Decline in panic selling: Bitcoin transfer volume from short-term holders bottoms out post-2024 halving

Decline in panic selling: Bitcoin transfer volume from short-term holders bottoms out post-2024 halving Onchain Highlights

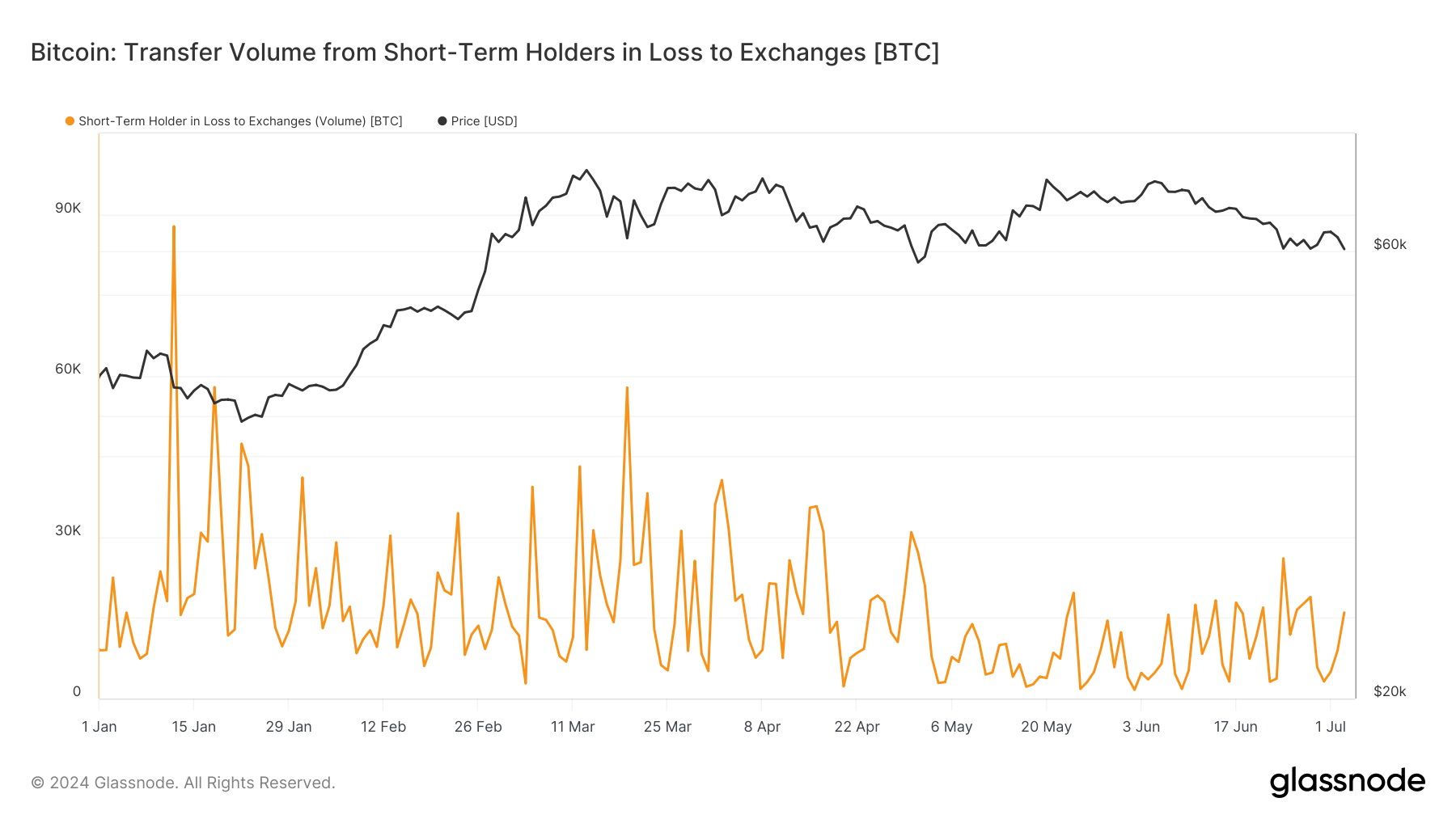

DEFINITION: The total amount of coins transferred from short-term holders in loss to exchange wallets.

Bitcoin’s transfer volume from short-term holders in loss to exchanges exhibits notable fluctuations. Glassnode data shows a significant decline in these transfers from January to July. In early 2024, volumes peaked around 90,000 BTC, aligning with market volatility, before stabilizing below 30,000 BTC post-halving in April.

