Divergence in futures as crypto margins at historic low, cash options preferred

Divergence in futures as crypto margins at historic low, cash options preferred Quick Take

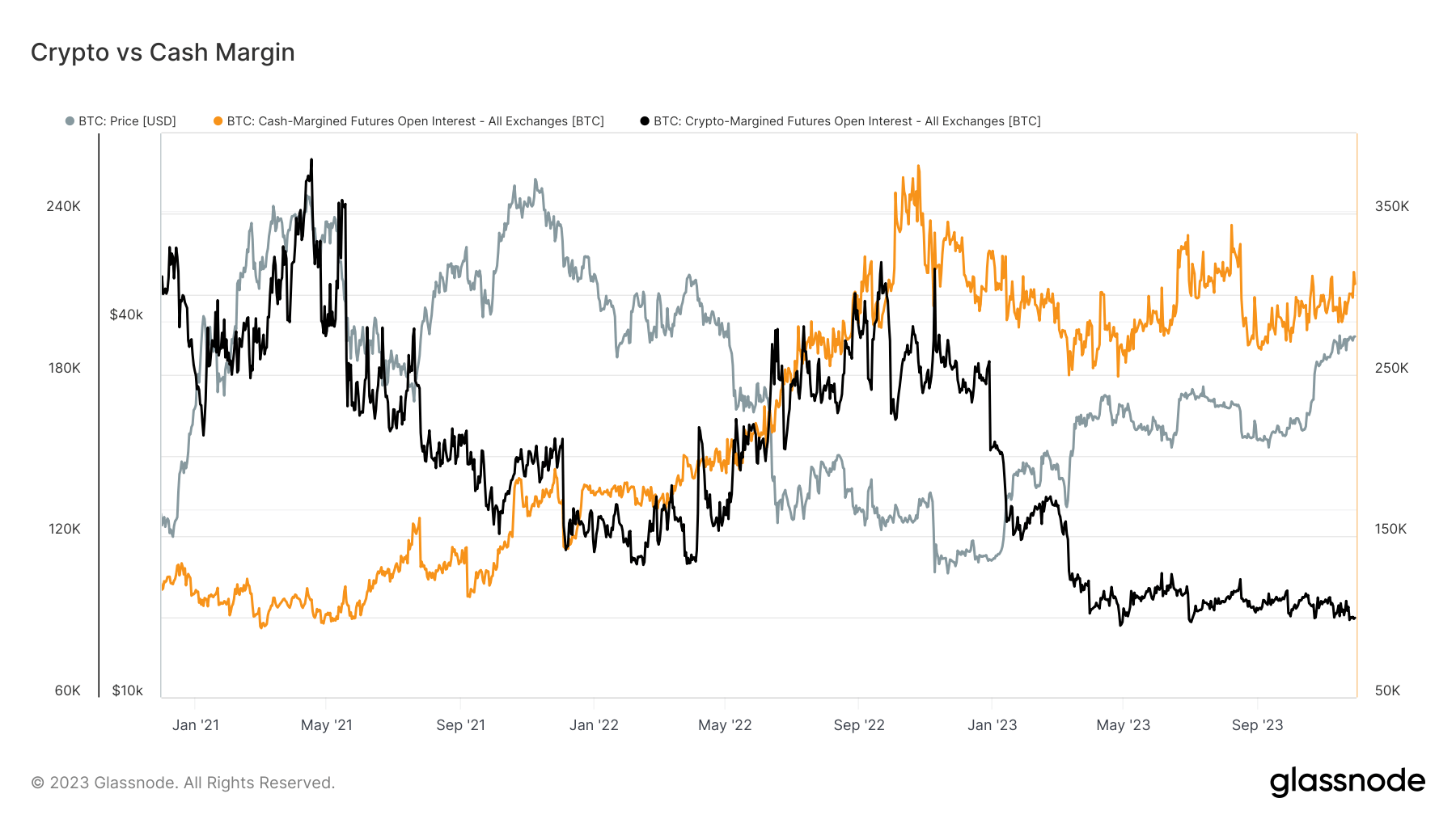

A shift is becoming evident in the crypto futures market as the divergence between cash margin and crypto margin continues to widen. According to recent data by Glassnode, crypto margin has reached an all-time low of below 90,000 BTC. Conversely, cash margin, denoted in USD or stablecoins such as USDT and BUSD, has surged to approximately 300,000 BTC.

