Bitcoin’s ratio to the U.S. long bond is nearing all-time highs

Bitcoin’s ratio to the U.S. long bond is nearing all-time highs Quick Take

The U.S. dollar, reigning as the global reserve currency, has been the standard benchmark for valuing all assets. However, an intriguing shift occurs when we start benchmarking financial assets against Bitcoin instead of the traditional USD.

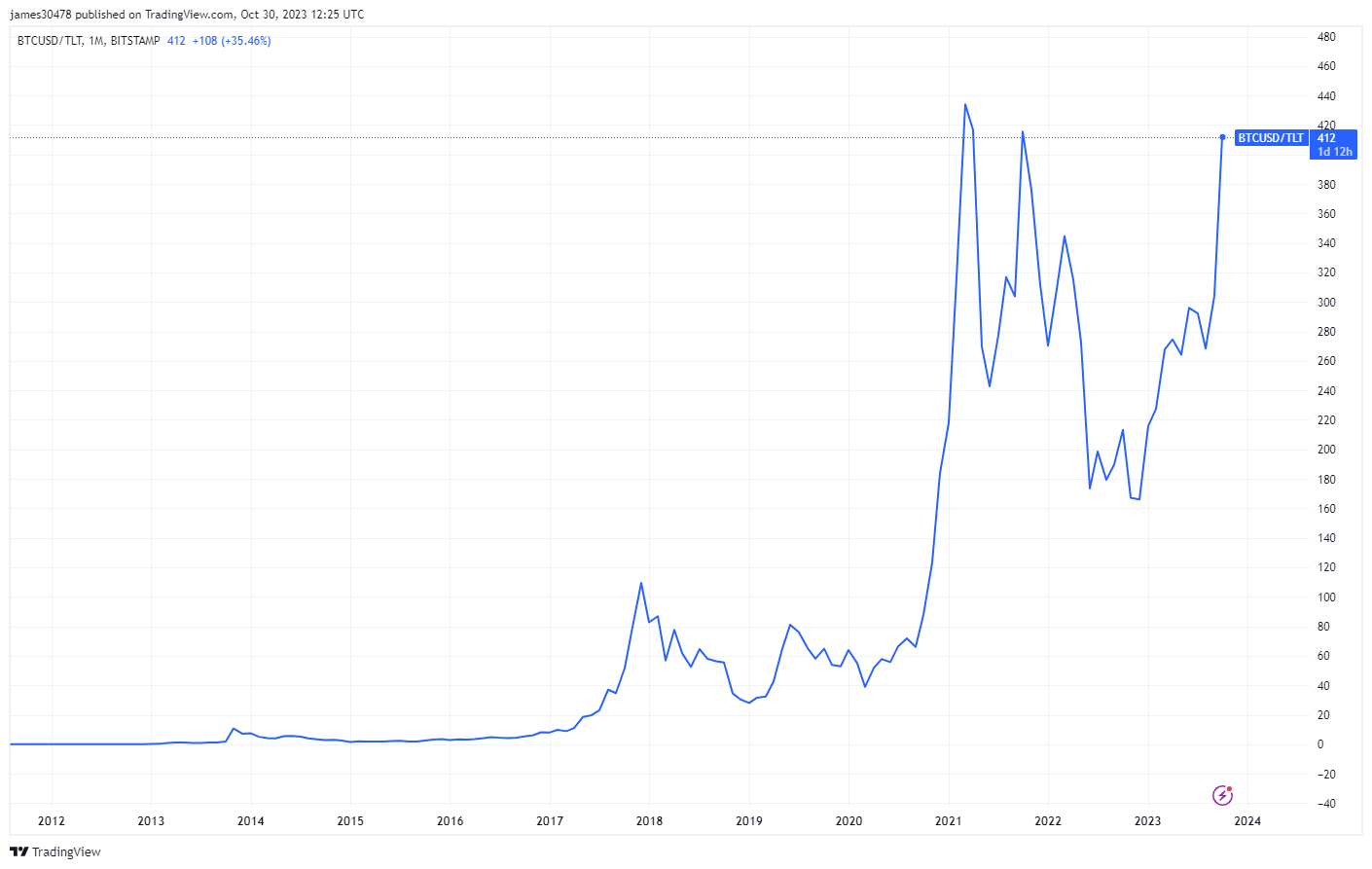

Take the U.S. long bond (TLT) as an example, which is currently trading at approximately $84. It would require a hefty sum of 411 TLT to match the value of a single Bitcoin, trading around $34,500. This ratio underscores a significant drawdown for TLT compared to Bitcoin, even more so when considering that in the 2021 bull run, the ratio was 432 TLT to one Bitcoin.

