Bitcoin network’s maturing phase reflected in post-halving fee stability

Bitcoin network’s maturing phase reflected in post-halving fee stability Onchain Highlights

DEFINITION: The total amount of fees paid to miners. Issued (minted) coins are not included.

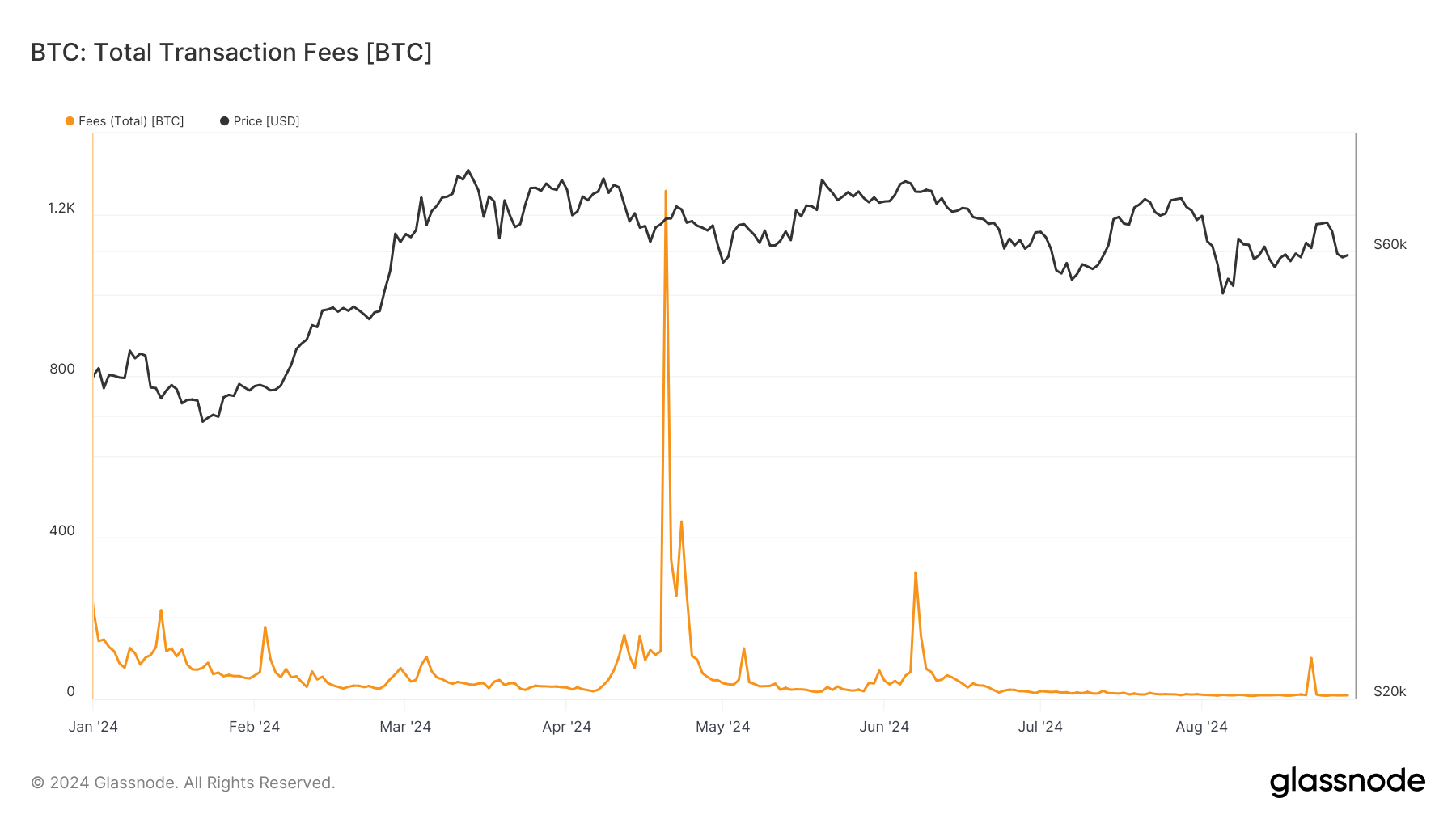

Bitcoin transaction fees have exhibited fluctuating patterns since the beginning of 2024, with notable spikes around significant events. The most prominent surge occurred in April, correlating with the Bitcoin halving event. This period saw transaction fees spike briefly to over 1,200 BTC, highlighting the network’s increased demand during this critical period.