This divergence emphasizes the inherent volatility of cryptocurrencies compared to their fiat and stablecoin counterparts. As cash margins are denominated in stablecoins or USD, they inherently exhibit less volatility in the underlying price.

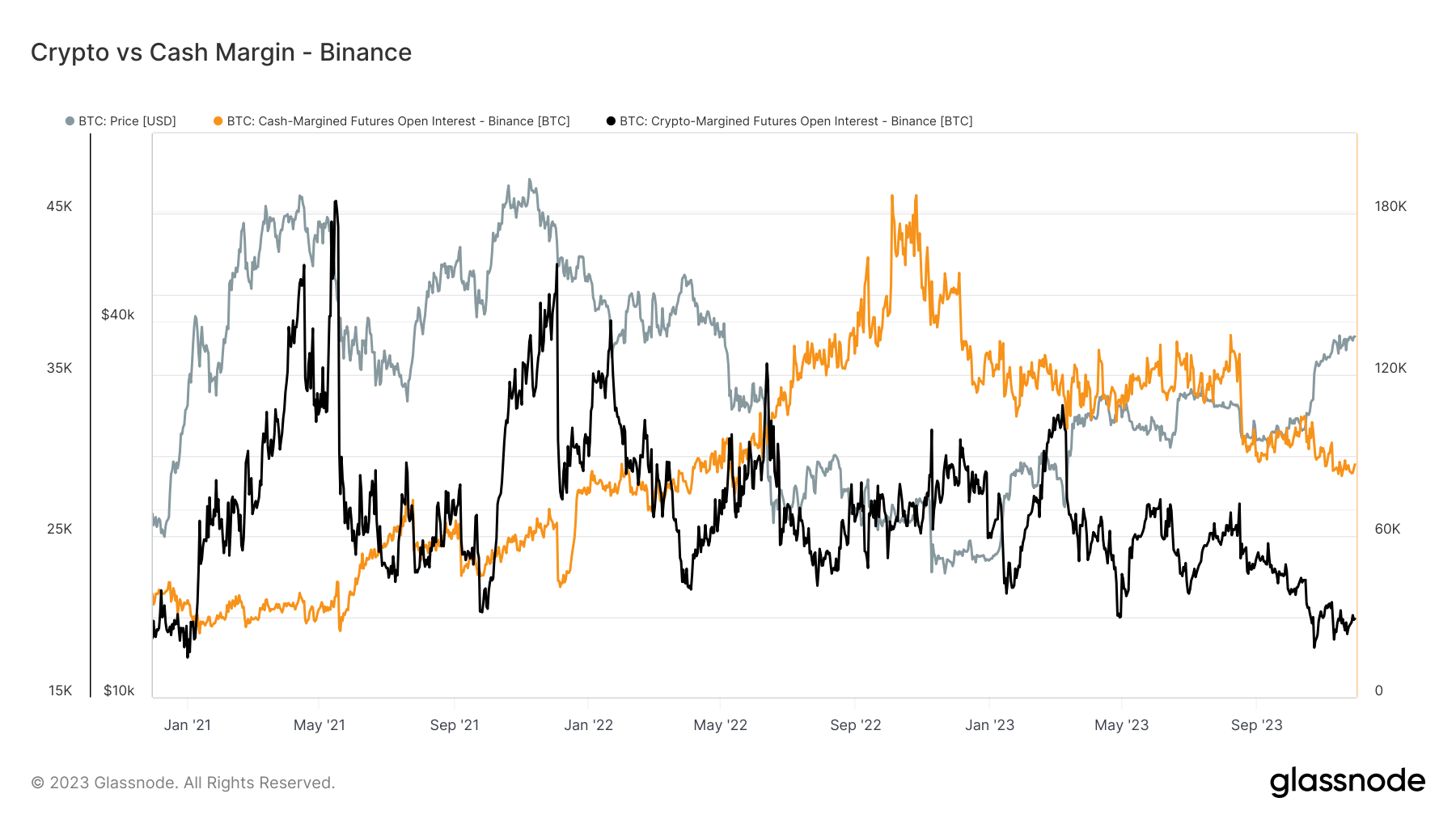

This trend is not only limited to individual traders but is also evident in exchanges. For instance, the CME exchange, which commands the most significant amount of futures open interest, settles in cash rather than crypto. In contrast, Binance allows the use of crypto as margin, mirroring the wider market divergence, but both cash and crypto are in an aggregate downtrend on Binance.