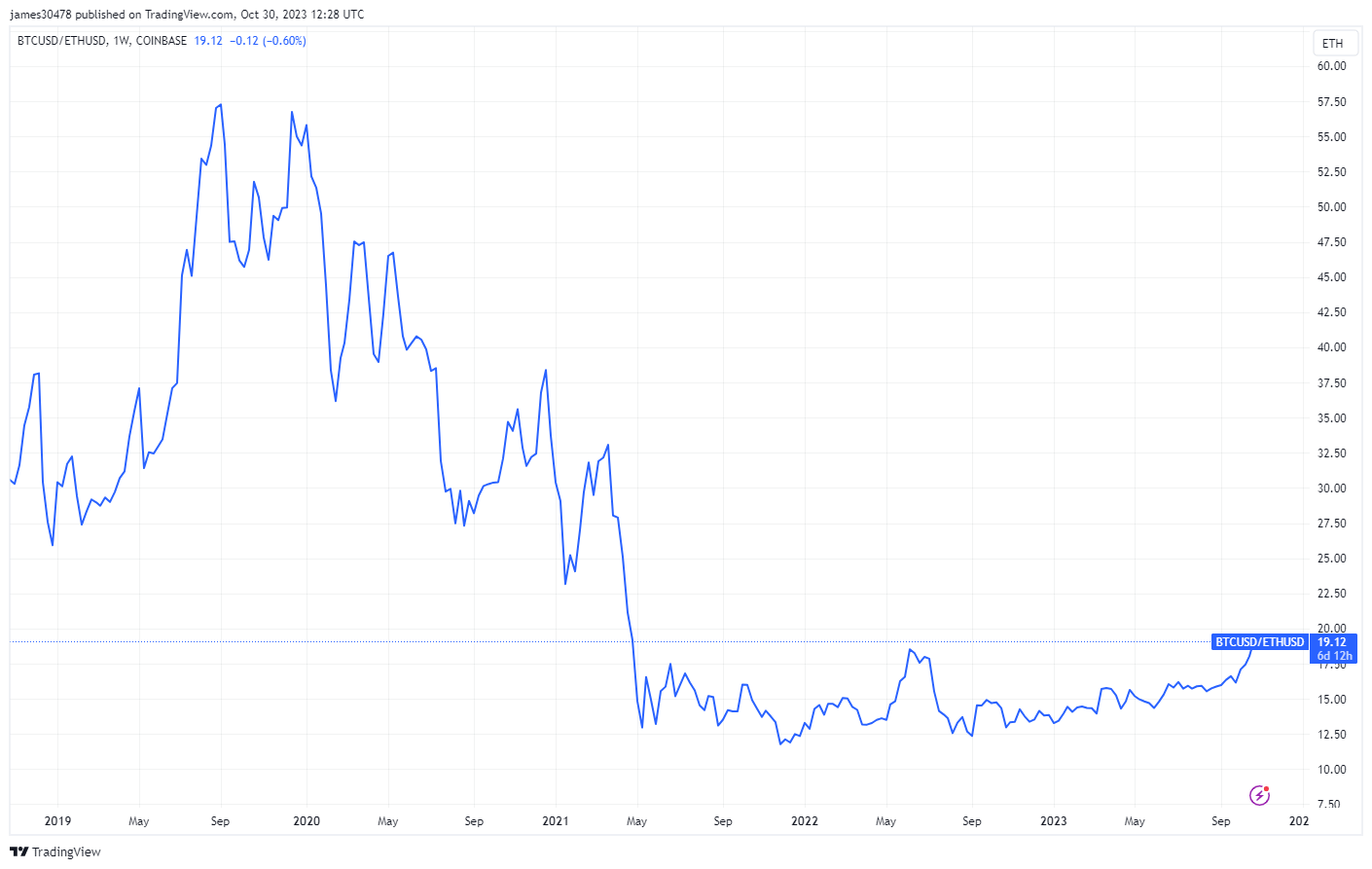

Similarly, when dissecting the Ethereum-Bitcoin relationship, it’s evident that the dynamics are changing. With Ethereum currently trading at just over $1,800, it would take a little over 19 Ethereum to equate to 1 Bitcoin. This ETH/BTC ratio continues to trend downwards, signaling a potential shift in the crypto hierarchy.

This unconventional method of asset denomination reveals a different perspective on the value of financial assets and may be a presage of a broader transformation in the financial realm sparked by the rise of cryptocurrency.