BlackRock ETF inflows hit $260 million as Grayscale records massive Bitcoin outflow

BlackRock ETF inflows hit $260 million as Grayscale records massive Bitcoin outflow BlackRock ETF inflows hit $260 million as Grayscale records massive Bitcoin outflow

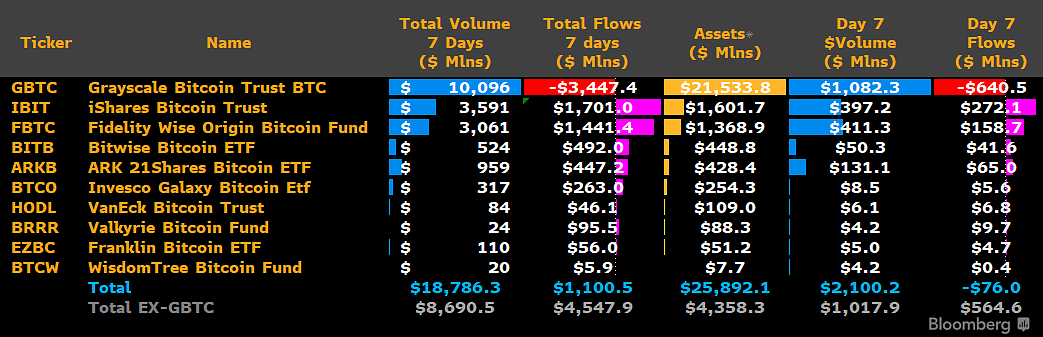

Grayscale Bitcoin Trust faces $3.45 billion in outflows while competitors flourish.

Quick Take

Grayscale Bitcoin Trust (GBTC) experienced an outflow of $640 million on its seventh trading day, the most significant outflow observed since its inception, according to James Seyffart. The total outflow has now reached a staggering $3.45 billion.

On the other hand, Seyffart indicates that BlackRock ETF (IBIT) witnessed a surge in inflows amounting to $272 million, marking its third-largest inflow day. Despite the sizeable influx into IBIT, the overall net outflows for the day stood at $76 million, underlining a shifting dynamic in the Bitcoin ETF market.

In summary, BlackRock ETF (IBIT) has recorded a total net inflow of $1.7 billion, placing it in the lead. Following closely, Fidelity comes in the second position with net inflows of $1.4 billion. Notably, the combined net inflows of the nine ETFs marginally outpace the outflows from GBTC, amounting to a total of $1.1 billion.

Update: The calculation of BlackRock inflows has been revised to $260 million.

| Day | Date | NAV per Share | Shares Outstanding | Share Volumne | BTC | Daily BTC Purchased | Daily Inflow by BTC Value |

|---|---|---|---|---|---|---|---|

| Day 7 | Jan 22, 2024 | $22.86 | 58,680,000.00 | 17,222,000 | 39,925 | 6,494 | $260,513,304 |

| Day 6 | Jan 19, 2024 | $23.87 | 50,240,000.00 | 18,240,000 | 33,431 | 4,809 | $201,487,482 |

| Day 5 | Jan 18, 2024 | $23.32 | 44,000,000.00 | 17,823,000 | 28,622 | 3,555 | $145,516,815 |

| Day 4 | Jan 17, 2024 | $24.31 | 28,720,000.00 | 13,950,000 | 25,067 | 8,705 | $371,407,530 |

| Day 3 | Jan 16, 2024 | $24.62 | 20,080,000.00 | 15,078,000 | 16,362 | 4,923 | $212,722,830 |

| Day 2 | Jan 12, 2024 | $24.94 | 4,600,000.00 | 22,920,000 | 11,439 | 8,818 | $385,963,860 |

| Day 1 | Jan 11, 2024 | $26.59 | 400,000.00 | 37,700,000 | 2,621 | 2,393 | $111,671,738 |