BlackRock’s IBIT spearheads Bitcoin ETF inflows with $52.5 million inflow

BlackRock’s IBIT spearheads Bitcoin ETF inflows with $52.5 million inflow Quick Take

Bitcoin

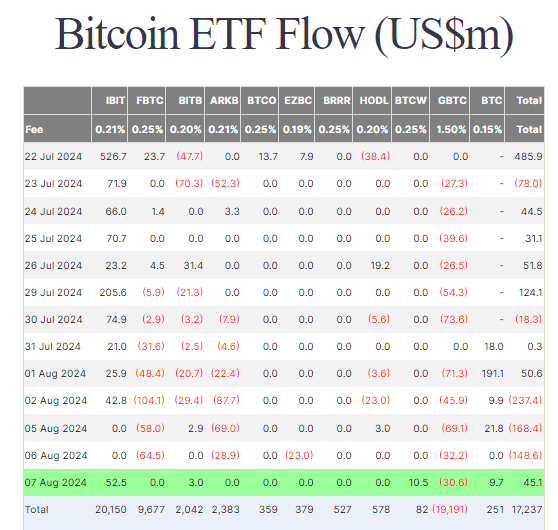

Farside data shows that the Bitcoin (BTC) exchange-traded funds (ETFs) experienced an inflow of $45.1 million on Aug. 7—the first since Aug. 1st. This surge was primarily driven by BlackRock’s IBIT, which saw an impressive $52.5 million inflow, bringing its total net inflows to $20.2 billion. Additionally, WisdomTree’s BTCW reported a $10.5 million inflow, while the Grayscale Mini Trust BTC observed a $9.7 million inflow. In contrast, the Grayscale GBTC experienced an outflow of $30.6 million, resulting in a total net outflow of $19.2 billion. Notably, no other ETF issuer reported any outflows. Consequently, the total inflow into Bitcoin ETFs now stands at $17.2 billion.

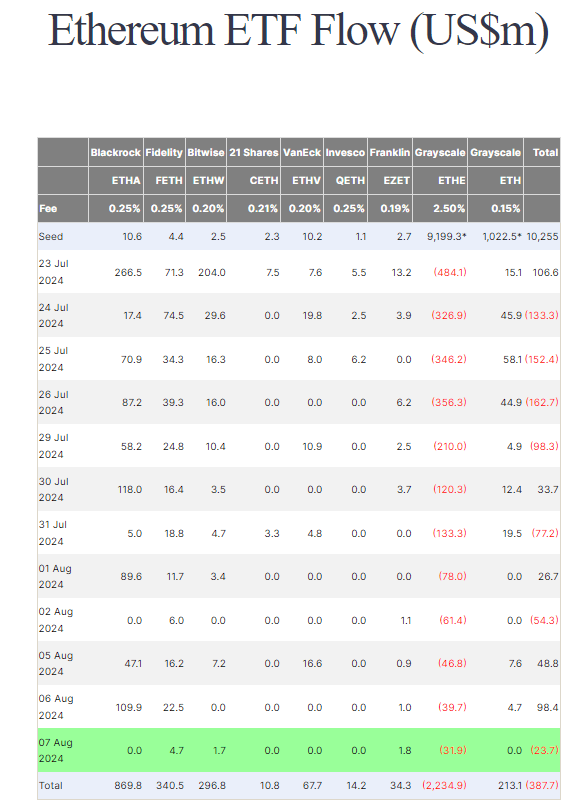

Ethereum

On the other hand, Ethereum (ETH) ETFs saw an outflow of $23.7 million, with Grayscale’s ETHE continuing to report reduced outflows, amounting to $31.9 million. Since their launch, no other Ethereum ETF has experienced outflows. The total outflows for Ethereum ETFs have now reached $387.7 million, according to Farside data.