Bitcoin peaks above $59,000 as US CPI data shows easing inflation

Bitcoin peaks above $59,000 as US CPI data shows easing inflation Quick Take

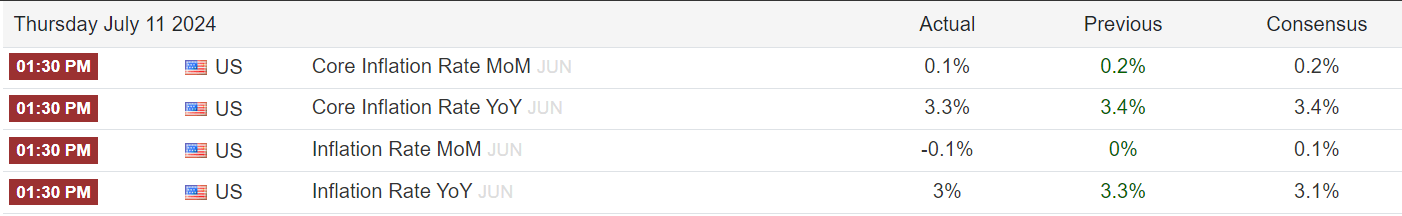

Trading Economics data shows that June’s Core Inflation Rate MoM (Month-over-Month) increased by 0.1%, slightly below the consensus of 0.2% and the previous month’s 0.2%. This suggests a modest deceleration in core inflation, which excludes volatile items like food and energy.

Year-over-year (YoY) figures show that Core Inflation stands at 3.3%, down from 3.4% previously and below consensus expectations, indicating a slight easing of core inflation pressures over the year.

The overall Inflation Rate MoM decreased by -0.1%, diverging significantly from the consensus of a 0.1% increase and the previous month’s 0% change. This unexpected decline points to potential deflationary pressures.

The YoY Inflation Rate remains at 3%, down from 3.3% in the previous period and slightly below the consensus of 3.1%. This suggests disinflation but is still above the Federal Reserve’s typical target of 2%.

Bitcoin jumps above $59,000 on the news of the US CPI data.