Bitstamp asserts 1% outflow, denies Bitcoin withdrawals totaling $600 million

Bitstamp asserts 1% outflow, denies Bitcoin withdrawals totaling $600 million [Editor’s Note: Bitstamp has since stated that Glassnode and Arkham Intelligence data does not accurately reflect current Bitcoin outflows from its Exchange. In an X post, the exchange asserted that outflows were 1% of holdings as opposed to the “38%” depicted on Glassnode. Specifically,

“[Glassnode] is inaccurately reporting a drop in our BTC balance. The wallets they have reported on are only a selection of our wallets used for day-to-day operational transactions. In fact, our net outflow was 1%, rather than the highly inaccurate 38% mentioned. Additionally, we have no affiliation with HTX.”

The below insight is unchanged from our original reporting while we investigate this issue. The above clarification has been included for transparency.]

UPDATE 2: Glassnode has now added a disclaimer to the Bitstamp charts stating they it is “updating the labels for Bitstamp. The revised data will be available shortly.”

Quick Take

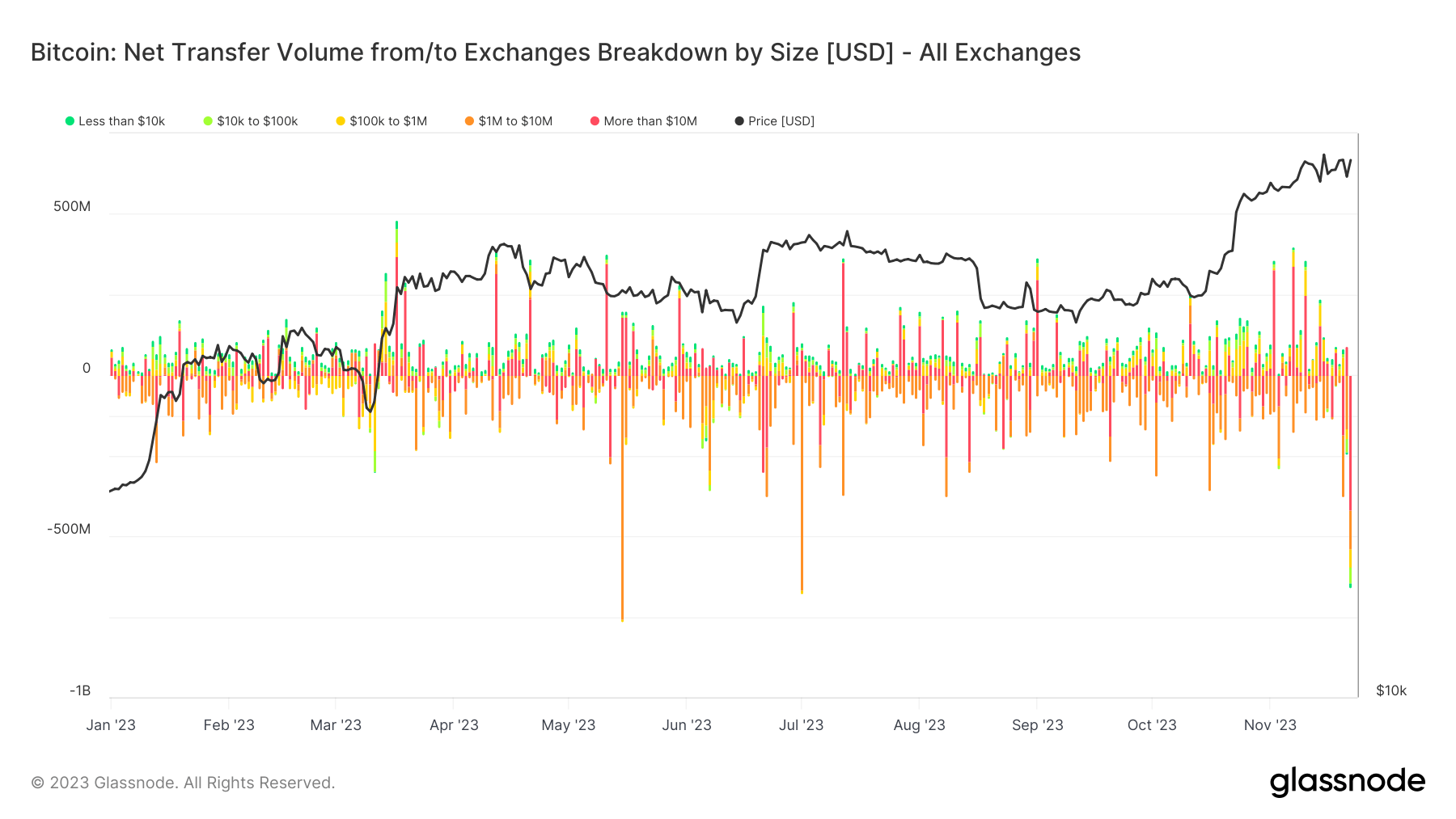

Yesterday, Nov. 22, marked the second-largest Bitcoin outflow of the year from digital asset exchanges, just over $600 million.

As observed by CryptoSlate, these outflows predominantly originated from two major platforms – Binance and Bitstamp. Post the Department of Justice (DOJ) and Binance agreement, Binance saw an exodus of approximately 8,000 Bitcoin, equivalent to nearly $288 million reported on Nov. 21.

