For the first time in two years, GBTC discount to NAV drops below 15%

For the first time in two years, GBTC discount to NAV drops below 15% Quick Take

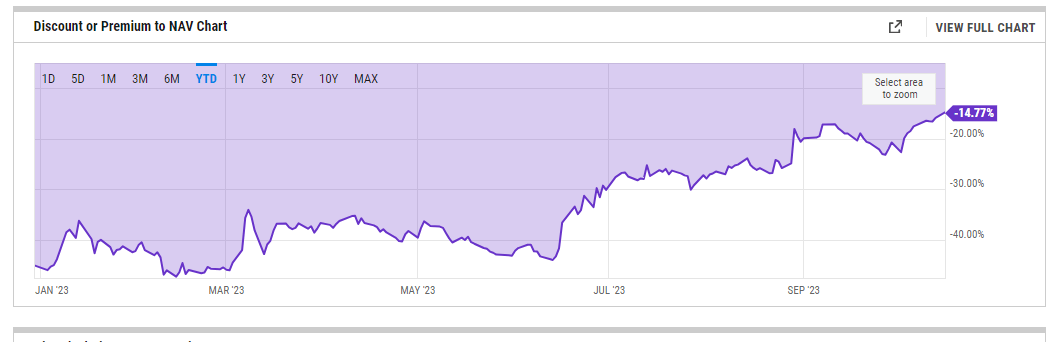

The Grayscale Bitcoin Trust (GBTC) fund ended the day yesterday, Oct. 16, up 7.7%. The substantial rise took GBTC’s year-to-date gains to a striking 166%. However, concurrently, the discount to Net Asset Value (NAV) has declined below 15% for the first time in the past two years, now standing at 14.77%, according to Y charts.

The current price action appears to be a reflection of investor sentiment regarding potential future developments. There is rising speculation that the GBTC fund could transform into a spot Exchange Traded Fund (ETF). This notable shift in market sentiment may be driving the increased activity in GBTC as investors position themselves in anticipation of a possible transition.

As the possibility of a spot ETF becomes increasingly plausible, financial markets may witness further volatility within the digital asset class.