Bitcoin OTC desk balances hit over 300,000 BTC

Bitcoin OTC desk balances hit over 300,000 BTC Onchain Highlights

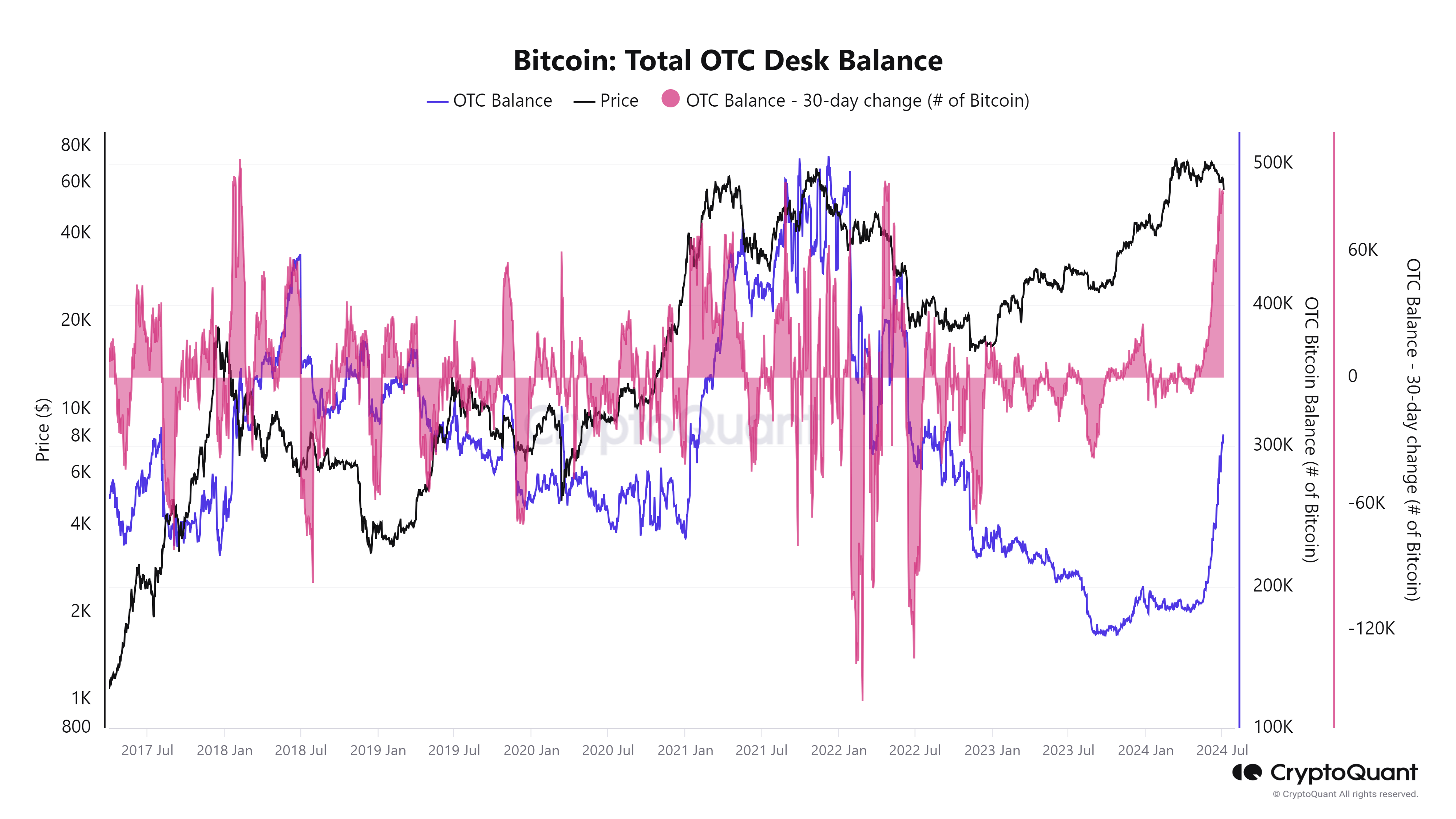

DEFINITION: The cumulative balance of Bitcoin stored in addresses associated with Over-The-Counter (OTC) desks is represented in this metric.

Bitcoin’s total OTC desk balance demonstrates notable trends correlated with price fluctuations. The chart from CryptoQuant highlights the relationship between Bitcoin price movements and OTC desk balances, which have shown significant activity throughout 2024. The recent surge in OTC desk balances reaching over 300,000 BTC aligns with Bitcoin’s price hitting around $55,000.

Historical data indicates that OTC desk balances often increase when Bitcoin prices peak, as institutional investors typically use OTC desks to execute large transactions without impacting the market price. The 30-day change metric reveals a sharp rise in recent months, suggesting heightened distribution by players possibly anticipating future price corrections.

This dynamic between OTC desk activity and Bitcoin price underscores the strategic maneuvers of institutional investors, reflecting broader market sentiment and potential future trends. As OTC balances swell, market participants may interpret this as a signal of a lack of sustained institutional interest, possibly setting the stage for future price developments.