Bitcoin whales on the rise as numbers hit three-year high as ETFs join cohort

Bitcoin whales on the rise as numbers hit three-year high as ETFs join cohort Quick Take

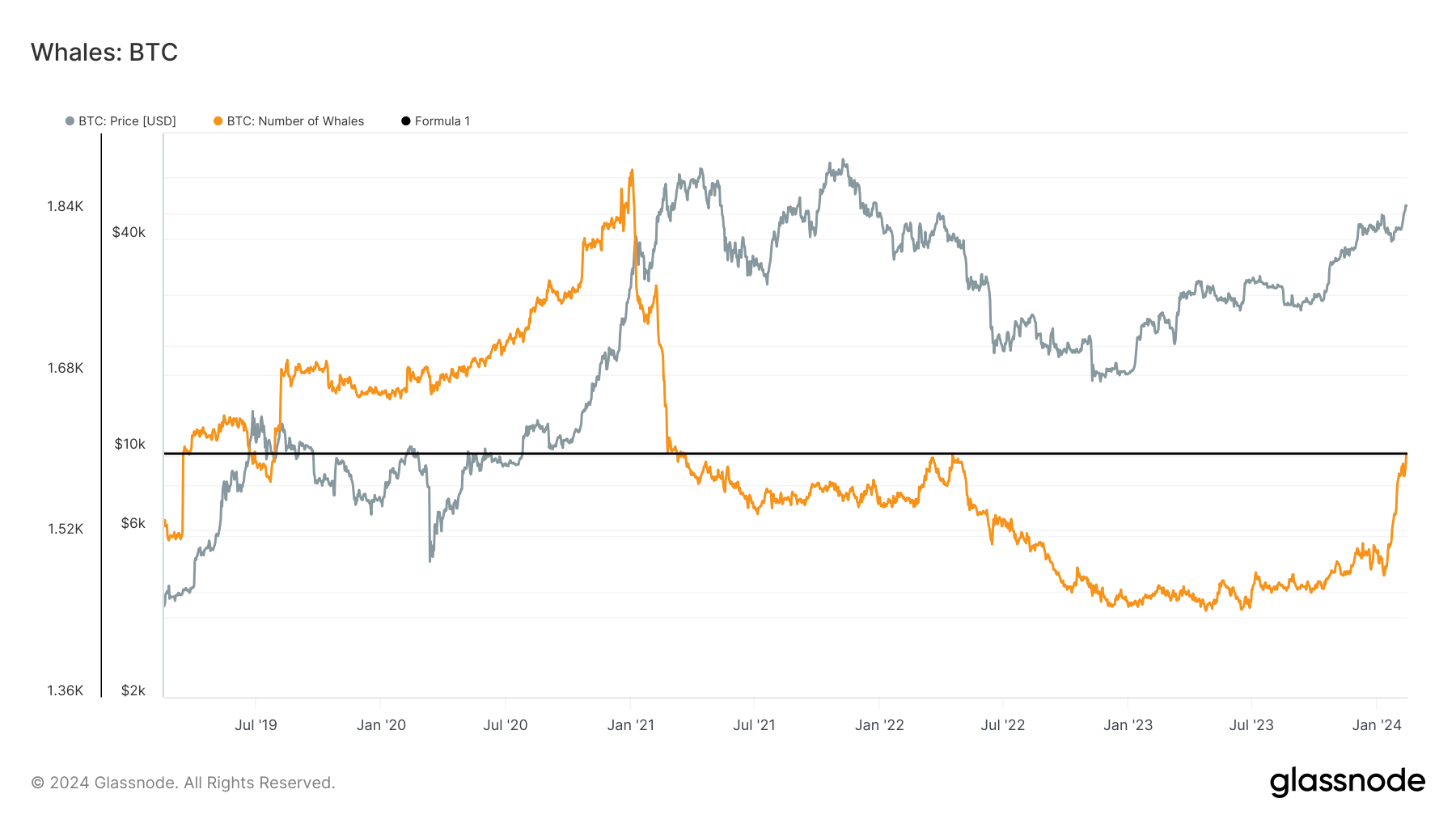

The Bitcoin landscape has witnessed a significant uptick of Bitcoin whales—entities holding 1,000 BTC or more. Their numbers have surged in recent weeks, coinciding with Bitcoin’s rise from $38,000 to $51,000.

Currently, there are 1,602 Bitcoin whales, a considerable uptick from 1,482 in January. This surge not only eclipses the March and April 2022 peak of 1,601 whales, but also marks a three-year high unseen since March 2021.

