Federal Reserve balance sheet rises by $2 billion amid rate cut speculation

Federal Reserve balance sheet rises by $2 billion amid rate cut speculation Quick Take

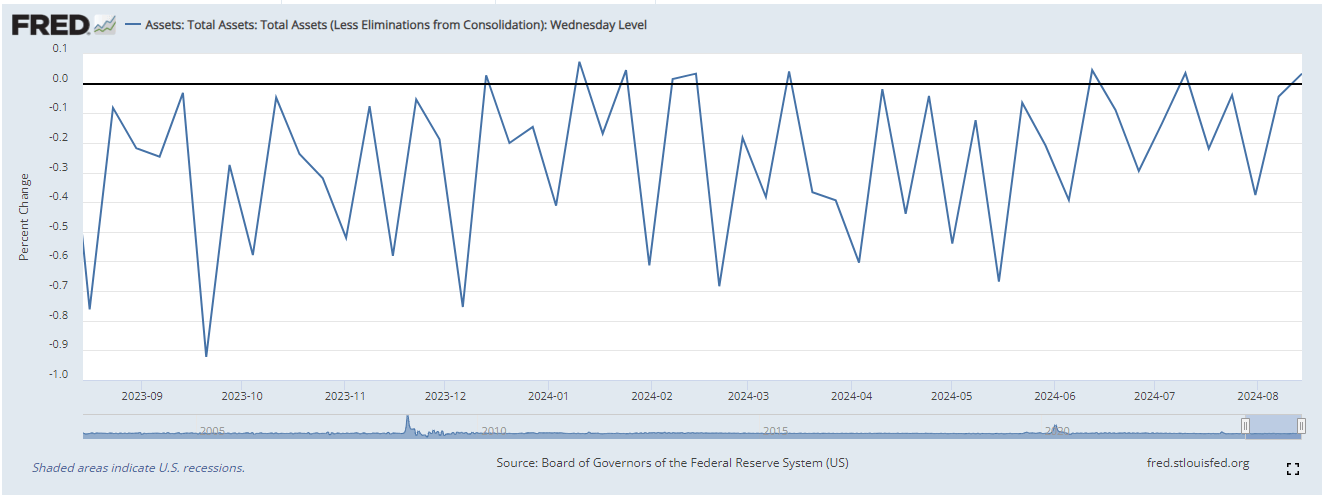

The Federal Reserve’s balance sheet saw a $2 billion increase week over week, now totaling $7.2 trillion, marking the ninth such increase in the past year amid recurring declines, according to FRED. However, the declines have been lessening since May, potentially approaching the start of the fed cutting cycle.

Concurrently, CME data indicates a likely 25 basis points rate cut on Sept. 16. Cooler-than-expected PPI and US inflation data bolster this expectation on a year-over-year basis for both headline and core measures. Despite these developments, retail sales on a month-on-month basis for Aug. 15 surprised on the upside, suggesting that an immediate recession is unlikely.

However, the financial markets have shrugged off the deleveraging following the unwinding of the yen carry trade on Aug. 5, but crypto remains weak, with Bitcoin remaining below $60,000.

The Japanese Yen has weakened from 141 to 148 against the dollar, while preliminary GDP growth data surpassed expectations at 0.8%, according to Trading Economics. This combination of a weakening currency, rising inflation, and stronger-than-expected GDP growth could signal a further rate hike by the Bank of Japan.

However, the UK saw positive economic growth yesterday. The UK economy grew by 0.6% in the second quarter (April to June) of 2024, following growth of 0.7% in the first quarter of 2024. Concerning the data, Coinbase’s UK CEO, Daniel Seifert, told CryptoSlate,

“Potential further interest rate cuts by the Bank of England could lead to increased interest in cryptocurrencies, and we see an opportunity to further harmonise regulatory efforts in the UK with global and EU regulatory movements to enhance investor confidence.”