Bitcoin’s 2022 bull cycle shows recurring deep corrections, aligning with historical patterns

Bitcoin’s 2022 bull cycle shows recurring deep corrections, aligning with historical patterns Onchain Highlights

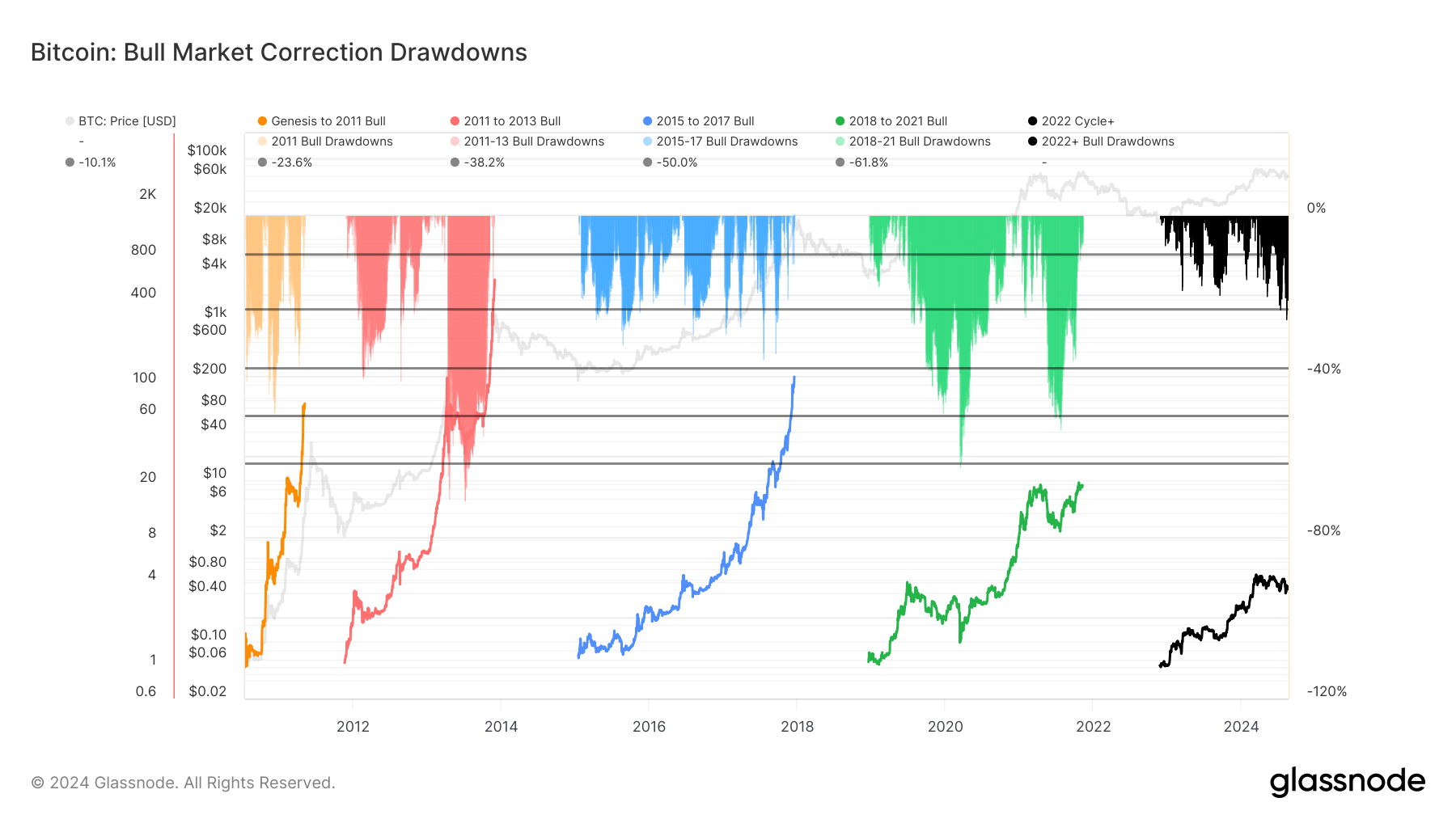

DEFINITION: Bitcoin bull market corrections: drawdowns compared across previous cycles

Bitcoin’s 2022+ cycle reveals a continuation of steep corrections, evidenced by multiple drawdowns exceeding 20% from peak values. This trend aligns with patterns observed in previous bull cycles, particularly the 2018-2021 period, where drawdowns reached as high as 61.8%. The consistent occurrence of deep corrections suggests a recurring dynamic where sharp retracements follow rapid price escalations.

Historically, these corrections are critical phases that recalibrate the market before subsequent recoveries. The 2022 cycle, characterized by black-shaded drawdowns, mirrors the drawdown severity seen in earlier bull markets but not as deep, suggesting Bitcoin maturing as an asset but reinforcing the notion that heightened volatility remains an intrinsic feature of Bitcoin’s bull phases.

This cyclical behavior highlights the importance of understanding historical patterns, as they provide valuable context for navigating the current market environment. The observed drawdowns highlight both the potential risks and opportunities within Bitcoin’s ongoing bull cycle.