Ethereum exchange deposits surge in echo of FTX collapse, while Bitcoin withdrawals stay dominant

Ethereum exchange deposits surge in echo of FTX collapse, while Bitcoin withdrawals stay dominant Quick Take

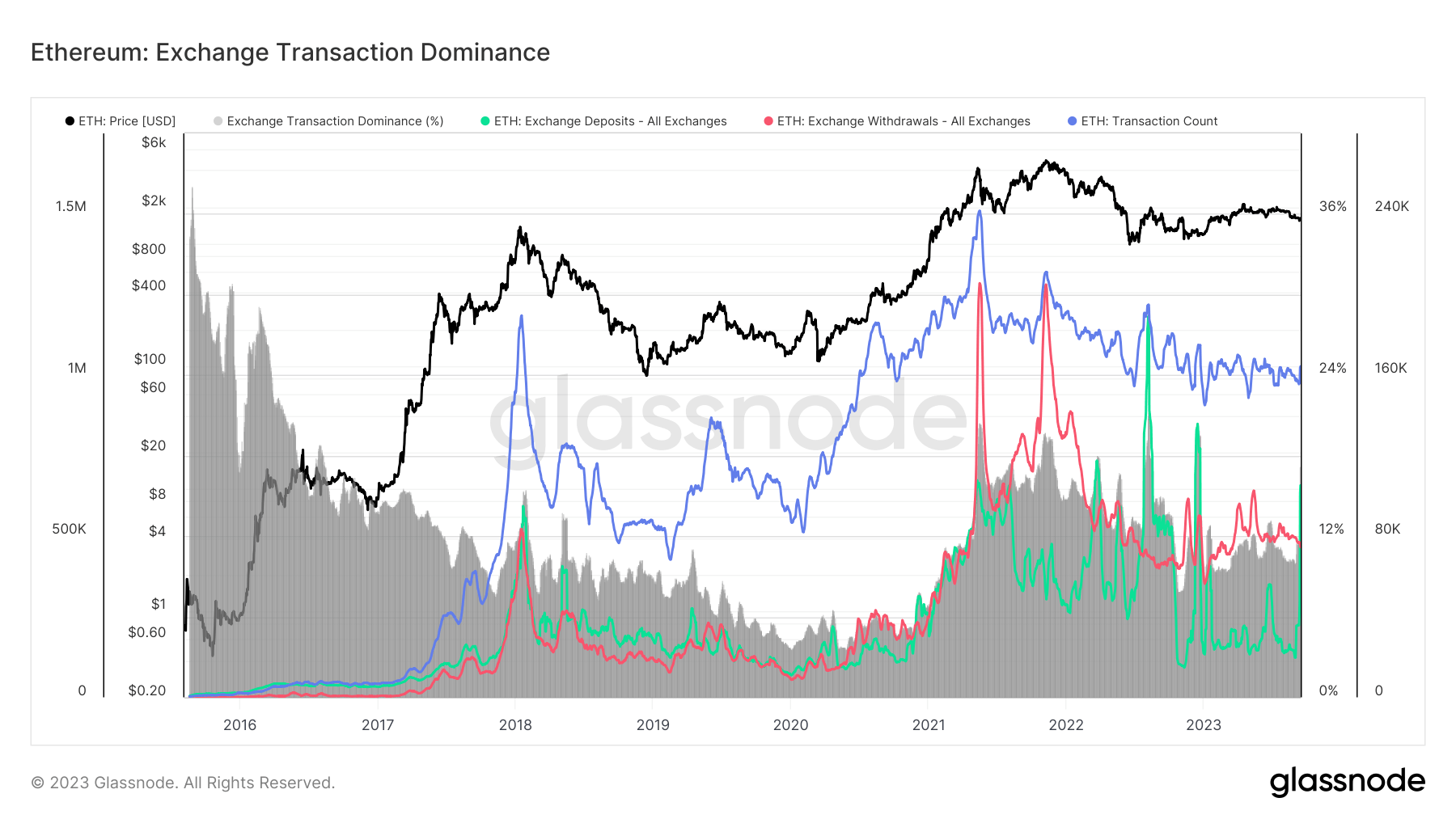

The recent data reveals a distinctive metric shift regarding Ethereum deposits and withdrawals. Exchange deposits for Ethereum have surged, exceeding the volume of withdrawals, a phenomenon last observed during the FTX collapse. Specifically, Ethereum experienced 105,000 ETH in deposits compared to 75,000 ETH in withdrawals, indicating an influx of Ethereum into exchange platforms.