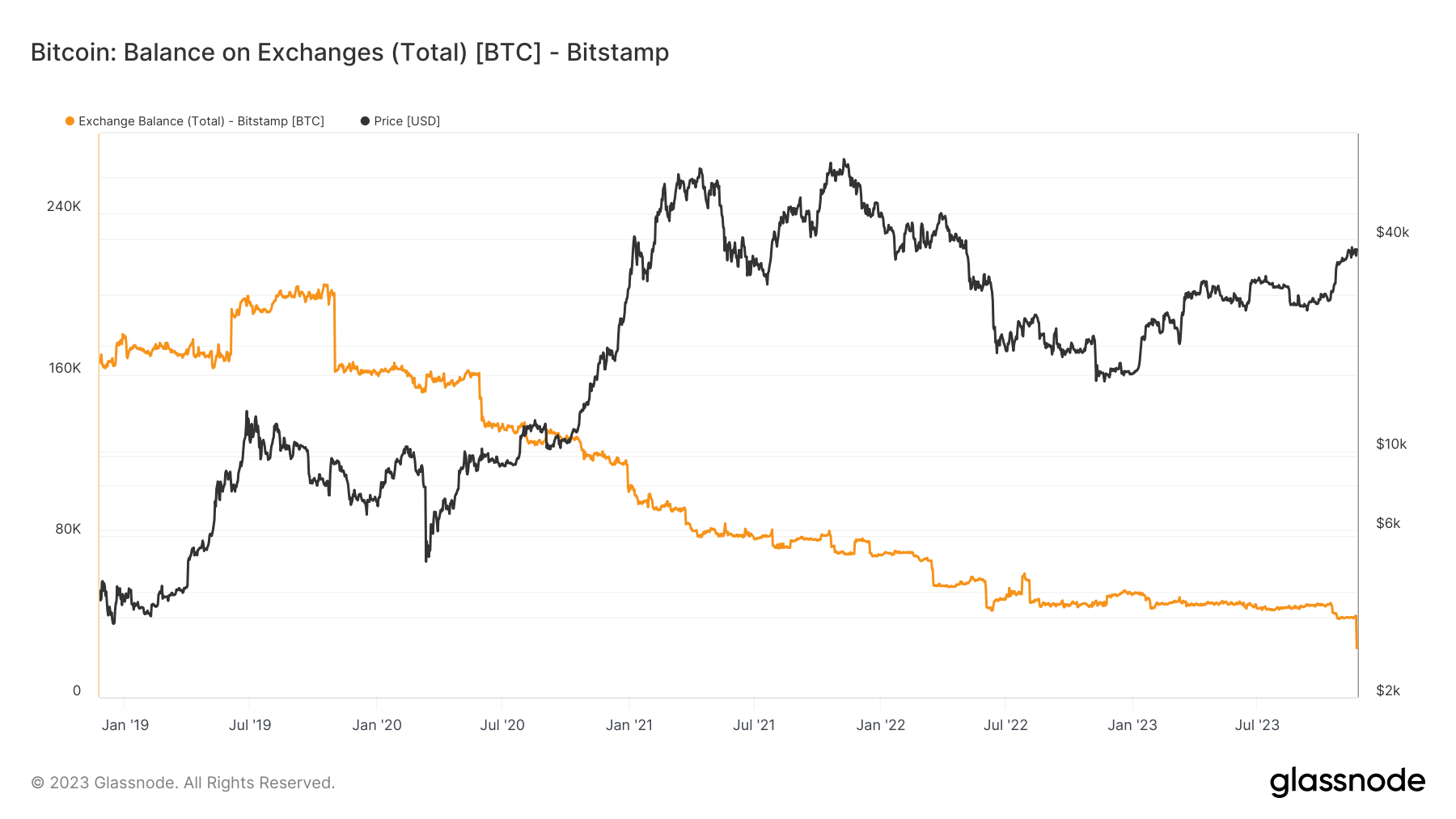

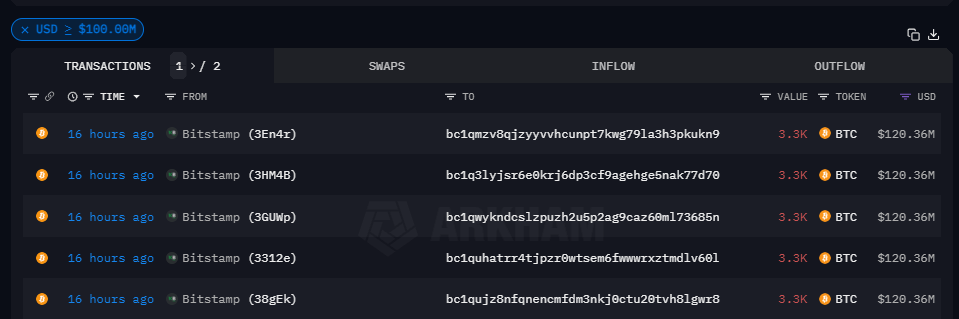

Another sharp decrease was spotted on Bitstamp, with a drain of about 16,500 Bitcoin. This outflow, valued roughly at $600 million, has also been confirmed via Arkham Intelligence Platform, evidencing the transaction in five increments of 3,300 Bitcoin each, 16 hours ago.

Consequently, Bitstamp’s Bitcoin reservoir stands depleted, now housing approximately 24,000 BTC.