Following the halving, fees stabilized but remained relatively subdued, even as Bitcoin’s price approached $60,000. This is in stark contrast to previous years, where fee spikes often mirrored rapid price increases or network congestion.

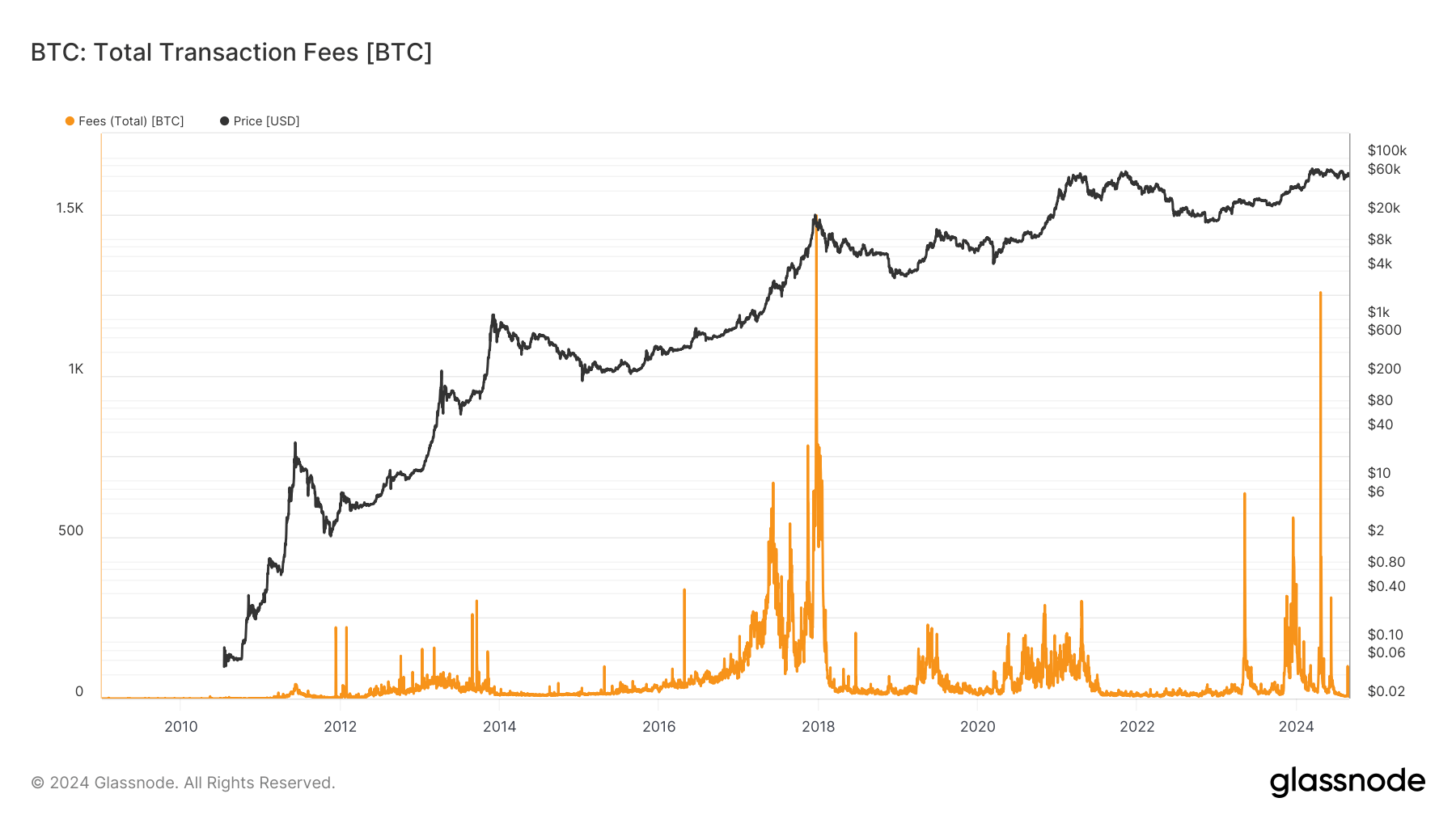

For instance, during the bull markets of 2017 and 2021, transaction fees surged alongside Bitcoin’s price, reflecting the intense activity and congestion on the network.

The current trend, where fees remain low despite significant price movements, suggests a maturing network with potentially more efficient transaction processing. As 2024 progresses, observing whether this decoupling of fees and Bitcoin’s price persists could offer insights into evolving market trends and user behavior within the ecosystem.