Bitcoin rally triggers over $36 million in shorts liquidations

Bitcoin rally triggers over $36 million in shorts liquidations Quick Take

December has started on a bullish note for Bitcoin, with the opening price over $38,000 and a high brushing just under the $38,400 mark.

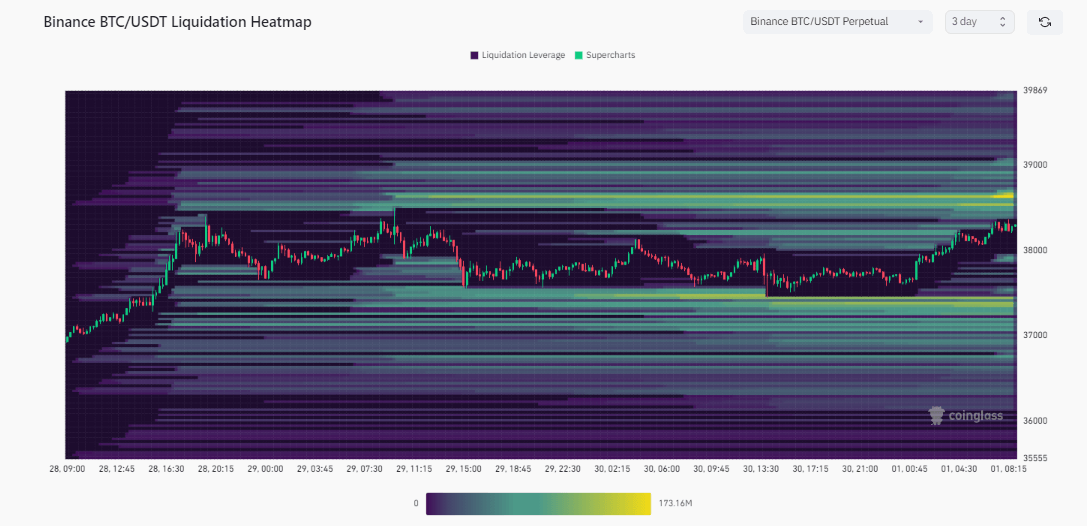

This price surge has had a significant impact on the digital asset market. In the past 24 hours, approximately $36.88 million worth of short positions have been liquidated. According to Coinglass, Binance shouldered the brunt of these liquidations, accounting for just $15.62 million in liquidated shorts.

Meanwhile, roughly $500 million of liquidation leverage is sitting between the current price of Bitcoin at $38,300 and $39,000.

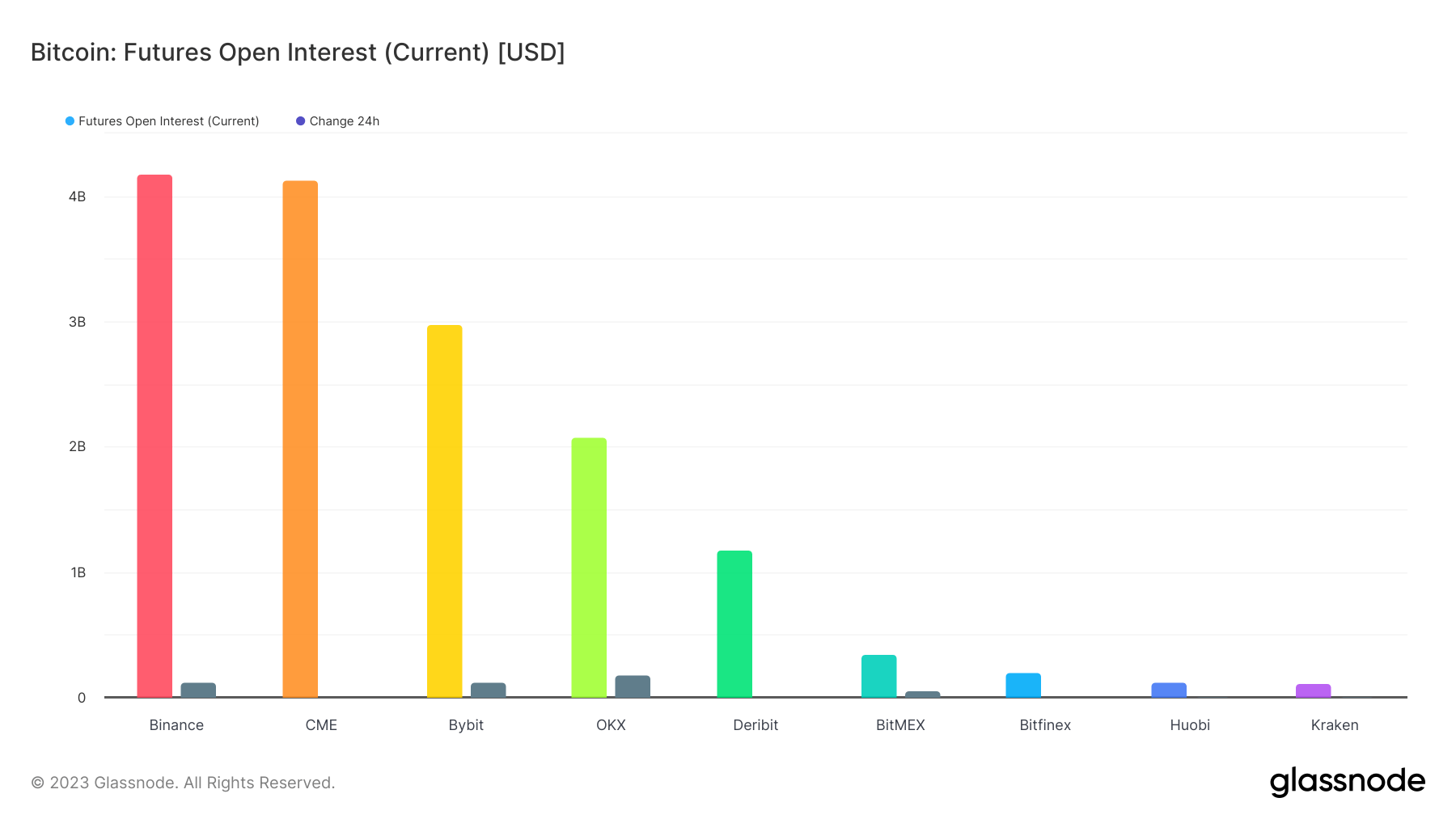

Furthermore, this price uptick has sparked a rise in Bitcoin open interest. Open interest represents the total number of outstanding Bitcoin futures or options contracts in circulation at a given time, indicating the amount of capital committed to Bitcoin derivatives. Open interest has seen a 4% rise over the past 24 hours. Consequently, Binance has emerged as the leading exchange in terms of Bitcoin open interest.