Bitcoin thrives as China combats deflation with fresh liquidity injections

Bitcoin thrives as China combats deflation with fresh liquidity injections Quick Take

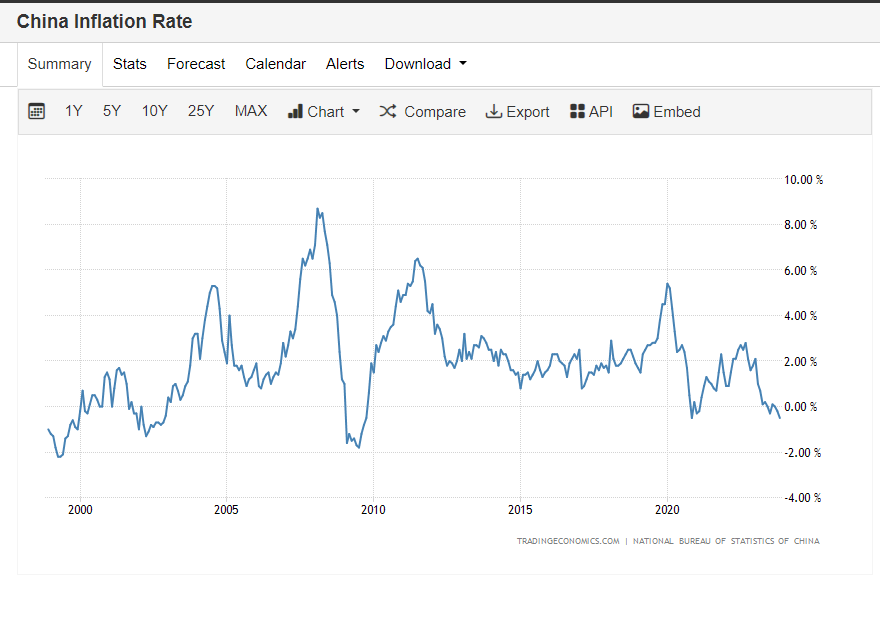

Chinese economic trends display a peculiar cycle. In November, China’s inflation rate fell into deflation, marking the second month in succession, with a rate of -0.5%, slightly higher than October’s -0.2%. Historical data shows a pattern: a recession follows simultaneously each time China slips into deflation. Notable instances were around 2000 and 2008, with rates nearing -2.00%, and in 2020, just shy of 0%.

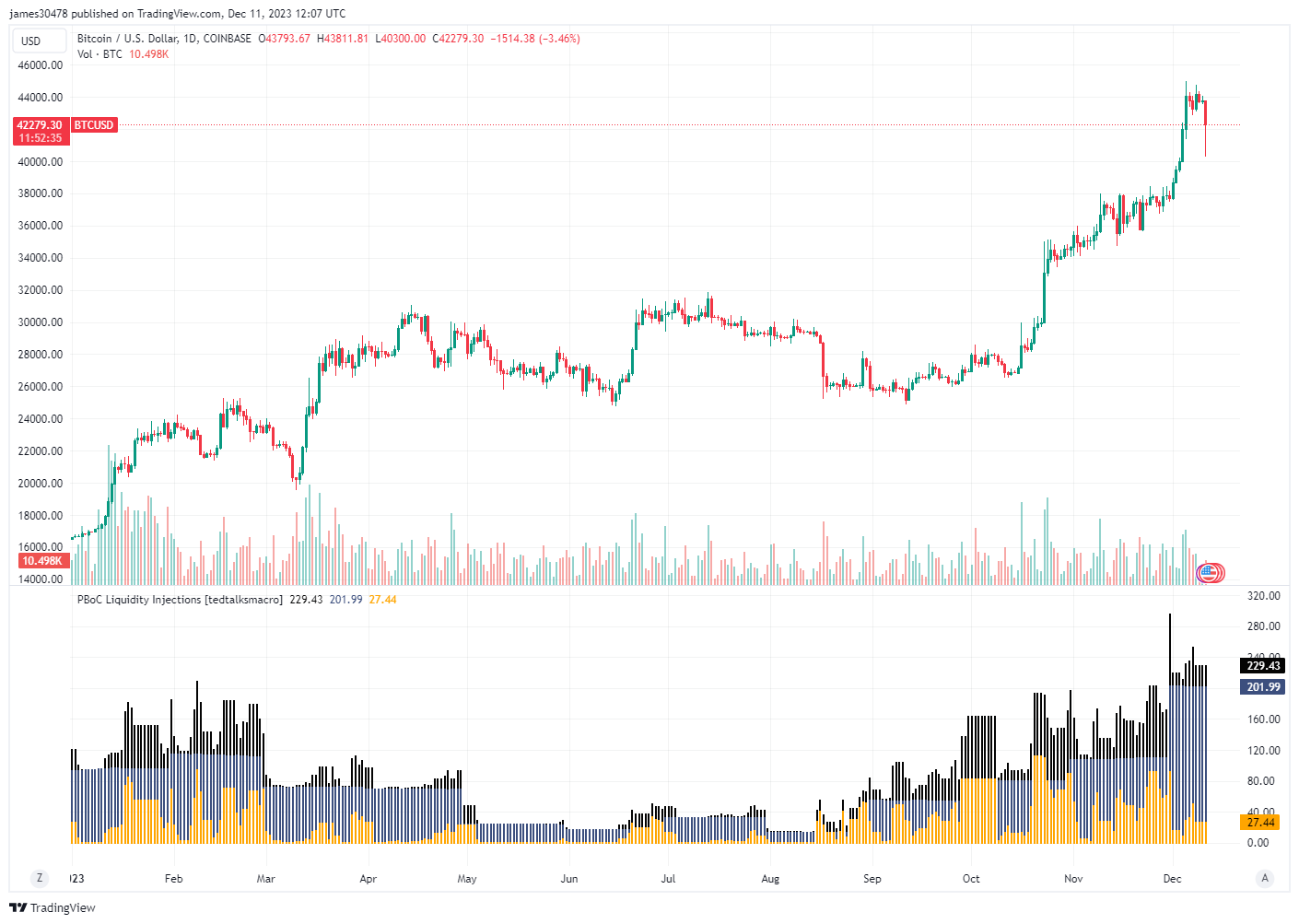

Given its significant status worldwide, China’s real estate issues are widely known. The People’s Bank of China has reportedly been infusing liquidity to counteract the deflation. These monetary measures seem to have positively influenced Bitcoin in a fascinating turn of events. Since September, there has been a noticeable positive correlation between this increased liquidity and the price of Bitcoin, as per data from Ted Talks Macro.