Despite Bitcoin’s slump and soaring Texas energy prices, miners display unexpected resilience

Despite Bitcoin’s slump and soaring Texas energy prices, miners display unexpected resilience Quick Take

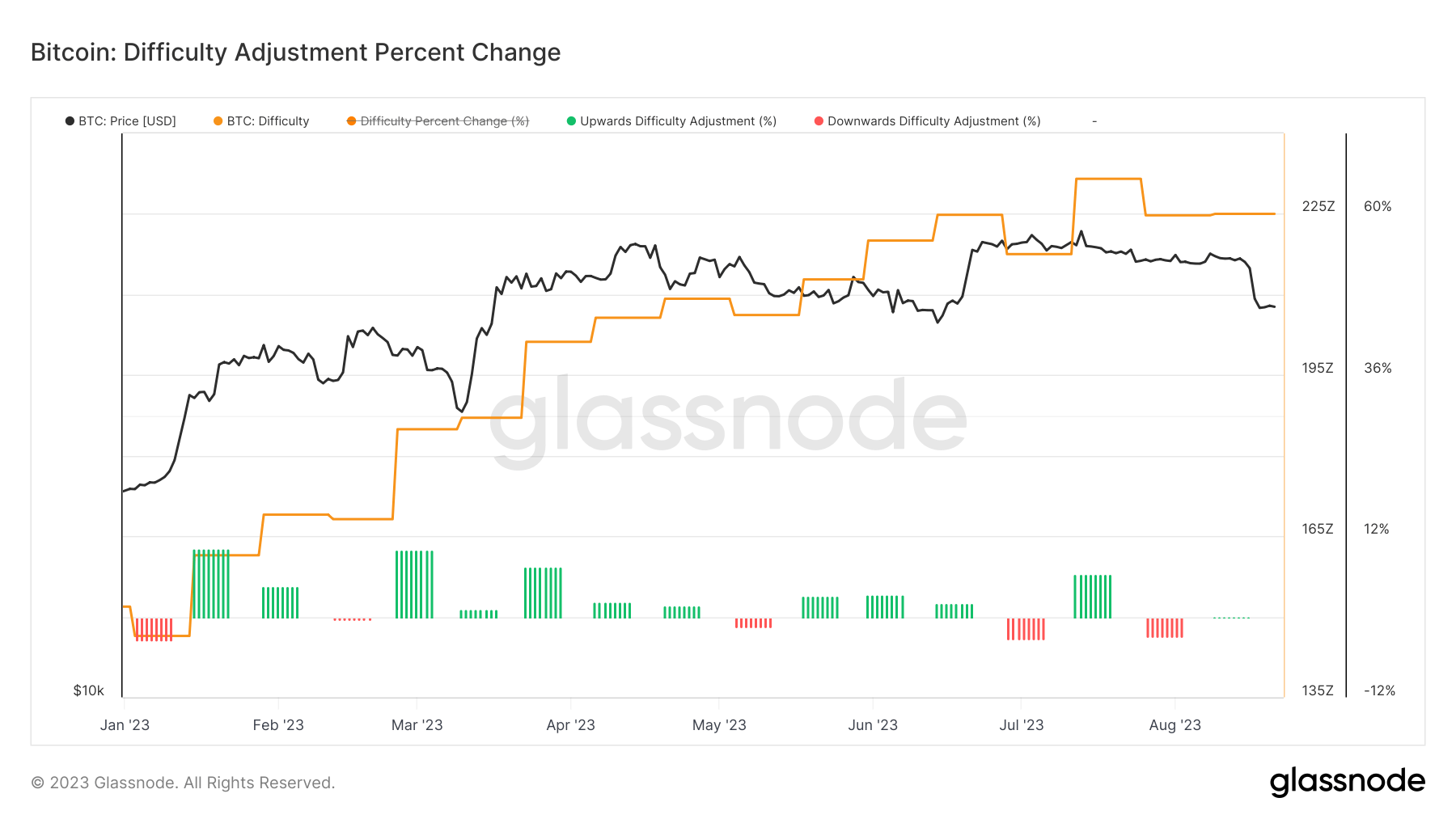

In the face of a notable 7% upward adjustment in Bitcoin’s hash rate — one of the most significant this year — and a plummeting price below $26,000, Bitcoin miners have demonstrated remarkable resilience.

Coinciding with this sharp adjustment, there has been a reported mining capitulation over the past month. Yet, the data points to a stronger-than-expected position for miners.

Interestingly, Bitcoin’s presence in treasuries remains sturdy, signifying a lack of considerable offloading, even amidst these challenging circumstances. This is a crucial indicator of sustained confidence in the cryptocurrency’s long-term value and potential, despite short-term price fluctuations.

On another front, Texas’ energy market is exhibiting dramatic shifts. As per Unusual Whales, there’s an astounding 6,000% surge in prices, pushing towards the $5,000 price cap. This potentially impacts Bitcoin miners, as higher electricity prices could squeeze operational profitability. However, the resilience exhibited thus far suggests miners may be well-equipped to navigate such challenges.