Fidelity’s Bitcoin ETF faces 7th consecutive outflow as Ethereum ETFs continue inflows

Fidelity’s Bitcoin ETF faces 7th consecutive outflow as Ethereum ETFs continue inflows Quick Take

Bitcoin

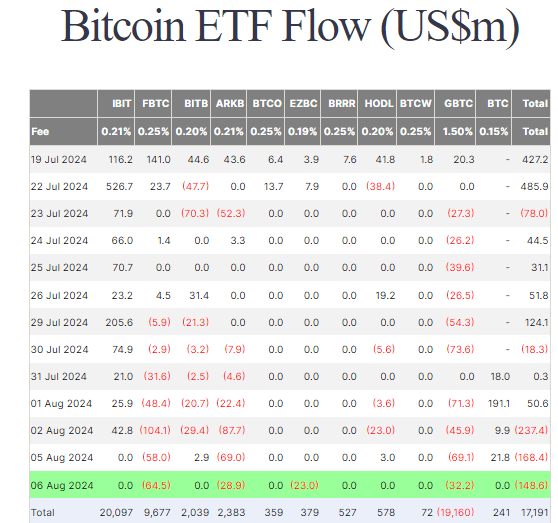

On Aug. 6, Farside data shows that Bitcoin (BTC) exchange-traded funds (ETFs) experienced $148.6 million in outflows, marking the third consecutive trading day of such trends, though each outflow has progressively decreased. No inflows were reported. Fidelity’s FBTC led the outflows with $64.5 million, marking its seventh consecutive trading day of outflows. Ark’s ARKB saw a $28.9 million outflow, Franklin Templeton’s EZBC experienced a $23.0 million outflow, and Grayscale’s GBTC had a $32.2 million outflow. Notably, BlackRock’s IBIT reported no activity, with zero inflows or outflows. Despite the outflows, total BTC ETF inflows stand at $17.2 billion.

Ethereum

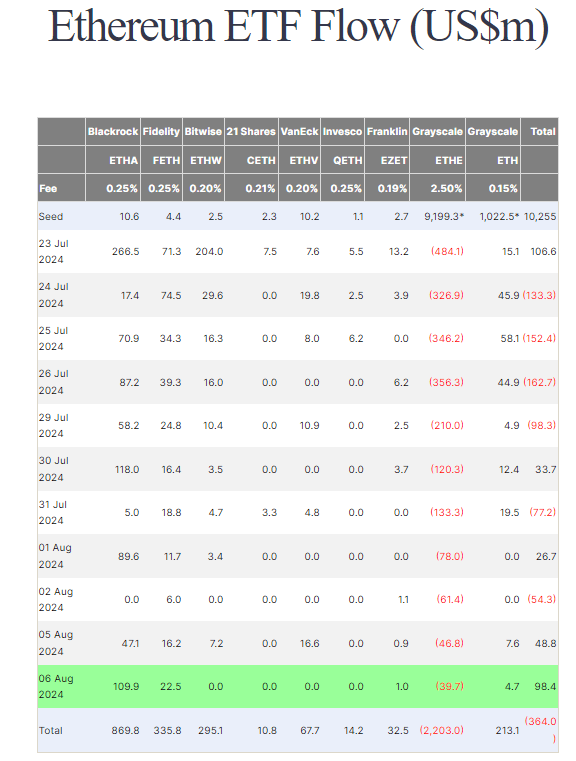

Meanwhile, Ethereum ETFs showed a contrasting trend with inflows. ETH ETFs saw a $98.4 million inflow, bolstered by BlackRock’s ETHA contributing $109.9 million, bringing its total net inflow to $869.8 million. Grayscale’s ETHE continued its pattern of reduced outflows, registering just $39.7 million, pushing total outflows of all ETFs to $364.0 million, according to Farside data.