ETF trading volumes on decline, failing to hit $3 billion since mid-May

ETF trading volumes on decline, failing to hit $3 billion since mid-May Quick Take

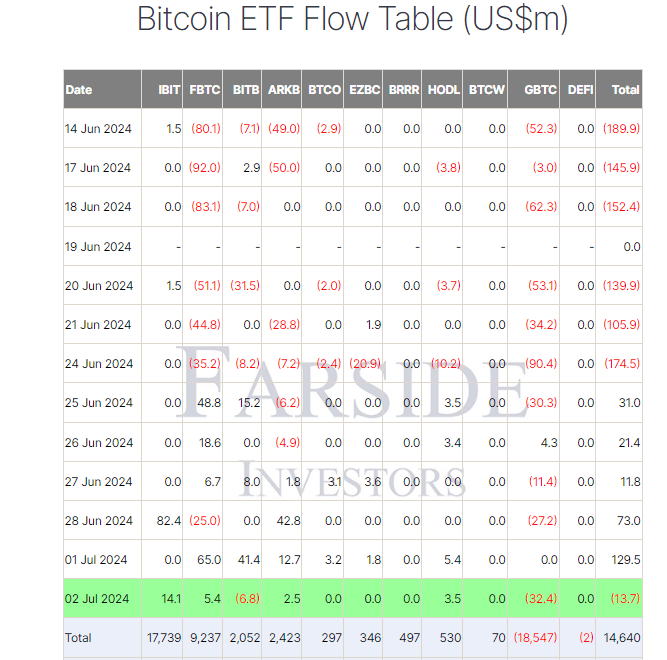

On July 2, Bitcoin (BTC) exchange-traded funds (ETFs) experienced their first outflow of July, as reported by Farside. The day saw a $13.7 million outflow, breaking a five-day trading streak of consecutive inflows. Leading the day’s activity was Grayscale’s GBTC, which recorded a substantial $32.4 million outflow, bringing its total net outflow to a staggering $18.5 billion.

Farside data reports that Bitwise’s BITB also saw a modest outflow of $6.8 million, although its total net inflow still stands at $2.1 billion. In contrast, BlackRock’s IBIT received an inflow of $14.1 million, pushing its total net inflow to an impressive $17.7 billion. Fidelity’s FBTC followed suit with a $5.4 million inflow, increasing its total net inflow to $9.2 billion. Despite the daily fluctuations, Bitcoin ETFs have collectively achieved a total inflow of $14.6 billion since launch.

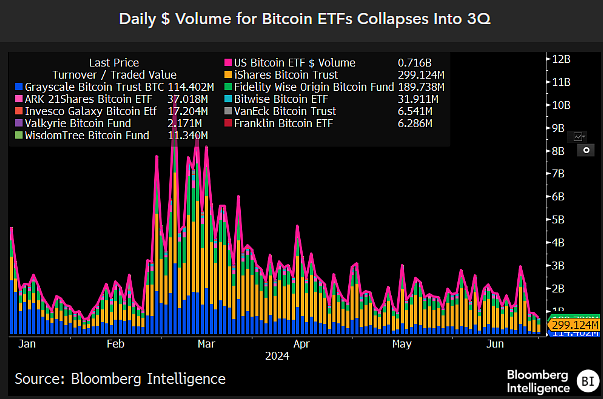

Bloomberg ETF analyst James Seyffart observed that ETF trading volumes have been on a downtrend, not reaching $3 billion since mid-May.