BlackRock’s IBIT sees second outflow since launch

BlackRock’s IBIT sees second outflow since launch Quick Take

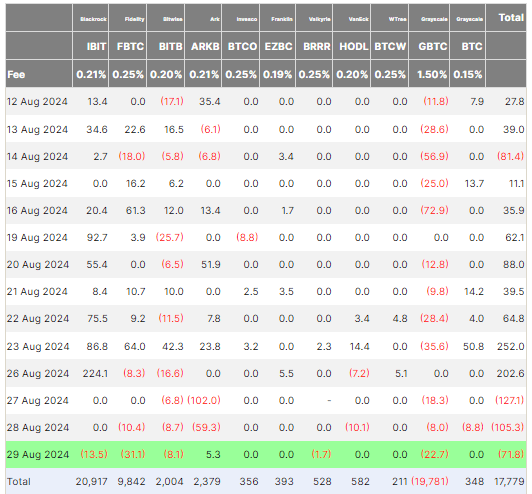

Farside data shows that Bitcoin ETFs have experienced a third consecutive day of outflows, with a total of $71.8 million withdrawn on Aug. 29. Grayscale’s GBTC saw an outflow of $22.7 million, Fidelity’s FBTC at $31.1 million and Bitwise’s BITB at $8.1 million. However, ARK’s ARKB ETF saw a $5.3 million inflow, halting a trend of roughly $160 million in outflows over the past two days.

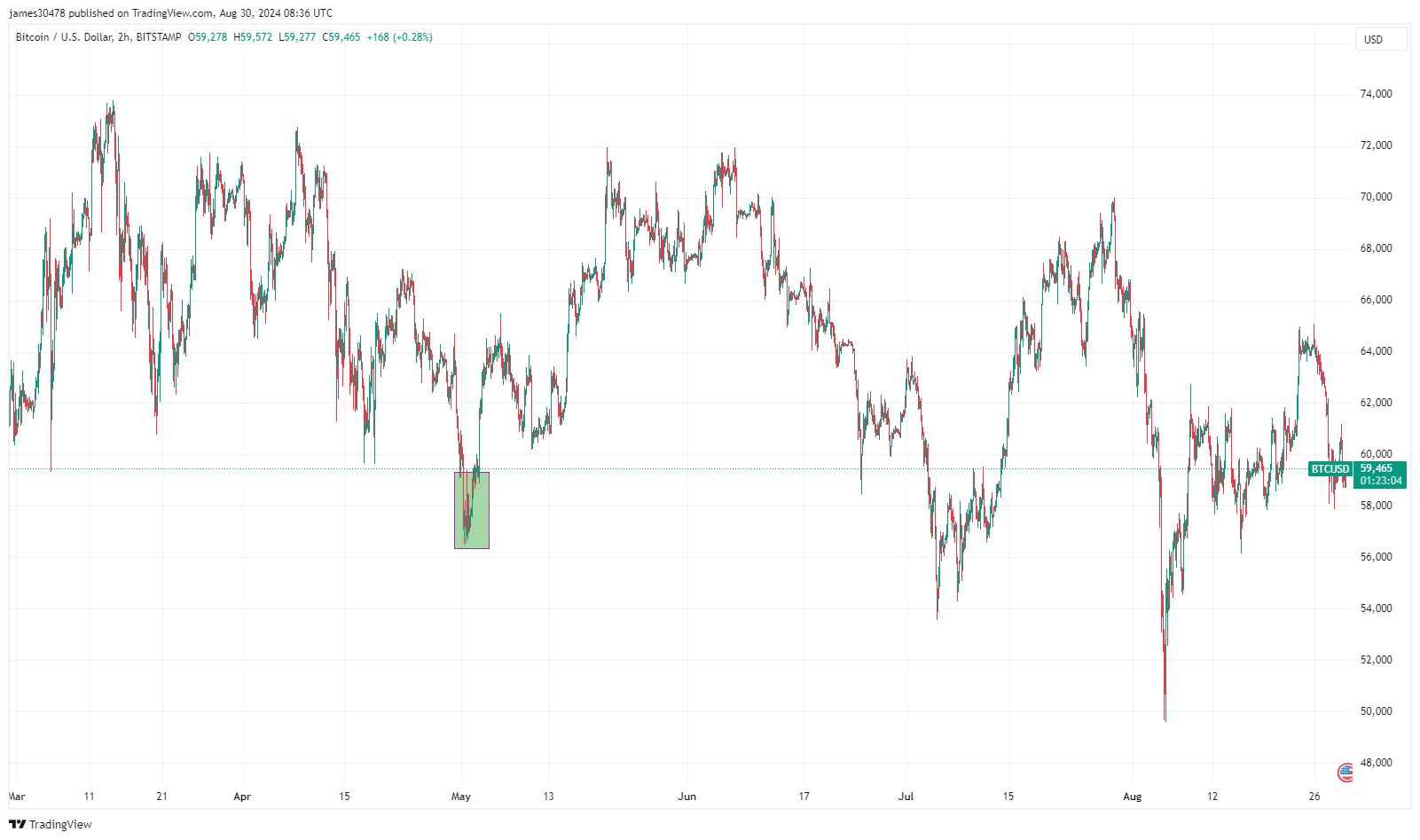

The most significant development comes from BlackRock’s IBIT, which recorded a $13.5 million outflow. This marks only the second outflow for IBIT since its Jan. 11 launch, with the previous one occurring on May 1, coinciding with a local Bitcoin low of $56,000. IBIT had seen no inflows or outflows for the two days prior, a pattern similar to the setup before the May outflow. Despite this, IBIT’s total inflows stand at an impressive $20.9 billion, contributing to a cumulative $17.8 billion in ETF inflows.

In contrast, Ethereum ETFs continue to show minimal activity, with a modest $1.7 million outflow. According to Farside data, Grayscale’s ETHE ETF experienced a $5.3 million outflow, while ETH saw a $3.6 million inflow, highlighting the subdued interest in Ethereum-related ETFs.