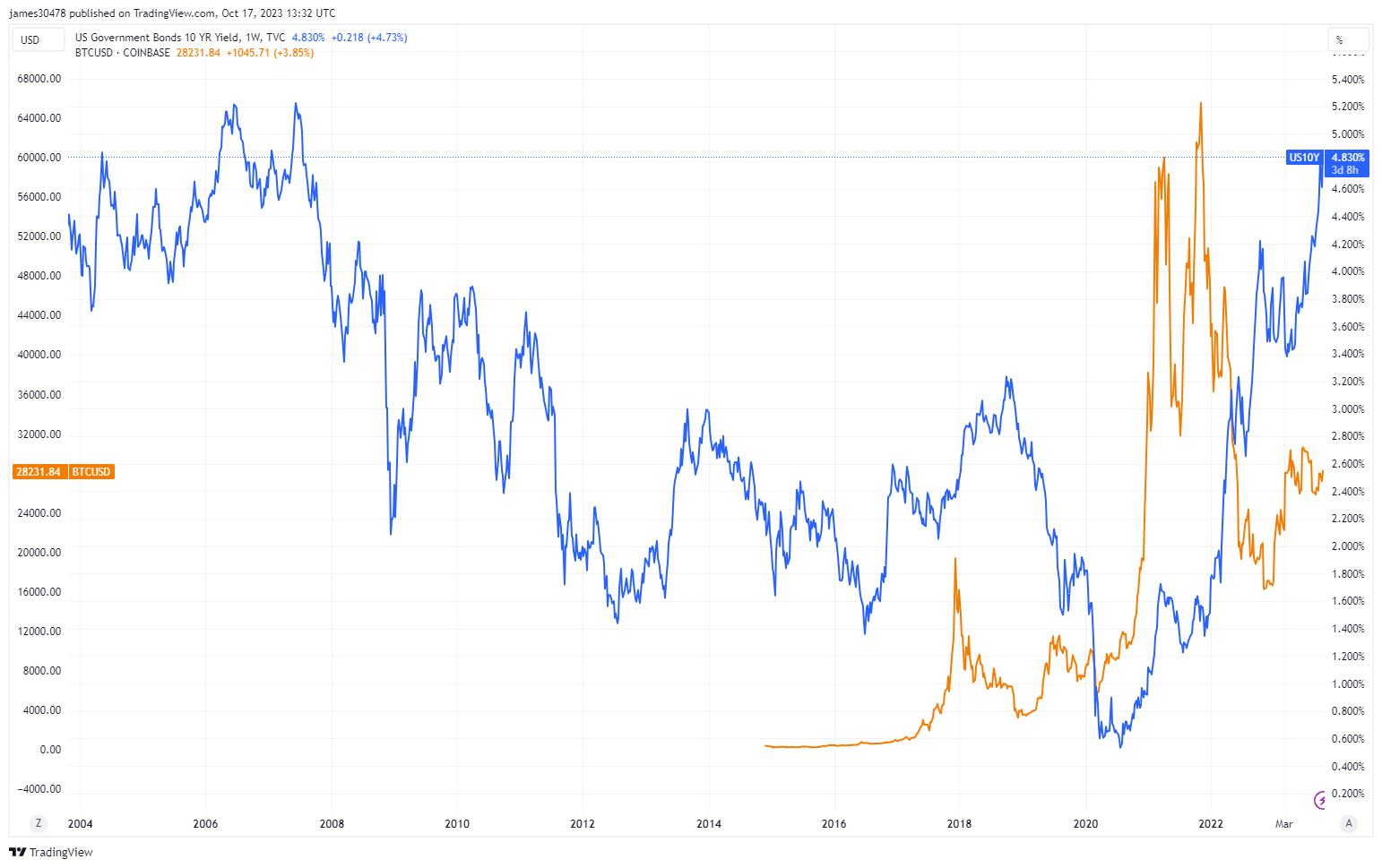

Echoes of ’07: 10-year U.S. Treasury note yield rises to pre-crisis levels

Echoes of ’07: 10-year U.S. Treasury note yield rises to pre-crisis levels Quick Take

The bond market is exhibiting significant destruction, as reflected by the current state of the U.S. 10Y note. Recently, the yield on the note surged above 4.843%, a high unseen since 2007 and just 17bps from the 5% mark. This high-yield period precedes the creation of Bitcoin by several years, illustrating just how long ago it was.

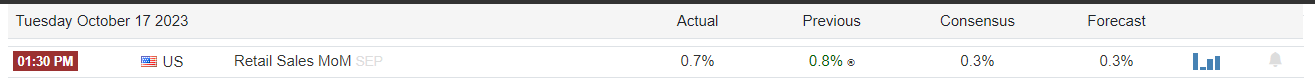

The rise in U.S. yields follows a considerable unexpected surge in U.S. retail sales, where the month-over-month increase reached 0.7%, more than double the initial projection of 0.3%.

This surge signifies a strong sell-off in the bond market, evident in the performance of long-duration bonds such as the TLT, a 20-year+ treasury bond. The TLT opened at a notably low level of 84.89, a mark only replicated a scant few times in 2004 and 2006.

This paints a stark picture of the upheaval bonds have endured due to the most rapid tightening of interest rates witnessed in four decades. The bond market is in a precarious position due to the intricate inverse relationship between bonds and yields, a dynamic that becomes even more critical in the current climate of swiftly rising interest rates.