Bitcoin’s 2024 market patterns echo 2019

Bitcoin’s 2024 market patterns echo 2019 Quick Take

According to a recent analysis by CryptoSlate, the current Bitcoin market is behaving in a strikingly similar pattern to that of 2019.

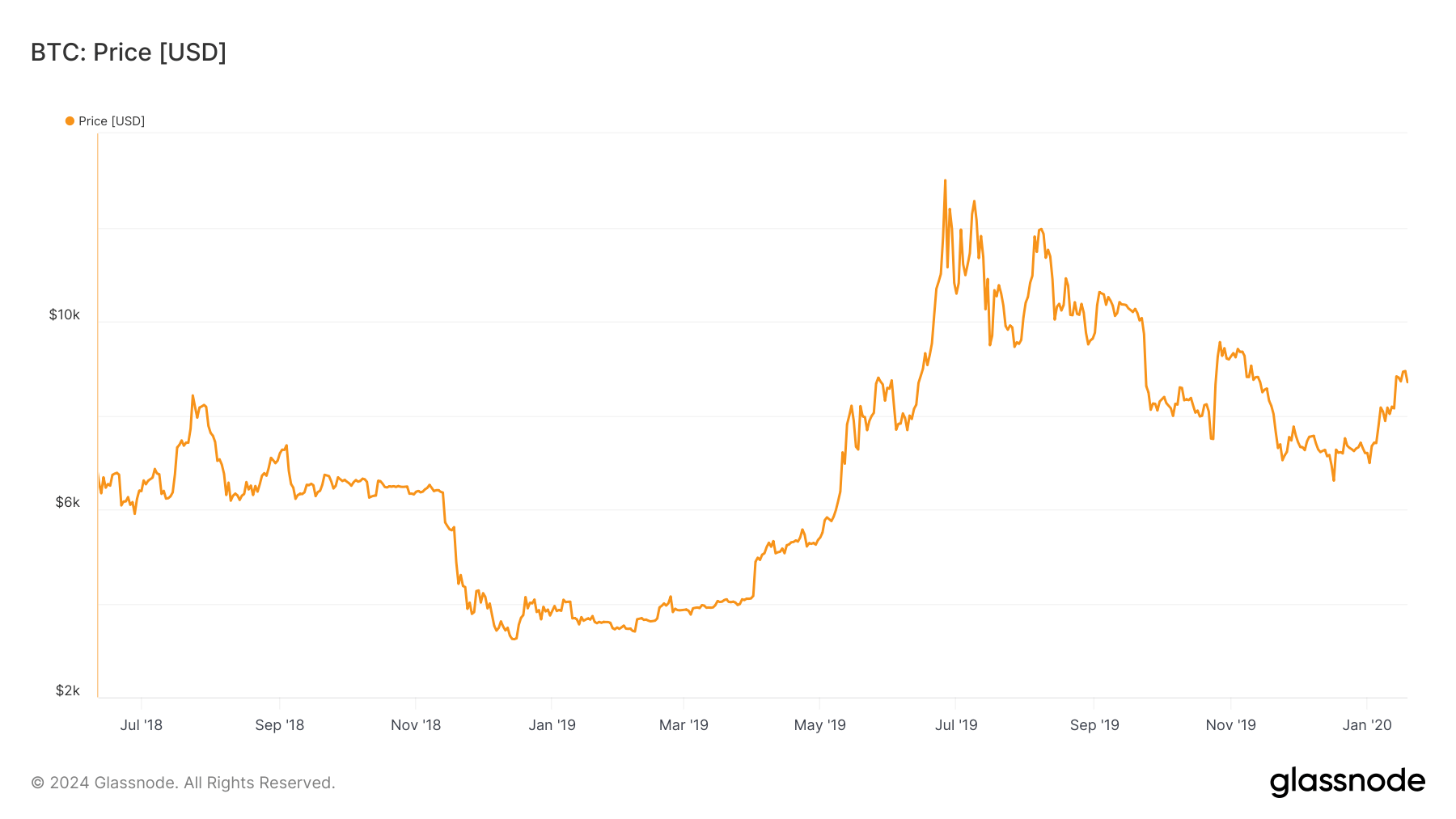

Since reaching an all-time high of approximately $73,000 in March, Bitcoin has been fluctuating mostly within the $60,000 range, reminiscent of previous periods of market consolidation. Notably, Bitcoin lingered in the $9,000 range longer than it has at $58,000, but the current trading pattern suggests a potential repeat of history.