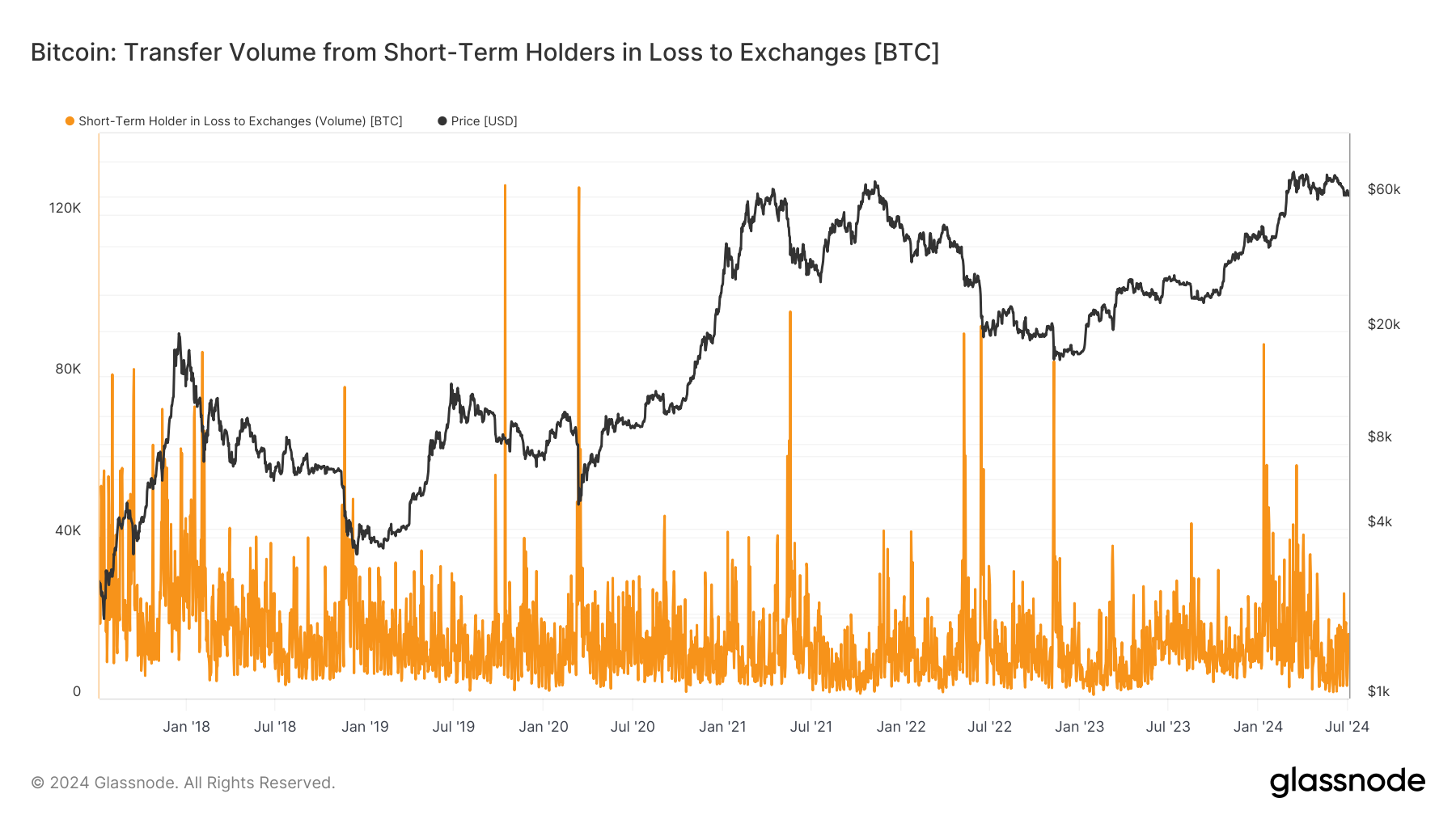

Historical data indicates heightened transfer activity during major price downturns. The 2018 bear market saw consistent surges as prices fell, reflecting panic selling among short-term holders. This trend reappeared in March 2020 during the COVID-19 crash.

Comparatively, the post-2024 halving period demonstrates reduced volatility and fewer panic-induced transfers, suggesting improved market maturity and investor confidence.

Despite recent stability, monitoring transfer volumes remains crucial. Spikes often precede significant price movements, serving as potential indicators of market sentiment shifts.