Capula Management and Goldman Sachs lead 30% surge in Bitcoin ETF holdings in Q2

Capula Management and Goldman Sachs lead 30% surge in Bitcoin ETF holdings in Q2 Quick Take

The second quarter of 2024 saw significant activity in the digital assets investment space, as institutional investment managers with over $100 million in assets under management (AUM) submitted their 13F filings by the Aug. 14 deadline. These filings, which disclose equity holdings as of June 30, 2024, provide valuable insights into the market’s institutional sentiment, particularly regarding Bitcoin ETFs.

Matt Hougan, CIO of Bitwise Invest, highlighted two key trends from the filings. First, institutional interest in Bitcoin ETFs is growing despite a dip in Bitcoin prices during Q2. Hougan noted a 30% increase in the number of ETF holder pairs, rising from 1,479 in Q1 to 1,924 in Q2. This uptick indicates that institutions are still entering the market, suggesting a continued belief in the long-term potential of Bitcoin.

“I count 1,924 holder<>ETF pairs across all 10 ETFs, up from 1,479 in Q1. That’s a 30% increase; not bad considering prices fell in Q2”.

Second, the data suggests that many institutions are holding their positions firmly. Among the Q1 filers, 44% increased their holdings in Bitcoin ETFs during Q2, while 22% maintained their positions. Though 21% decreased their holdings and 13% exited, these figures are consistent with other ETFs, reflecting a balanced market sentiment.

“If you thought institutional investors would panic at the first sign of volatility, the data suggest otherwise. They’re pretty steady”.

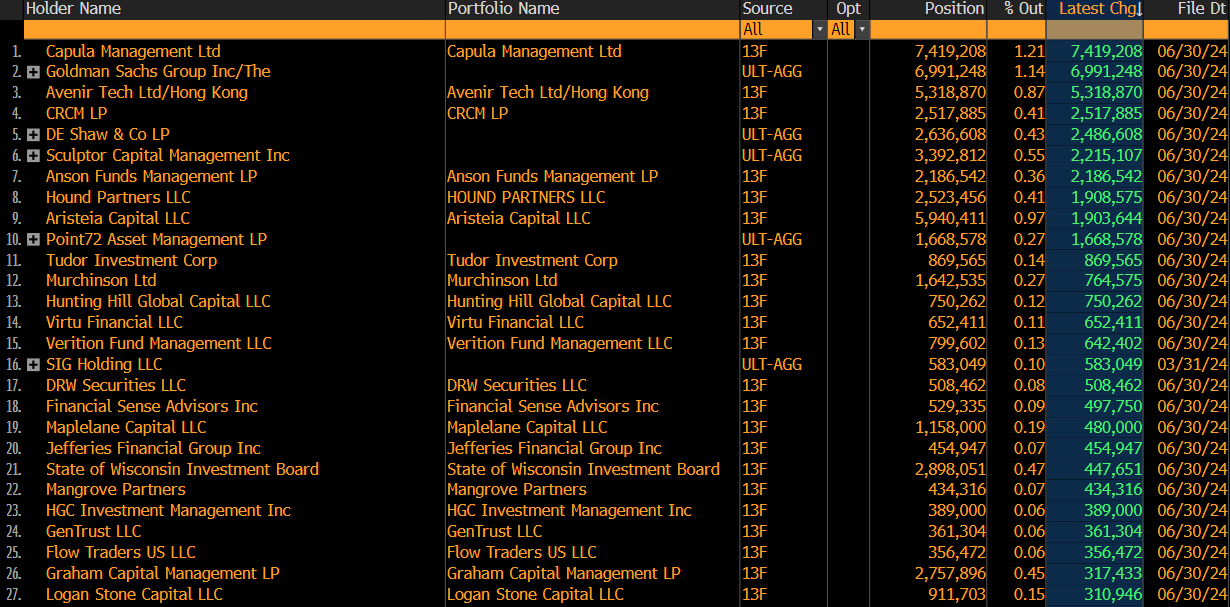

Notably, a screenshot shared by Zerohedge revealed the largest buyers of IBIT in Q2; Capula Management Ltd., a major British hedge fund, bought the largest position in BlackRock’s IBIT ETF, with 7.4 million shares. Goldman Sachs followed closely as the second-largest buyer, emphasizing the continued strong institutional interest in Bitcoin ETFs.