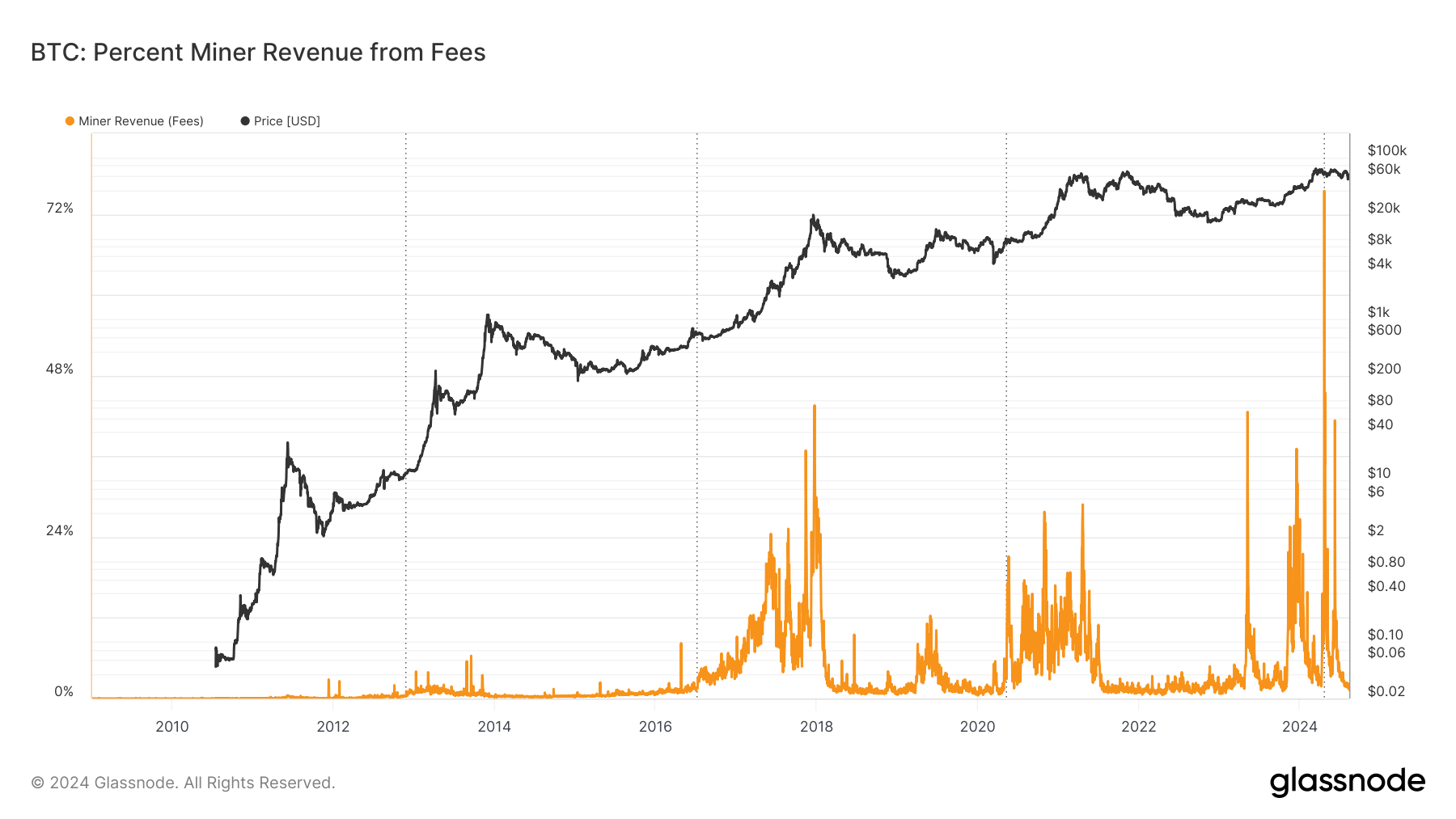

DEFINITION: The percentage of miner revenue derived from fees, i.e., fees divided by fees plus minted coins.

Historically, the percentage of miner revenue from fees has exhibited periodic spikes during periods of heightened network activity and congestion, particularly during bull markets and major protocol upgrades.

For instance, in late 2017, during Bitcoin’s rapid price ascent, fee revenue briefly surged to similar levels seen in 2024, reflecting intense demand for block space.

Another notable period occurred in 2021, where fee revenue spiked during the broader market rally, driven by increased on-chain transactions and the proliferation of DeFi applications.

These historical patterns reveal a consistent correlation between network congestion and the share of miner revenue derived from fees. As Bitcoin’s block subsidy continues to decrease with each halving, the importance of transaction fees in sustaining miner incentives is likely to grow, making these historical trends critical in forecasting future miner revenue conditions.

The cyclical nature of these spikes suggests that miners increasingly rely on fees during times of high demand, especially as block rewards diminish.