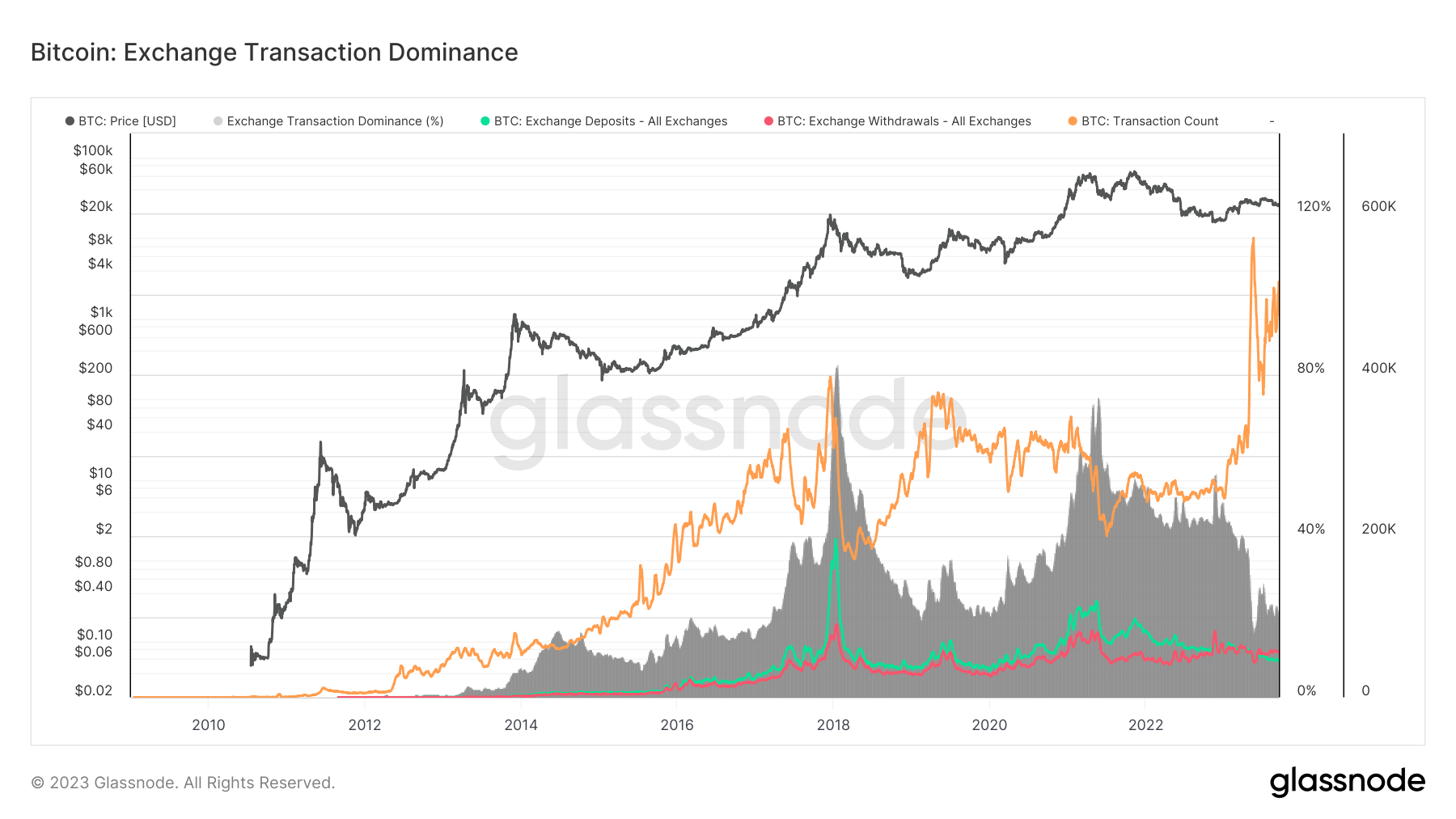

In stark contrast, Bitcoin presents a different scenario, revealing a continuing trend of withdrawals outpacing deposits. This trend toward Bitcoin outflows suggests that investors are opting to hold their Bitcoin assets rather than placing them in exchanges, which could be motivated by various factors, including market sentiment or a strategy to reduce potential risks associated with exchanges.

The divergence in the flow of Ethereum and Bitcoin within exchanges not only underscores their unique market behaviors but also indicates the varying investor perceptions and strategies towards these leading cryptocurrencies.