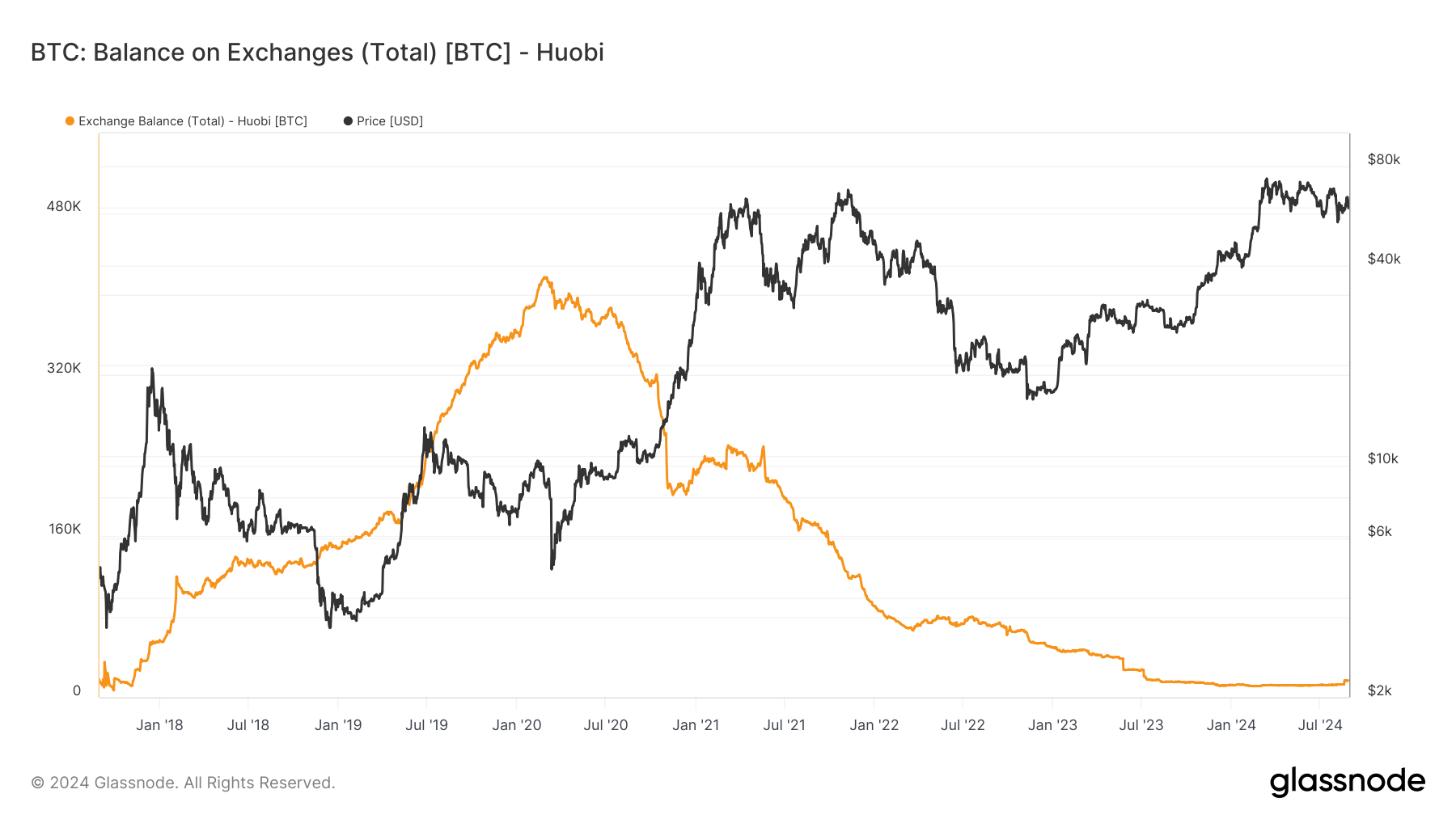

Analyst Checkmate recently highlights further parallels with the market in 2019. In April of that year, Bitcoin’s price was around $4,000 before surging to $14,000 by July, driven by the Ponzi scheme PlusToken in China, which absorbed about 2% of the Bitcoin supply. However, after the Chinese government sold the assets on Huobi, the price plunged back to $9,000 until the COVID-19 crash.

Meanwhile, in 2024, the launch of US Bitcoin ETFs initially drove the price from $50,000 to $73,000, echoing the surge to $14,000 in 2019. Subsequent sales by the US and German governments, alongside distributions from Mt. Gox, led to a volatile market that has seen a consolidation period.

The latest significant event, the Aug. 5 yen carry trade unwind, pushed Bitcoin down to $49,000, with the price now stabilizing again in the $60,000 range. These patterns suggest that Bitcoin’s market behavior in 2024 continues to mirror the movements in 2019.