Bitcoin short-term holders increased holdings by over 1 million BTC in six months

Bitcoin short-term holders increased holdings by over 1 million BTC in six months Onchain Highlights

DEFINITION: The total supply held by short-term holders [BTC] is the total amount of circulating supply held by short-term holders. Long-term and Short-Term Holder supply is defined with respect to the entity’s average purchasing date, with weights given by a logistic function centered at an age of 155 days and a transition width of 10 days.

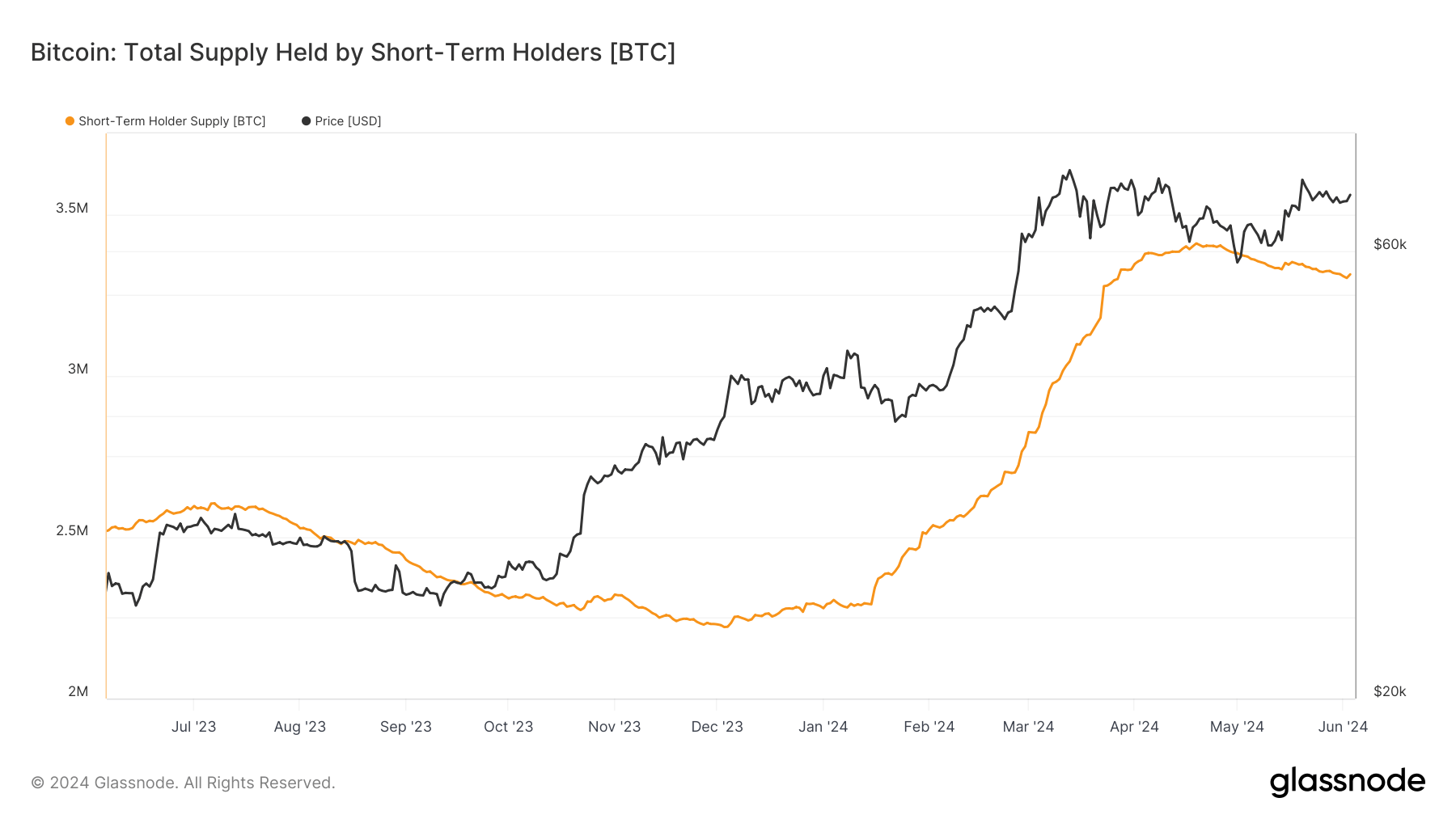

Data from Glassnode reveals a significant accumulation among short-term holders, with their holdings increasing from 2.2 million BTC in January to over 3.4 million BTC by mid-April. This trend emphasizes a heightened level of market engagement from investors with shorter holding periods, often defined as less than 155 days. Since April, however, it has declined slightly to around 3.3 million.

