Bitcoin price aligns with past cycles despite correction concerns

Bitcoin price aligns with past cycles despite correction concerns Quick Take

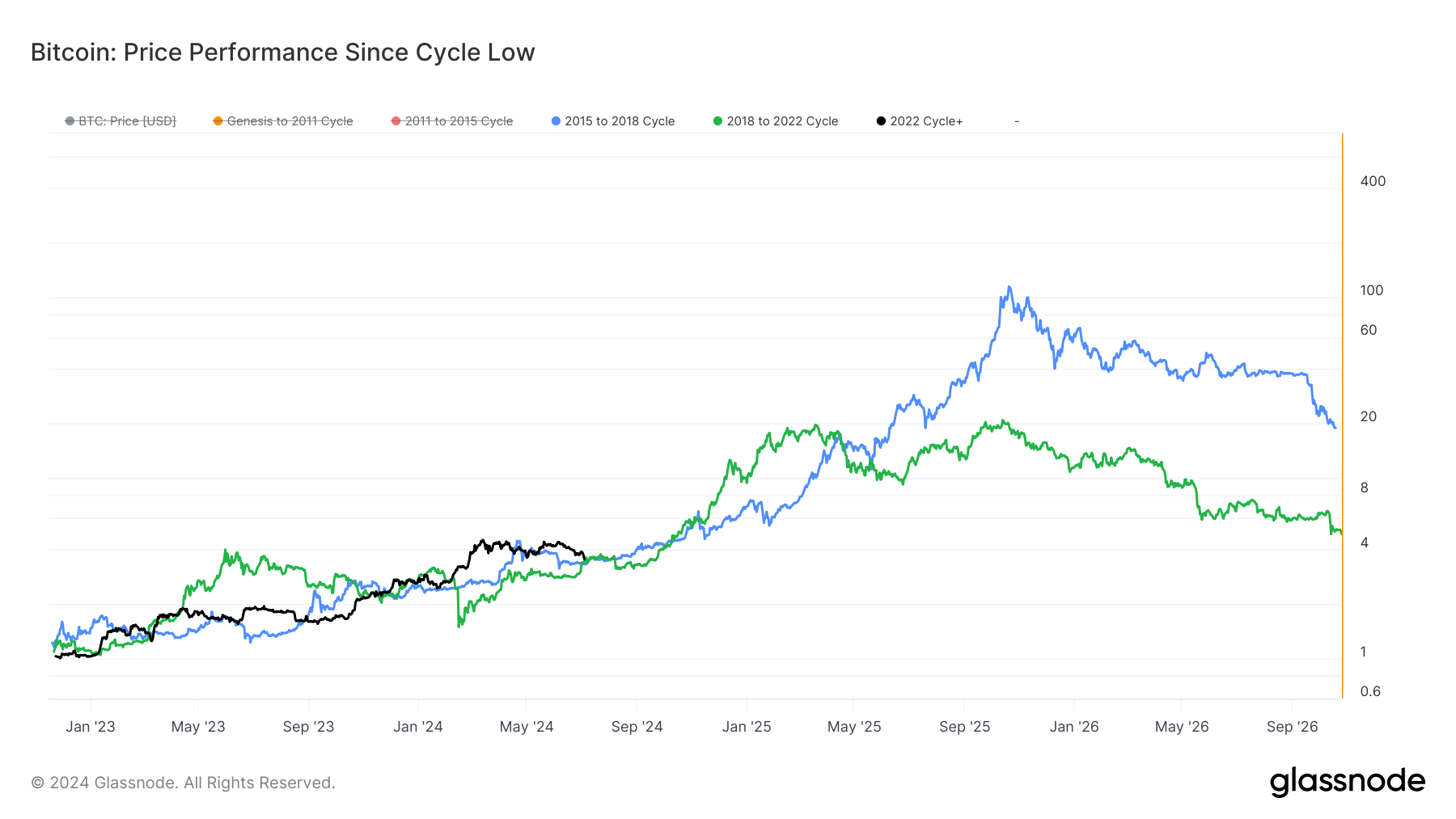

There are ongoing debates about whether Bitcoin is now in a bear market or its bull market cycle has ended. However, a closer look at the data from the cycle-low during the FTX collapse, when BTC was around $15,500, shows that Bitcoin has since risen approximately 250%.

Interestingly, this aligns with the patterns of previous cycles. At a similar point in the 2015 to 2018 cycle, Bitcoin increased by 234%. Likewise, in the 2018 to 2022 cycle, Bitcoin was up about 240%. Both these cycles experienced stagnation during the next few months, only to see significant upward movement starting in Q4.

Historically, Bitcoin tends to struggle in the first three to six months following a halving event, which is consistent with current performance. Despite the recent correction, BTC’s trajectory remains on track with past cycles. This pattern suggests that the current market movements are part of a typical cycle rather than an indication of a definitive bear market.