The last bull run in 2021, which saw Bitcoin skyrocket from $10,000 to $60,000, conversely triggered a notable decline in whale numbers from 1,884 to 1,601, implying a profit-taking strategy.

The current accumulation trend is influenced by large-scale holders, such as Bitcoin ETFs, including Grayscale, that spread their holdings across multiple wallets. Entities like these, with assets under management exceeding $51 million, now meet the whale criteria according to Glassnode metrics.

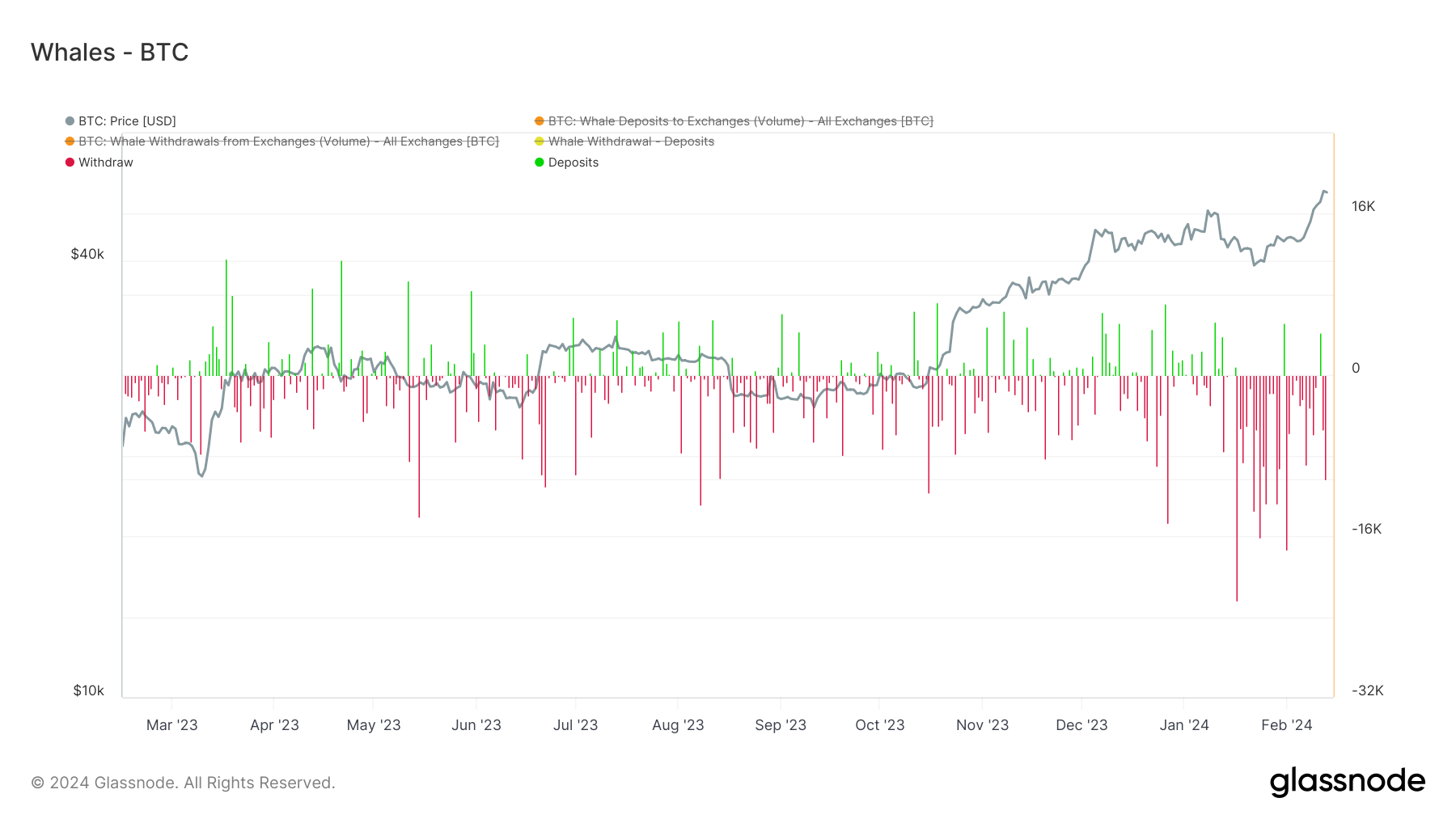

Since Jan. 15, whale withdrawals have surpassed deposits, barring two days, underscoring the extent to which whales have accumulated Bitcoin.