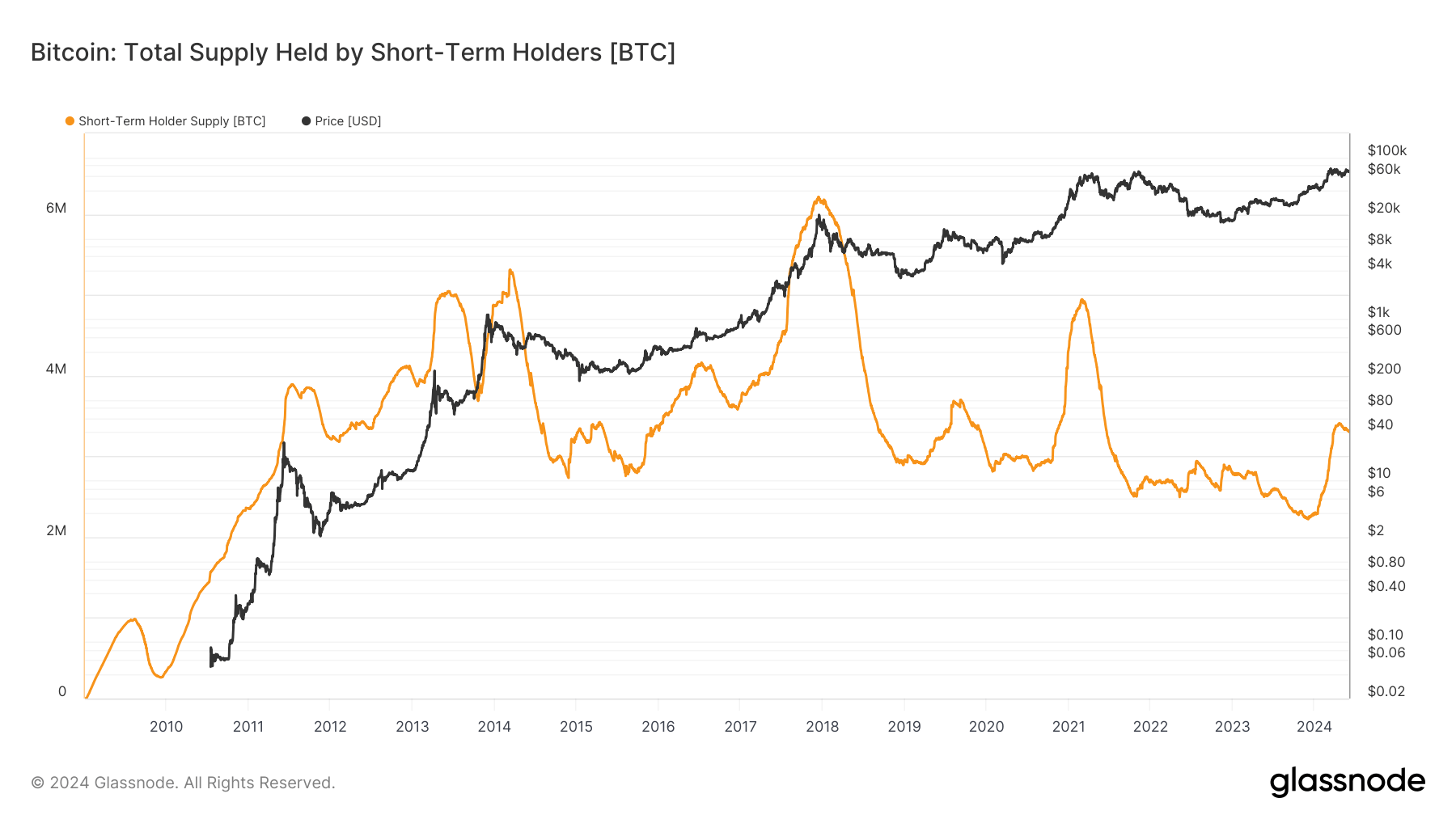

Notably, this increase aligns with broader historical movements and investor behaviors at the start of a bull run. In the past, short-term holders have both capitalized on and contributed to Bitcoin’s price volatility. For example, during a 48-hour period in November 2023, short-term holders reaped $1.8 billion in profits, highlighting their reactive strategies to market conditions. In 2019, there was a bump in short-term holder supply before it plateaued ahead of the 2021 bull run proper.

The implications of these trends are multifaceted. The increasing short-term holder supply suggests a robust engagement from newer investors, while the persistent activity among long-term holders points to foundational stability within the market. At present, the US spot Bitcoin ETF wallets are considered short-term holders and thus contribute to this metric. As of June 15, the Bitcoin acquired by ETFs will begin to be reclassified as long-term Bitcoin. This evolving landscape is crucial for understanding future price movements and investor behaviors in the Bitcoin ecosystem.